Key takeaways

In imposter scams, scammers impersonate employees of trusted organizations, most often police officers or lawyers.

Law enforcement officers will never contact you directly to threaten arrest, demand money, or promise to keep your crypto safe.

If you have been the victim of an imposter scam, you should definitely report the incident to local authorities immediately.

Imposters can create a very elaborate web of lies: don't be fooled! Protect yourself from scams by learning how to spot, avoid and report impostors who pose as employees of trusted organizations. Stay informed by continuing to read this week’s “How to Survive Scams” article.

“Imposter” scammers impersonate employees of trusted organizations such as banks, law firms or government departments to trick their victims into handing over their personal information and their money.

These criminals use various fallacious arguments and social engineering tactics, and can even craft very convincing speeches based on current events. They may contact you by phone, text, or email, and some of them will even go so far as to set up a fraudulent customer service hotline for added legitimacy.

Below we take the usual outline of an imposter scam and offer you two concrete examples to help you better understand the mechanisms of interaction between scammers and their victims.

A scam in four steps

1. Develop a scenario

If you've read our previous articles on employment and fake investment scams, you'll notice that the four-step modus operandi of classic imposter scams differs slightly from these other two types of scams.

In the context of an impostor scam, producing a foolproof and adaptable speech that reacts dynamically to various scenarios and suits very specific groups of people is the key to success: after all, the author of the The scam impersonates an authority figure and must give the impression of professionalism.

Although creating a convincing scenario requires a lot of work, criminals are often willing to expend this effort if it will increase their chances of success.

2. Find a victim

Typically, scammers scour the black market to acquire various personal information such as phone numbers, personal information, purchase and travel histories: all information that will allow them to identify potential targets. Scammers prefer to target individuals who have already been scammed: they can pose as legitimate police officers, lawyers or detectives who genuinely want to help.

3. Gain their trust and encourage them to take action

Once the target has been identified, the scammer will select a speech that suits him and implement it. If the victim does not respond as expected, he will improvise, sometimes putting pressure on them through intimidation or scolding.

At this stage, the scammers' main goal is to gain the victim's trust, and they will persevere even if they don't play their game right away.

4. Close the trap

If the imposter succeeds in their goal, the victim will believe a fabricated scenario and think they are in a “desperate situation” or must “make up for their past crimes” by paying penalties.

In some cases, the scam continues even after the victim has paid the “fine”: another scammer can then join in and keep the hoax going until he robs the victim of all their savings.

Here are two concrete examples illustrating how these mechanisms work in practice.

