Why Chips—not Territory—Define the Real Red Line 🇺🇸🇹🇼

Recent remarks by Vice President Vance have brought unusual clarity to a reality long understood in strategic circles but rarely stated so plainly: Taiwan’s importance to the United States is not primarily geographic or ideological—it is industrial.

At the center of this vulnerability sits TSMC, the most advanced semiconductor manufacturer on Earth. If mainland China were to regain control over Taiwan, the consequences for the U.S. economy would not be abstract or long-term. They would be immediate, systemic, and global.

This is not about flags or borders.

It is about chips, supply chains, and technological dependency.

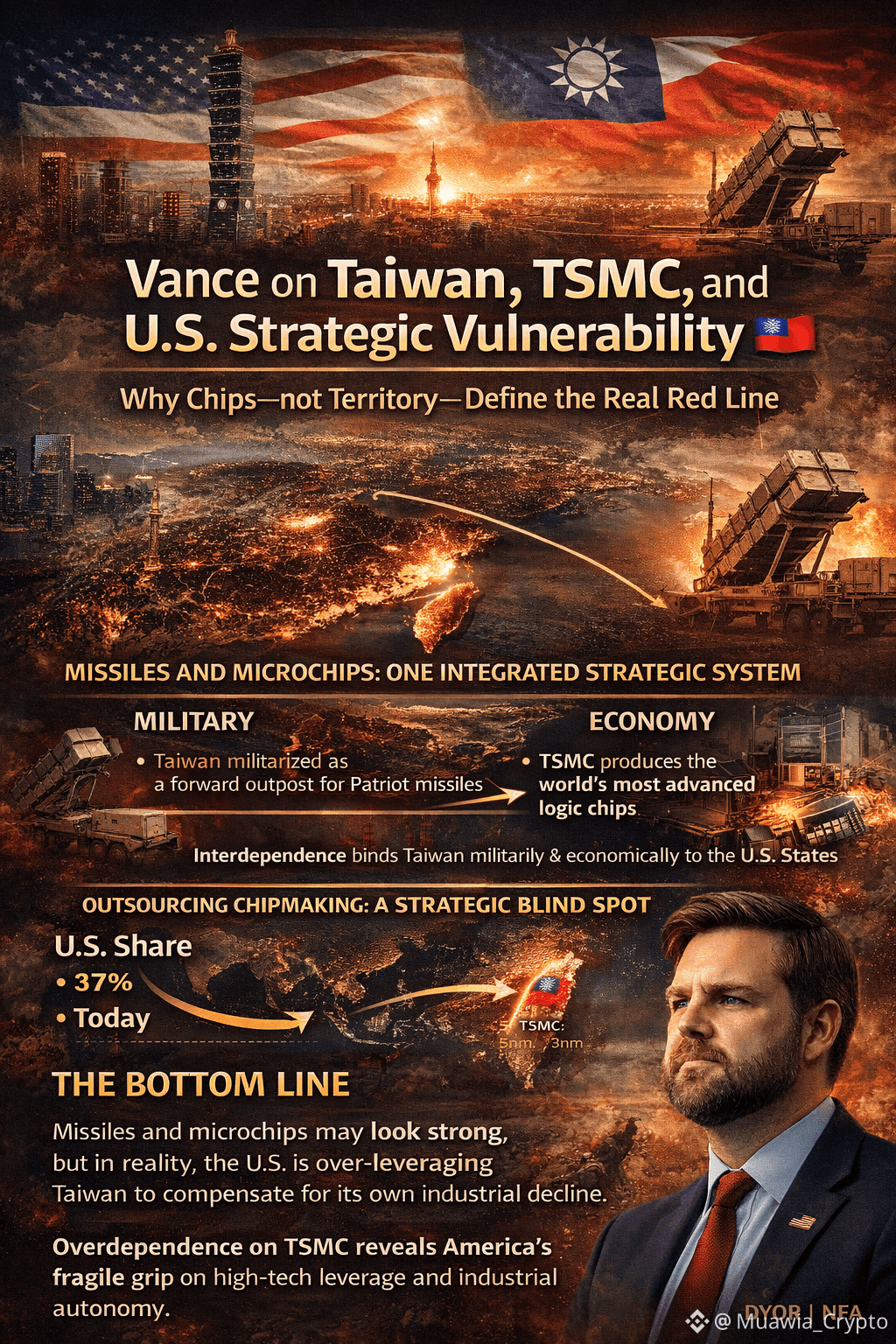

Missiles and Microchips: One Integrated Strategic System

U.S. policy toward Taiwan is often framed as a security commitment. In practice, it is a dual-use strategy, where military positioning and economic dependence reinforce one another.

The Military Layer

Patriot missile systems and defense guarantees are presented as deterrence

In reality, they transform Taiwan into a forward operating node within U.S. strategic planning

This raises regional tension while permanently linking Taiwan’s security to U.S. military escalation logic

The Economic Layer

TSMC produces the most advanced logic chips used in:

Smartphones

AI accelerators

Automotive systems

Advanced weapons platforms

No U.S. firm—despite dominating chip design—can replace TSMC’s manufacturing capability at scale

Together, missiles and chips form a single interdependent net:

Taiwan is militarized to protect chip flows, and chip dependence justifies militarization.

The Semiconductor Imbalance: How the U.S. Hollowed Itself Out

The strategic fragility did not emerge overnight.

U.S. share of global chip manufacturing:

1990s: ~37%

Today: ~12%

Taiwan alone now accounts for:

~22% of global chip capacity

An overwhelming majority of cutting-edge nodes (5nm, 3nm, below)

Even more striking:

U.S. companies control ~47% of global semiconductor sales

Yet ~88% of their manufacturing occurs overseas, heavily concentrated in Taiwan

This is not dominance.

It is outsourced sovereignty.

