$BTC What just happened is not normal market behavior.

Within a single hour following news that the U.S. Supreme Court delayed its ruling on the high-impact tariffs case, on-chain data recorded one of the largest synchronized Bitcoin accumulation events of the year.

This was not retail FOMO.

This was institutional capital moving with intent.

📊 The On-Chain Evidence (Verified Wallet Activity)

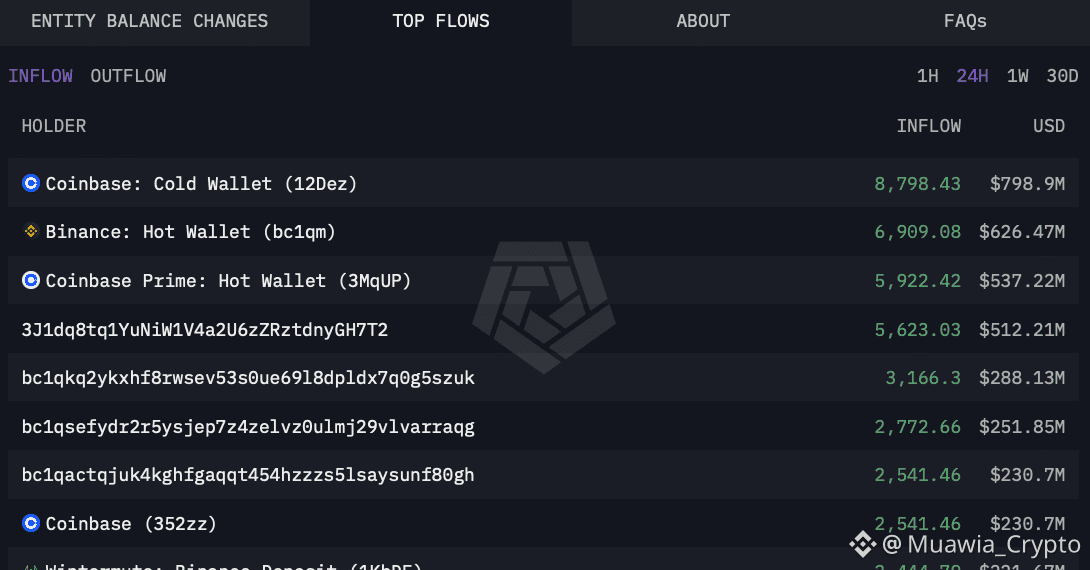

Tracked inflows show over $3 BILLION worth of Bitcoin absorbed almost instantly:

Coinbase: 8,797 BTC

Binance: 6,909 BTC

Wintermute (market maker): 3,711 BTC

Kraken: 2,551 BTC

Independent whale wallets: 22,158 BTC

👉 Total: 44,126 BTC accumulated in ~60 minutes

At prevailing prices, this represents one of the most aggressive short-timeframe BTC buy programs since post-ETF approval flows.

⚖️ Why the Supreme Court Tariff Delay Matters

Markets were positioned for legal clarity that could have triggered:

Higher import costs

Inflation re-acceleration

Bond market repricing

USD volatility

Instead, the delay extended uncertainty, which historically benefits:

Hard assets

Neutral, non-sovereign stores of value

Liquidity hedges against policy risk

Bitcoin checks all three boxes.

Institutions didn’t wait for headlines — they positioned first.

🧠 Why This Looks Coordinated (Not Coincidental)

Several red flags point to intentional synchronization:

Timing precision

Buys clustered tightly around the legal update window.

Venue diversity

Accumulation occurred across multiple exchanges and OTC-linked wallets, reducing slippage and visibility.

Market maker participation

Wintermute’s involvement strongly suggests liquidity preparation, not speculation.

No corresponding retail spike

Search trends and funding rates stayed muted during the initial accumulation phase.

This is textbook smart money behavior.

🧩 What This Usually Precedes (Historically)

Similar accumulation patterns in the past have preceded:

Volatility expansion phases

Narrative shifts from “risk asset” to “macro hedge”

Sudden repricing events that leave late participants chasing

Importantly:

These moves tend to happen before mainstream awareness catches up.

⚠️ Final Thought

This doesn’t guarantee straight-line price action.

But it does confirm one thing:

Large players are positioning Bitcoin as a strategic asset amid rising legal, fiscal, and geopolitical uncertainty.

When billions move this fast, it’s not emotion.

It’s preparation.

👀 Watch what happens next, not what already happened.