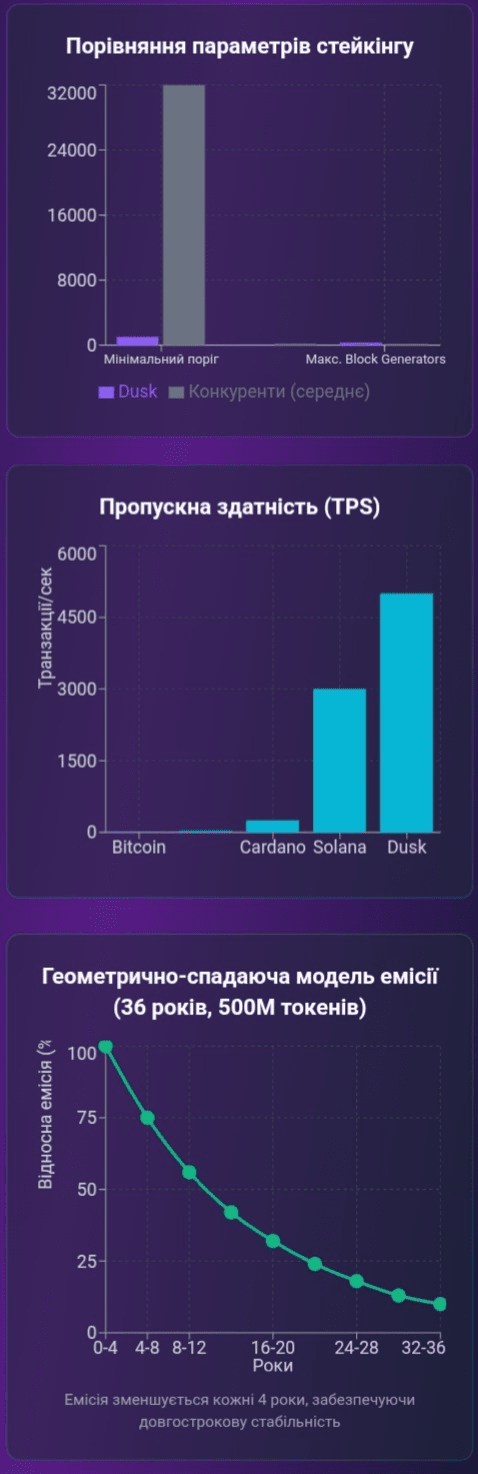

To be honest, I'm tired of projects that promise scalability, but when it comes to real numbers, it turns out they've just optimized test conditions to get a nice figure for marketing materials. When I look at @dusk_foundation, I see a completely different approach to scalability—not as an end in itself, but as a natural outcome of a well-thought-out architecture. The network can handle up to 5000 transactions per second, and this isn't a theoretical maximum under lab conditions—it's real throughput achieved thanks to the unique Segregated Byzantine Agreement consensus mechanism. What impresses me the most is that this speed is achieved without sacrificing security or decentralization, which is usually where the catch lies in most "fast" blockchains.