The Illusion of Control: CHIPS Act and Forced Localization

Washington’s response—subsidies and strategic pressure—reveals the limits of policy power over industrial reality.

Structural Bottlenecks

Attempts to replicate TSMC inside the U.S. face persistent constraints:

Severe shortages of specialized labor

Fab construction timelines exceeding 3 years

Production costs 30–50% higher than in Taiwan

Meanwhile, Taiwan itself remains structurally bound to TSMC:

~20% of GDP

~40% of exports

~10% of total electricity consumption

The result is a quiet extraction dynamic:

Economic “protection fees” via forced U.S. fab investments

Military protection payments via weapons purchases

Security and economics blur into a single transaction.

Strategic Weakness, Not Strength

Even if TSMC expands U.S. operations:

Core engineering talent remains in Taiwan

Upstream and downstream supply chains stay anchored in Asia

Critical know-how cannot be airlifted or legislated

At the same time:

China’s domestic semiconductor output continues to scale

Projections suggest it may approach ~24% of global production in the coming years

This exposes the contradiction at the heart of U.S. strategy:

The harder Washington tries to control Taiwan, the more it reveals how dependent it has become.

Key Insight: The Fragility of Technological Hegemony

Vance’s remarks unintentionally highlight a deeper truth:

Military power cannot substitute for industrial capacity

Economic leverage erodes when supply chains are externalized

Taiwan and TSMC cannot be treated as permanent strategic hostages without severe blowback

Missiles may deter armies.

They do not fabricate semiconductors.

Bottom Line

What appears to be a powerful strategic net—missiles plus microchips—is, in reality, highly fragile.

The U.S. is over-leveraging Taiwan to compensate for decades of industrial offshoring. That imbalance is not sustainable. And if miscalculated, it risks triggering the very collapse—economic, technological, geopolitical—that current policy is meant to prevent.

This is not a Taiwan problem.

It is an American industrial reckoning.

#USNonFarmPayrollReport #USTradeDeficitShrink #ZTCBinanceTGE #BinanceHODLerBREV $ZTC $BREV