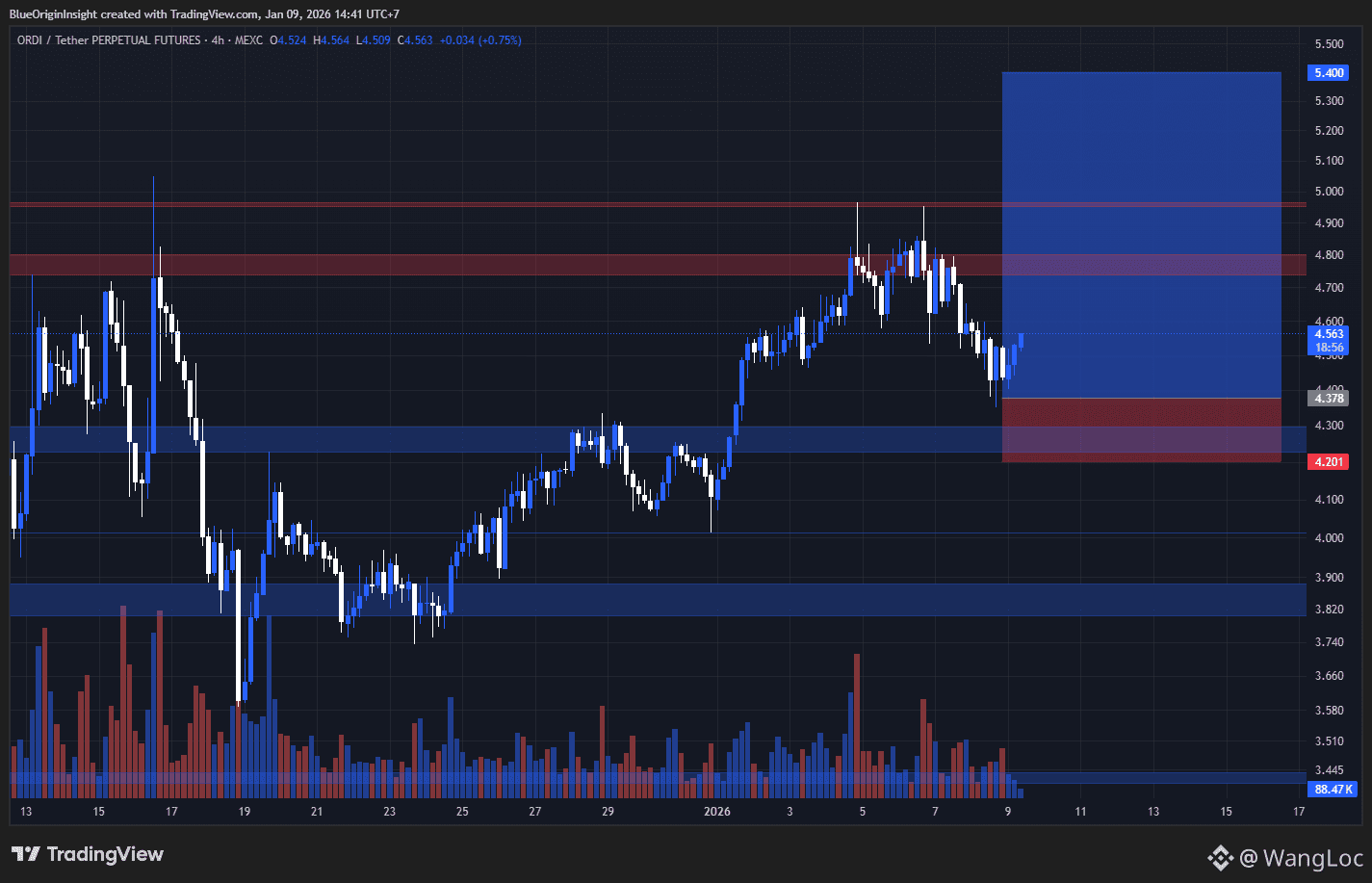

After a strong impulsive move, $ORDI reacted at the 4.8–5.0 supply zone and is now pulling back toward 4.3–4.4, a key H4 demand area.

So far, nothing about this move signals a trend reversal. The bigger picture remains intact:

Market structure is still higher high – higher low

The current decline looks like a post-expansion pullback, not distribution

Price is retesting a former accumulation base that led to the breakout

Key levels that matter:

4.30–4.40: Critical demand. If this zone holds, ORDI has a strong foundation to continue higher.

4.20: Line in the sand. Losing this level would weaken the H4 structure and calls for caution.

4.80–5.00: Overhead supply. This is an area to take profits or consider shorts only if clear rejection appears.

Preferred approach:

No FOMO chasing

Wait for clear reactions at demand to confirm buyer intent

The best trades appear when patience is tested, not when emotions peak

Strong trends don’t end because of pullbacks. They end when demand stops being defended.

#ORDI #altcoins #TrendingTopic $ETH $XRP