A massive forced liquidation wave has swept through the market, with Altcoin being the hardest hit group. In the last 24 hours, over 1.44 Billion USD in positions have been wiped out, exposing the market's heavily over-leveraged state.

🔹 The 1.4 Billion USD Long Squeeze

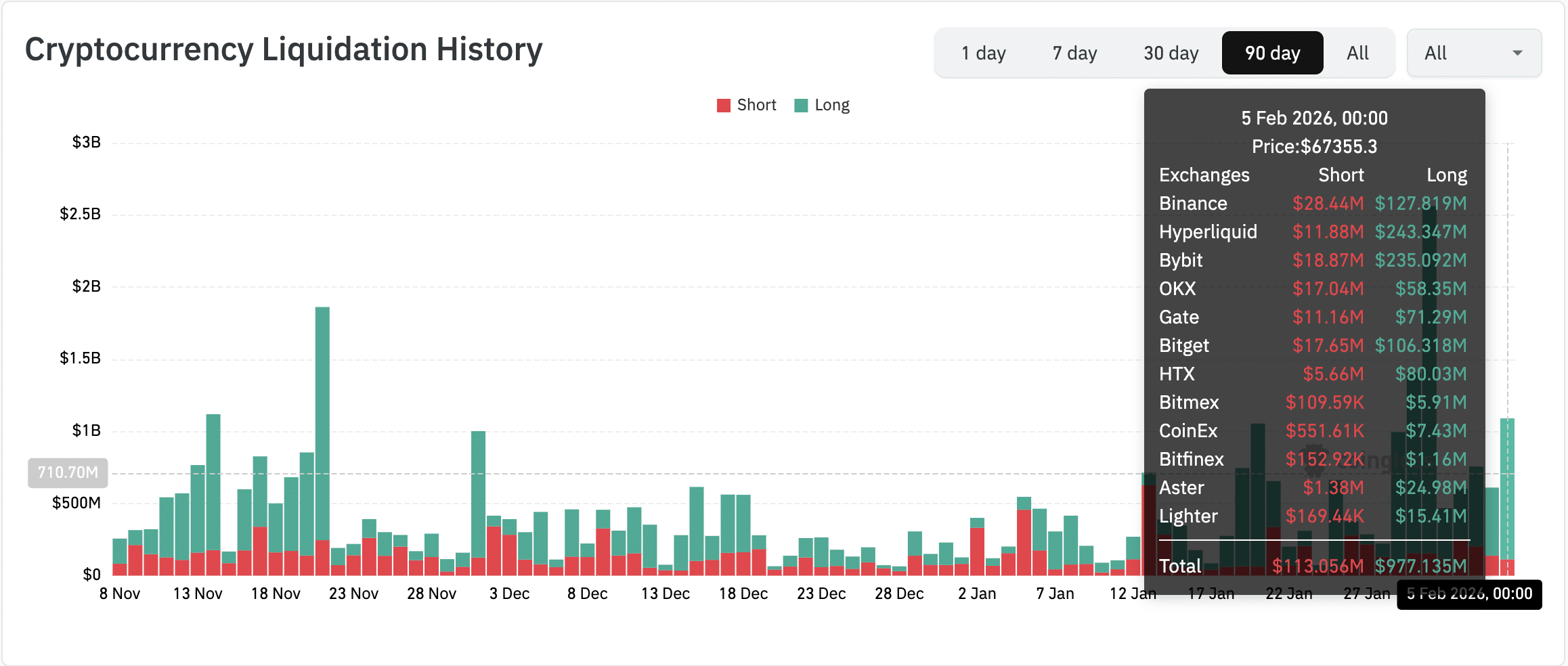

Out of a total of 1.44 Billion USD liquidated, up to 1.26 Billion USD came from long positions, compared to only 187 Million USD from the short side.

The sell-off happened rapidly. Liquidations increased from 427.8 Million USD (in 1 hour) to 930.2 Million USD (12 hours) before reaching the final number of the day.

Traders betting on recovery were crushed as prices continued to slide, triggering a massive liquidation wave across Binance, Bybit, Hyperliquid, and OKX.

🔸 Altcoin Massacre

$ETH Leading the losses with over 120 Million USD liquidated just in the last hour.

$SOL Witnessing about 33 Million USD evaporate.

$XRP Recording more than 13 Million USD being forcibly closed.

Others: Dogecoin and Sui are also facing high liquidation activity due to thin order books amplifying volatility.

🔹 A painful but necessary reset.

Shaking off leverage.

The market has hit the "reset" button on over-leveraged bulls. Although this massive liquidation may help stabilize prices in the short term, the risk of volatility remains if traders try to catch the bottom too early.

1.26 Billion USD in long leverage has just evaporated. Is the market light enough to create a true bottom, or is this just the first wave of capitulation?

News and research information from Trading Insight is for reference only and not investment advice. Please read carefully before making a decision.