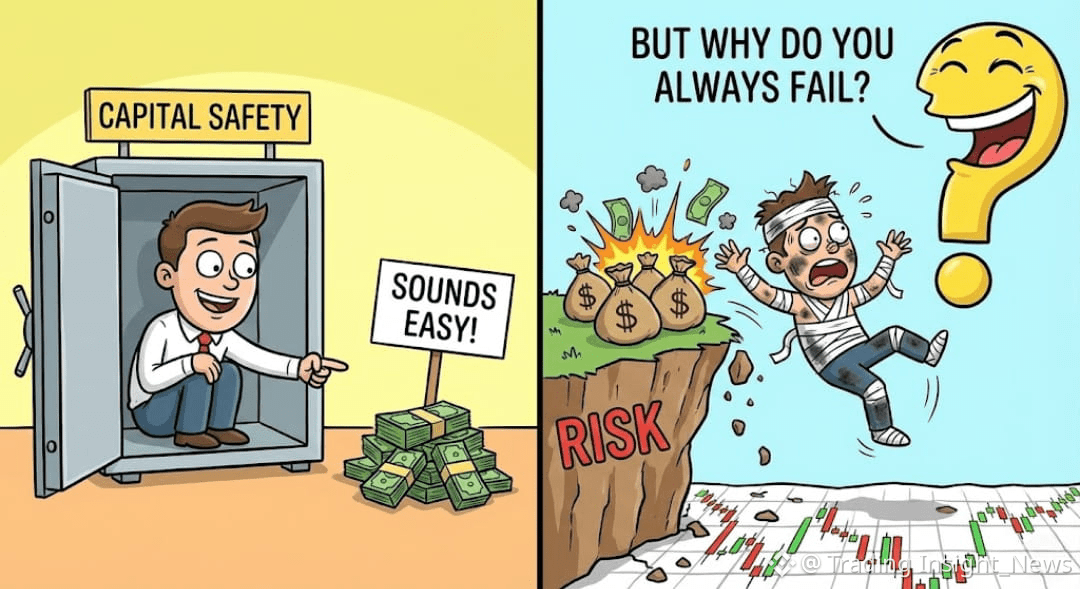

Keeping money is more important than making money. Everyone who enters the market knows this mantra by heart. But why do 90% of traders still lose their accounts? Because capital safety completely contradicts the human instinct for greed.

🔸 The Boredom of Safety vs The Dopamine of Action

The Theory is I will wait for the perfect setup. I will sit in stablecoins until the market is clear.

The Reality is Sitting in cash feels like losing. When you see a random meme coin pump 50% in an hour, your brain screams You are missing out!

To the amateur, safety looks like laziness. To the pro, safety is a position.

🔸 The Illusion of House Money

You turn $1,000 into $2,000. You think That extra $1,000 is the market's money, I can gamble with it.

Wrong. Once it is in your account, it is your money.

Treating profits recklessly is the fastest way to round trip back to zero. Real safety means treating every dollar of profit with the same fear and respect as your initial deposit.

🔸 The Opportunity Cost Trap

Safety requires you to say No to 90% of trades.

The psychological pain of watching a coin moon without you often hurts more than the pain of losing money.

This pain causes you to abandon your safety rules and chase high-risk tops. You trade safety for the feeling of participation.

👉 How to Actually Practice Safety:

If you double your account, withdraw the principal immediately. You cannot lose what isn't on the exchange.

If you are worried about a position overnight, close half of it. Capital safety is also mental safety.

Make peace with the fact that you will miss pumps. The goal is to catch the easy ones, not every one.

Do you have a Withdrawal Schedule, or does your money stay on the exchange until you eventually give it all back?

News is for reference, not investment advice. Please read carefully before making a decision.