Most cryptocurrencies are born with a familiar goal: transfer value, secure a network, or coordinate governance. WAL was motivated by a more specific problem—how to make decentralized data storage sustainable, verifiable, and economically fair without recreating the same centralization risks seen in Web2 infrastructure. That starting point shapes every distinguishing feature of the WAL token.

A token designed around data, not just transactions

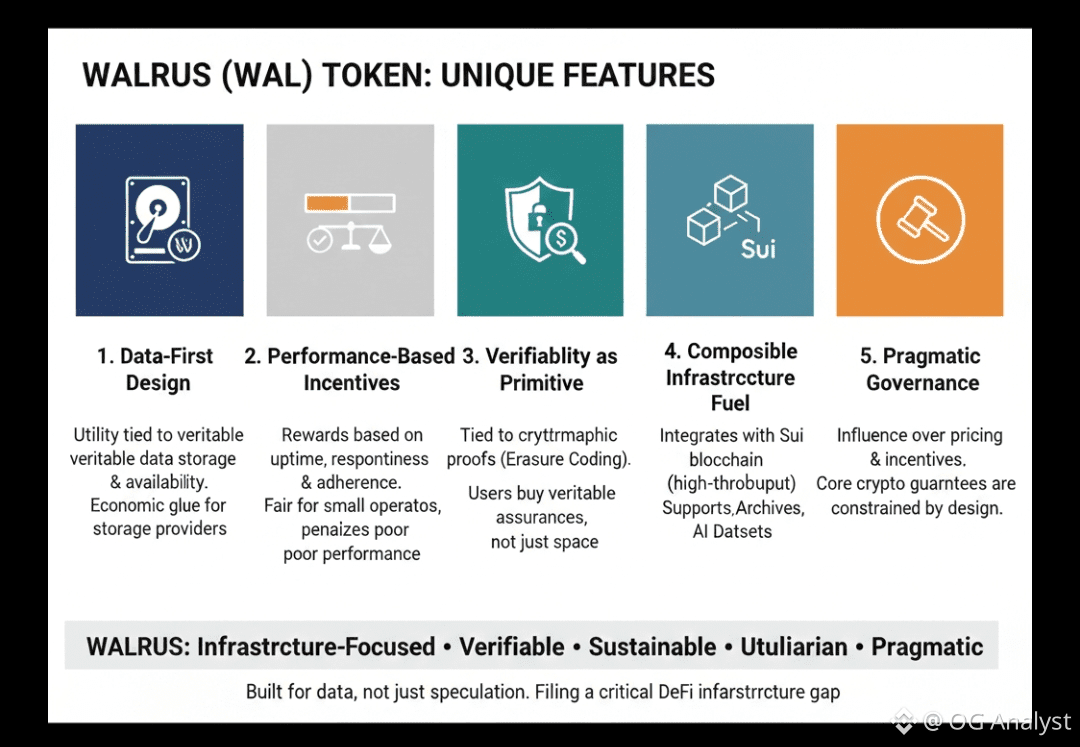

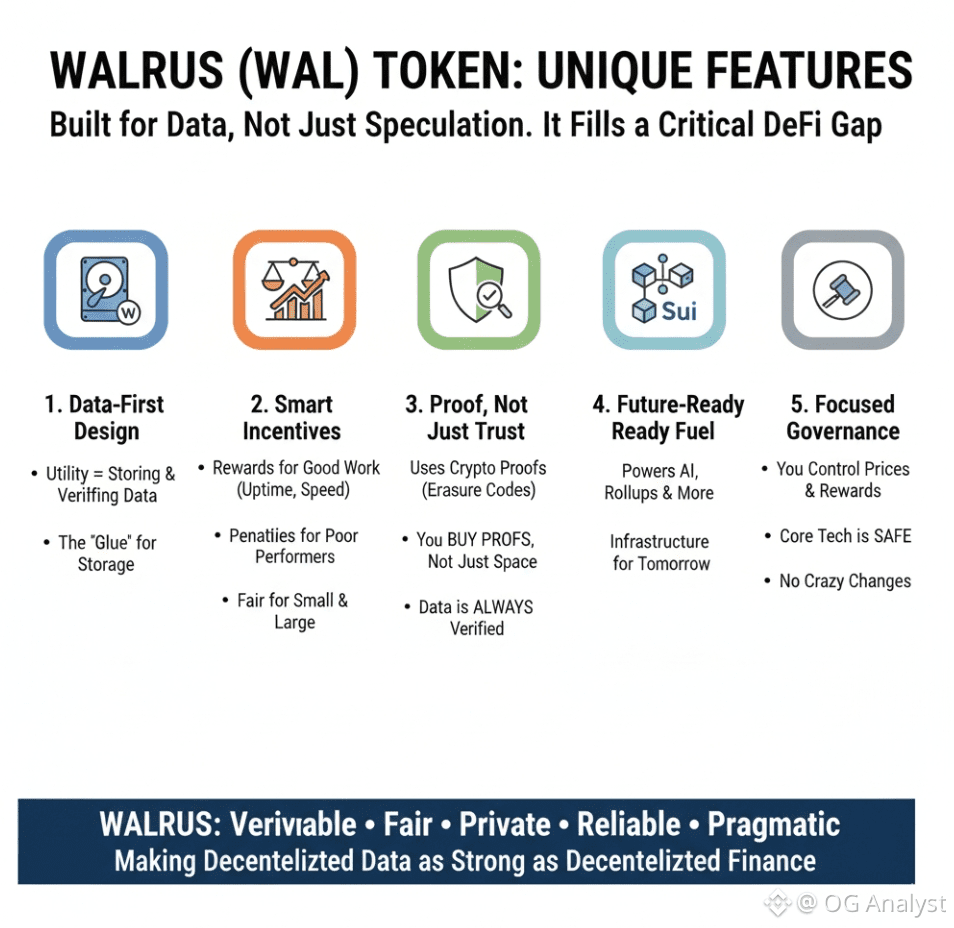

Unlike general-purpose tokens that later search for utility, WAL is deeply embedded in Walrus’s data availability and storage model from day one. WAL is not simply used to pay fees; it is the economic glue that binds storage providers, data publishers, and verifiers into a single system. The token’s role is to ensure that data can be stored redundantly, retrieved reliably, and verified cryptographically—without trusting any single operator.

This data-first design is a key distinction. WAL’s value is directly linked to measurable services: storing blobs, maintaining availability over time, and proving that data remains intact. This grounds the token’s utility in real protocol activity rather than abstract promises.

Incentives tied to performance, not size

Many networks unintentionally favor large operators by rewarding scale alone. WAL takes a different approach by aligning rewards with behavior. Storage nodes earn WAL based on correct data storage, responsiveness, and adherence to protocol rules—not simply on how much capital they control.

This creates a more level playing field. Smaller, well-behaved operators can remain competitive, while poorly performing large nodes face penalties. The result is a token economy that discourages silent monopolization and encourages consistent service quality.

Verifiability as an economic primitive

A defining feature of WAL is how closely it is tied to cryptographic proofs. Storage claims are not trusted—they are verified. Erasure coding, availability sampling, and on-chain commitments ensure that data integrity can be checked without exposing the underlying content.