Concrete examples

Example #1: The police are after you

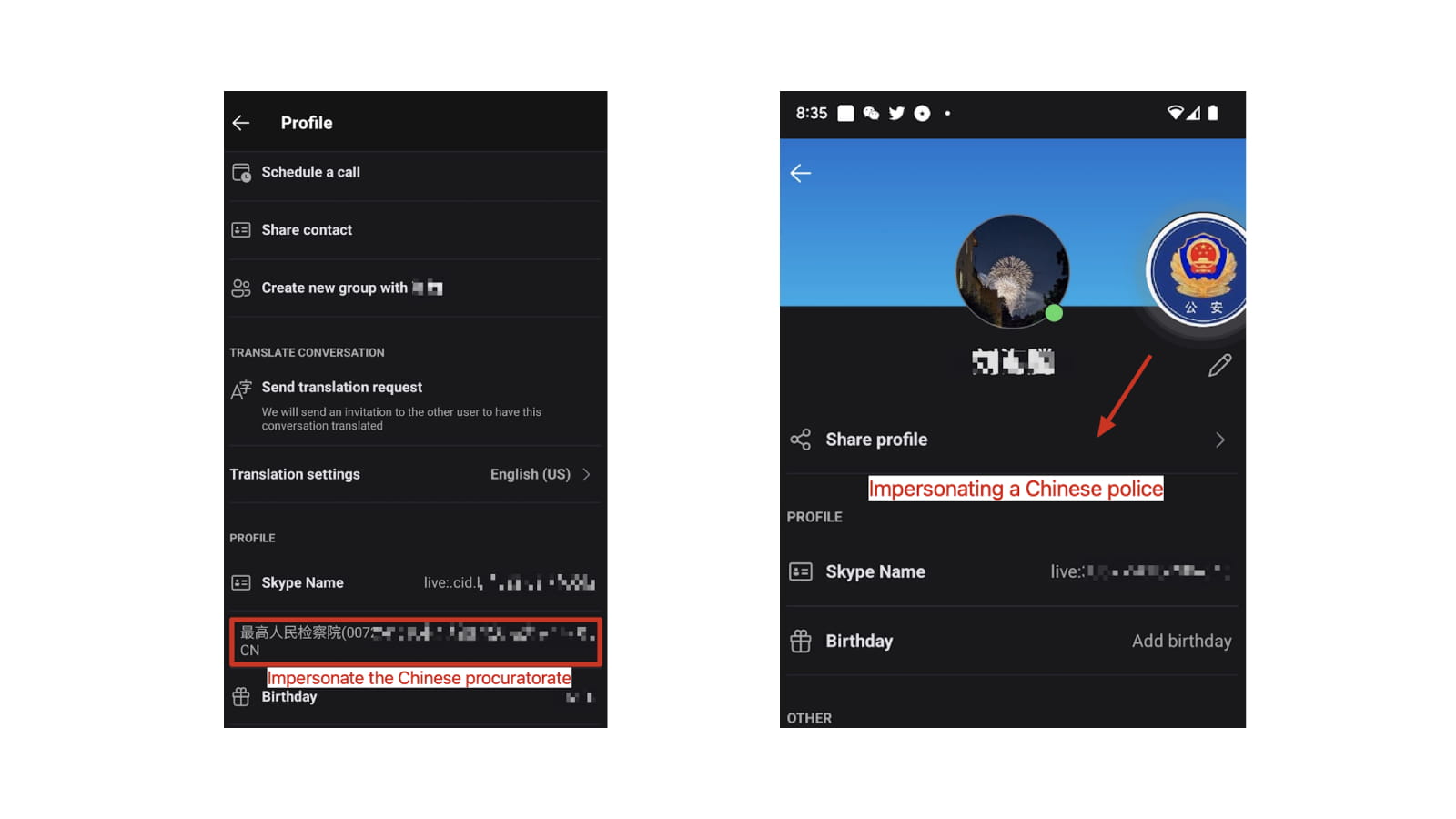

The victim, who we'll call David, finds himself in a sticky situation when the "police" claim he spread false information about COVID-19. The “authorities” demand that David write a document justifying his actions, which he agrees to do. His case is then transferred to "Detective Zhang", a con artist impersonating a police officer.

Mr. Zhang claims without preamble that David is suspected of taking part in a high-profile case of secret money laundering using cryptos, and tells him that a card issued by the Bank of China in David's name reportedly found among the possessions of an apprehended criminal.

David is then questioned for five long hours, via video call. “Law enforcement” orders David not to tell anyone about the case and not to make any phone calls or do any web searches about it.

David gave in to their demands and provided the scammers with daily reports on his activities for seven days. In the end, David was tricked into handing over details of his wallets and bank accounts, and he lost a staggering $1.2 million.

Imposter scams of this type are very common in this day and age. It is crucial to be vigilant and verify the authenticity of any message sent by a so-called authority figure.

