When I first saw the Dusk and NPEX partnership announcement in March 2024, I almost scrolled past it. Another blockchain claiming to help exchanges tokenize assets. Then I noticed something unusual in the details—Dusk didn't just partner with NPEX. They became a shareholder.

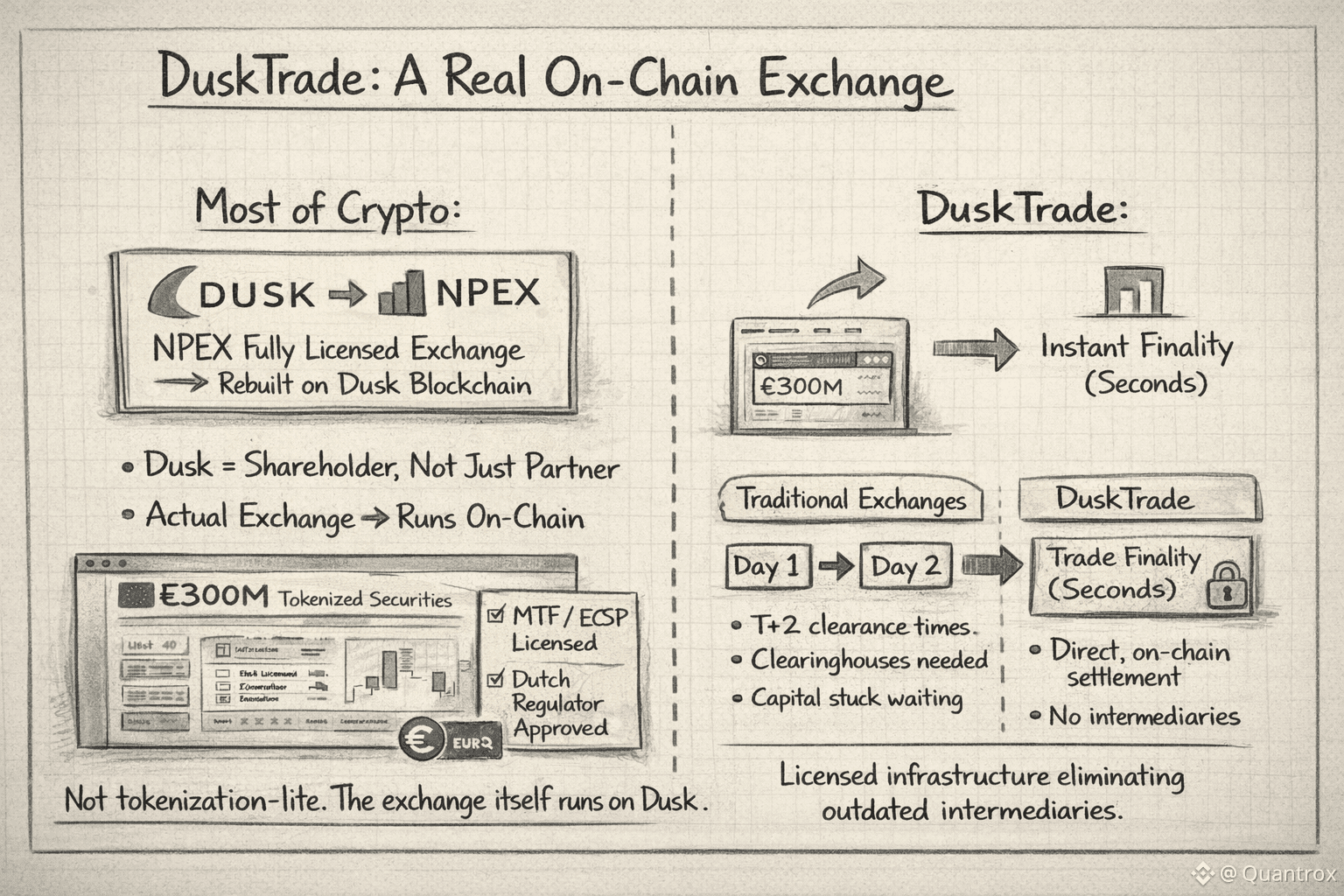

That changes everything about what's actually being built here. Most RWA projects are essentially asking "will institutions list their assets on our chain?" Dusk answered a different question entirely: what if the licensed exchange infrastructure itself ran on blockchain? Not assets wrapped and moved to a new platform, but the actual trading venue operating on-chain from the ground up.

NPEX holds MTF and ECSP licenses from the Dutch financial authority. Those aren't easy approvals—they require years of compliance work and ongoing regulatory oversight. When a licensed exchange decides to rebuild its infrastructure on blockchain, that exchange doesn't experiment with unproven technology. They evaluate whether the protocol can actually meet the regulatory obligations their licenses require.

DuskTrade launching in 2026 represents that evaluation's outcome. Over 300 million euros in tokenized securities are ready to move on-chain through this infrastructure. NPEX has completed 102 financings to date using traditional systems. That operational history doesn't disappear—it migrates to blockchain rails while maintaining the same regulatory standing.

What makes this work underneath is Dusk's dual transaction model. Phoenix handles private transfers using zero-knowledge proofs but includes provable encryption so regulators can access data under proper legal authority. Moonlight provides transparent transactions when institutions need them. The architecture satisfies both institutional confidentiality needs and regulatory auditability requirements simultaneously, which is why a licensed MTF can actually use it.

Settlement happens in seconds once a block reaches finality through Dusk's Succinct Attestation consensus. Traditional exchanges take 48 hours because they're coordinating across separate ledgers maintained by different intermediaries. DuskTrade settles on a shared authoritative ledger where all participants see the same state at the same time. That eliminates clearinghouses in many contexts and removes the capital inefficiency of funds locked in pending settlements.

The waitlist opening in January isn't marketing theater. It's institutions getting their first direct access to securities that settle like crypto trades—instant, final, self-custodied. Quantoz's EURQ stablecoin provides the compliant payment rail since it's actual electronic money issued under an EMI license, not just a token claiming euro backing.

What this reveals about where things are heading is that institutions don't need new platforms. They need their existing platforms to work better. Traditional stock exchanges understand how to operate under regulatory oversight. They understand how to serve issuers and investors. What they lack is infrastructure that reduces settlement time from days to seconds while cutting out layers of intermediaries that add cost without adding value.

Dusk positioned itself as that infrastructure while everyone else was trying to convince institutions to abandon their licenses and move to permissionless chains. When DuskTrade goes live, it won't prove blockchain works for finance. It will prove licensed financial infrastructure can operate on blockchain without sacrificing regulatory compliance.