WAL is used to pay for these guarantees. In effect, users are not buying storage space; they are purchasing verifiable assurances. This makes WAL fundamentally different from tokens where security is assumed rather than continuously proven.

Designed for composability with modern blockchains

WAL is also distinct in how it integrates with the broader ecosystem. Built alongside the Sui blockchain, Walrus leverages high-throughput execution and parallelism to keep data commitments efficient and low-latency. WAL therefore supports use cases beyond simple storage, including rollups, archives, AI datasets, and application backends that require long-term data availability.

This composability turns WAL into infrastructure fuel rather than an isolated asset.

Governance with practical boundaries

Governance tokens often promise total control, which can lead to instability. WAL governance is narrower and more pragmatic. Token holders influence parameters that affect pricing, incentives, and protocol evolution, but core cryptographic guarantees remain constrained by design. This balance helps WAL avoid governance capture while still allowing the system to adapt over time.

A quieter kind of differentiation

Perhaps the most unusual feature of WAL is what it does not try to be. It does not market itself as a universal currency or a speculative meme. Its identity is intentionally utilitarian. WAL exists to coordinate trustless data storage at scale, and its features reflect that singular focus.

Conclusion

The Walrus (WAL) token stands out not through novelty, but through discipline. By anchoring its utility to verifiable data storage, aligning incentives with performance rather than power, and limiting governance to practical levers, WAL fills a gap that many cryptocurrencies overlook. It shows what a token can look like when it is built for infrastructure first—and speculation second.