Example #2: A Particularly Helpful Stranger

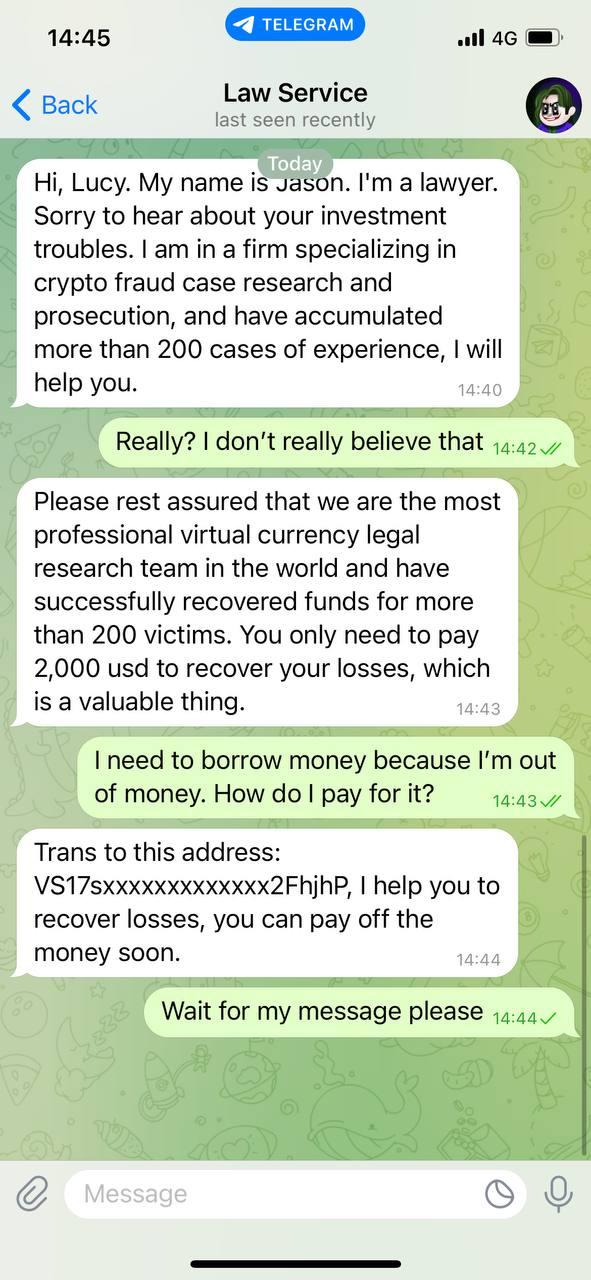

The victim, who we'll call Lucy, is recovering from a scam that tricked her into making a fake investment in crypto. On social media, she crosses paths with a so-called “lawyer” who promises to help her recover her stolen funds for the sum of 2,000 USDT.

Convinced by his repeated promises, Lucy agrees to pay the fees requested by the “lawyer” and borrows money from her friends. The scammer no longer bothers to continue playing the game and immediately disappears with the funds.

How to protect yourself from imposter scams?

Beware of self-proclaimed “government officials”

Remember that no government official, especially a law enforcement officer, will contact you directly to threaten arrest, demand money, or promise to keep your coins safe in their wallet crypto. If you believe that the person claiming to be a government official is an impostor, contact the police using official channels to try to verify the authenticity of this person's statements.

Protect your confidential information

Scammers can use your travel history, purchase history, and personal contact information to steal your identity and engage in other illicit activities. To minimize your risks, be sure to protect your personal information.

If you have been scammed

Another scammer may try to defraud you further: avoid responding favorably to requests for withdrawals or additional transfers from strangers. The likelihood that this is a different scammer trying to take advantage of your situation is very high.

If you have been the victim of an impostor scam, you should definitely report the incident to local authorities immediately.

If your Binance account is compromised, contact our customer service by following the steps in our FAQ How do I report a scam on Binance customer service?

To learn more about how to spot and avoid scams, read our other articles in the Fighting Scams series, which will provide you with useful information to protect your funds.

For more information

(Blog) How to Survive Scams: The Complete Guide to the Most Common Crypto Scams

(Blog) How to Survive Scams: Fake Crypto Investments to Be Wary of

(Blog) How to survive scams: Fake job offers to be wary of | Binance Blog

Disclaimer and Risk Warning: This content is presented to you “as is” for general information and educational purposes only, without representation or warranty of any kind. It should not be construed as financial advice, nor as a recommendation to purchase a specific product or service. Prices of digital assets can be volatile. The value of your investment may go down as well as up and you may not get back the amount you invested. You are solely responsible for your investment decisions and Binance is not responsible for any losses you may incur. This does not constitute financial advice. Please see our Terms of Use and Risk Disclaimer for more information.