When Bitcoin sneezes, our wallets get pneumonia, and today the market just hit us with a reality check by breaking the $67,000 barrier. Family, we are living through a week that tests our steel nerves: the price has dropped 20% in just seven days, and what we're seeing is not a simple correction, but a massive liquidation that has wiped out more than $1,400 million in trading positions. 📉

To understand the magnitude of the issue, most of that blood in the market (about $1,240 million) came from people who were betting that the price would go up. When the price suddenly dropped, the systems forcefully closed those positions, creating a chain reaction that dragged down our favorites: Ethereum, Solana, XRP, and BNB not only followed "daddy Bitcoin," but suffered even uglier drops. It's as if the appetite for risk vanished from the table in the blink of an eye. 🛑

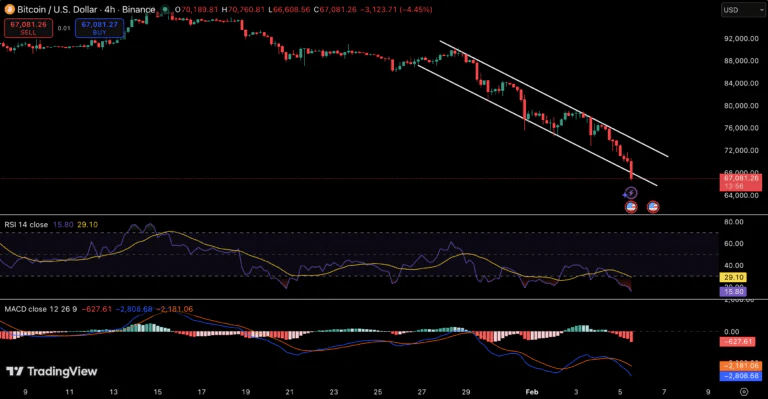

But pay attention to the technical data, because this is where the novices are separated from the knowledgeable: Bitcoin is now in "extremely oversold" territory. What does this mean in plain English? It has been sold off so much and so quickly that the indicators are screaming that the movement is stretched to the maximum. Now all eyes are on a magic number: $65,000. That is our containment wall, our last line of historical defense. If we can hold there, we could see a breather or a rebound; but if that floor breaks, get ready because the correction could get much more serious. 🧱

We are at that point in the movie where panic is forcing the "weak hands" out of the game through forced sales, and although the outlook looks grim, these are the moments that define market cycles. The question is: are we at the bottom of the barrel or is this just the beginning of a winter harsher than we expected?

Do you think the support at $65,000 will be enough to stop the fall, or is institutional fear too great to hold the price this month?$BTC