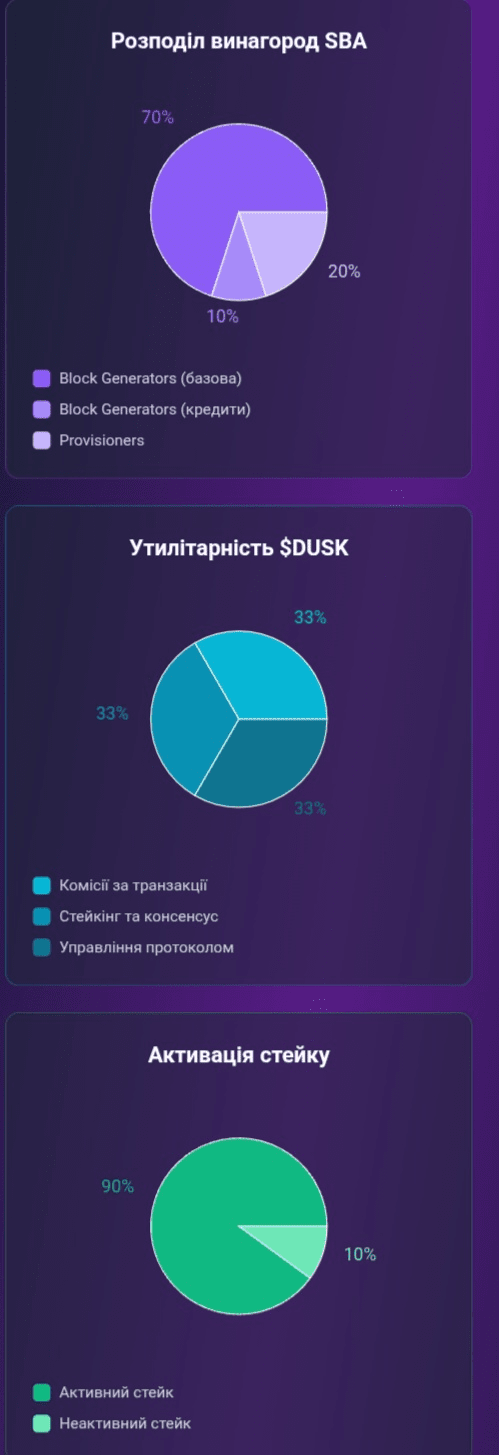

SBA is not just a modified Proof of Stake—it's a fundamentally different way of organizing consensus. In standard PoS networks, all nodes perform the same tasks, creating bottlenecks and limiting scalability. Here, it's different: there are Block Generators, who propose blocks and receive 70% of rewards plus an additional 10% based on credit in their certificate, and Provisioners, who vote on block validity. This role segregation allows workloads to be distributed so that network-intensive and compute-heavy operations do not compete for the same resources. The result is a network that can scale without the typical trade-off between speed and decentralization. Provisioners can use simpler hardware since they don't perform heavy computations, while Block Generators focus solely on creating valid blocks without needing to maintain a massive number of network connections.

Reflecting on the staking economic model, I realize how crucial it is for the network's long-term stability. The minimum entry threshold is 1,000 $DUSK, making consensus participation accessible to average token holders, not just whales. The staking maturity period is just 4,320 blocks—approximately 12 hours—after which you start earning rewards. This is much faster than in many competitors, where you must wait weeks. Rewards are distributed probabilistically based on the size of your stake relative to the total staked tokens in the network—the larger your contribution, the more frequently you receive rewards. But the most interesting part is the slashing mechanism, which penalizes only actual violations: confirming invalid blocks or offline nodes. This is not arbitrary confiscation, but a fair system that ensures security without excessive repression.

The token $DUSK in this ecosystem performs three critical functions that create organic demand. First, it's used to pay transaction and smart contract deployment fees—basic utility, but enhanced by the fact that a portion of unclaimed rewards are burned via the gas-burning mechanism, creating deflationary pressure. Second, staking for consensus participation with an emission of 500 million tokens over 36 years following a geometrically declining model, where emissions decrease every 4 years—this ensures long-term participant motivation without sudden inflationary shocks. Third, protocol governance through voting by token holders—not a formality, but real influence over the network's development. #Dusk has created a tokenomics model that aligns the interests of developers, validators, and asset holders in a single direction.

Especially valuable is how @dusk_foundation solved the initial liquidity problem for staking. In many networks, there are hard caps on the number of validators or astronomical minimums for entry, creating centralization. Here, the limit of 300 Block Generators is combined with an annual reward pool of 3 million $DUSK, enabling even small stakers to expect predictable returns. When you stake, 90% of your assets become active immediately and start earning rewards, while 10% go into an inactive state—this prevents manipulation through constant in-and-out cycles to maximize profit. Withdrawn rewards are available immediately and can be restaked without waiting for another maturity period, providing flexibility in portfolio management.

Transparency in market participant interactions is achieved not through public visibility of every transaction, as in Bitcoin or Ethereum, but through an elegant combination of Zero-Knowledge proofs and auditing. Regulators with appropriate keys can decrypt transaction details for compliance purposes, but the general public and competitors do not see this information. This changes the game for institutional participants: you can trade tokenized bonds, stocks, and real estate on-chain without revealing strategies or violating regulatory requirements. The modular architecture with separation of DuskDS for consensus and DuskEVM for smart contract execution allows each component to scale independently—if computational load increases, you can add processing power at the execution layer without overburdening the consensus layer. This is not just a technical detail—it's an architectural solution enabling the network to grow alongside demand without hard forks or complex upgrades. In a world where financial institutions seek blockchain solutions capable of processing thousands of transactions per second with guarantees of security and compliance, such scalability is not just a competitive advantage but a fundamental requirement for survival in the market.