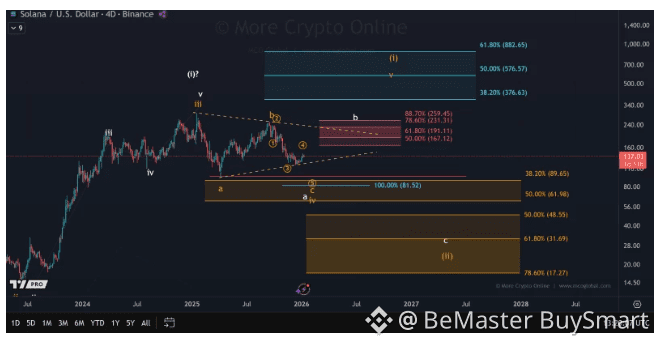

$SOL Solana remains stuck in a corrective pattern, with technical analysis pointing to another potential drop toward the $81-$90 range before the current downtrend completes.

👉 Solana continues trading in correction territory, and the chart structure suggests the decline isn't over yet. Technical analysis shows SOL could need another low before wrapping up this corrective phase. Current price action looks like a correction unfolding, not an impulsive recovery—keeping downside scenarios on the table.

👉 The primary scenario has Solana moving through a C-wave decline as part of a larger wave iv correction. This outlook holds up as long as price keeps showing corrective traits: overlapping moves and weak upside momentum. There's also an alternative count where the current drop could be an A-wave, which would still allow for another low before either a B-wave bounce kicks in or a fifth wave rally develops.

👉 Short-term targets sit in the $81 to $90 zone—a key area where this correction might bottom out. So far, there's no structural evidence pointing to a direct bullish reversal. Without impulsive upside movement, downside scenarios remain active, and there's little reason to believe the correction has already finished.

👉 This setup matters because it shapes what comes next for Solana. If price reverses higher without making another low, the structure since January 2025 would start looking like a triangle—suggesting extended consolidation instead of a quick trend resumption. Until stronger upside momentum appears, the focus stays on the possibility of one more corrective low defining SOL's next move.

🚀🚀🚀 FOLLOW BE_MASTER BUY_SMART 💰💰💰

Appreciate the work. 😍 Thank You. 👍 FOLLOW BeMaster BuySmart 🚀 TO FIND OUT MORE $$$$$ 🤩 BE MASTER BUY SMART 💰🤩

🚀🚀🚀 PLEASE CLICK FOLLOW BE MASTER BUY SMART - Thank You.