While most are only looking at BTC and ETFs, large exchanges are already preparing for a new narrative — RWA + stablecoins.

For example, O-K-X is already actively investing in the tokenization of real assets.

🔍 What is really happening:

Exchanges are planning to become financial hubs, not just a place for trading

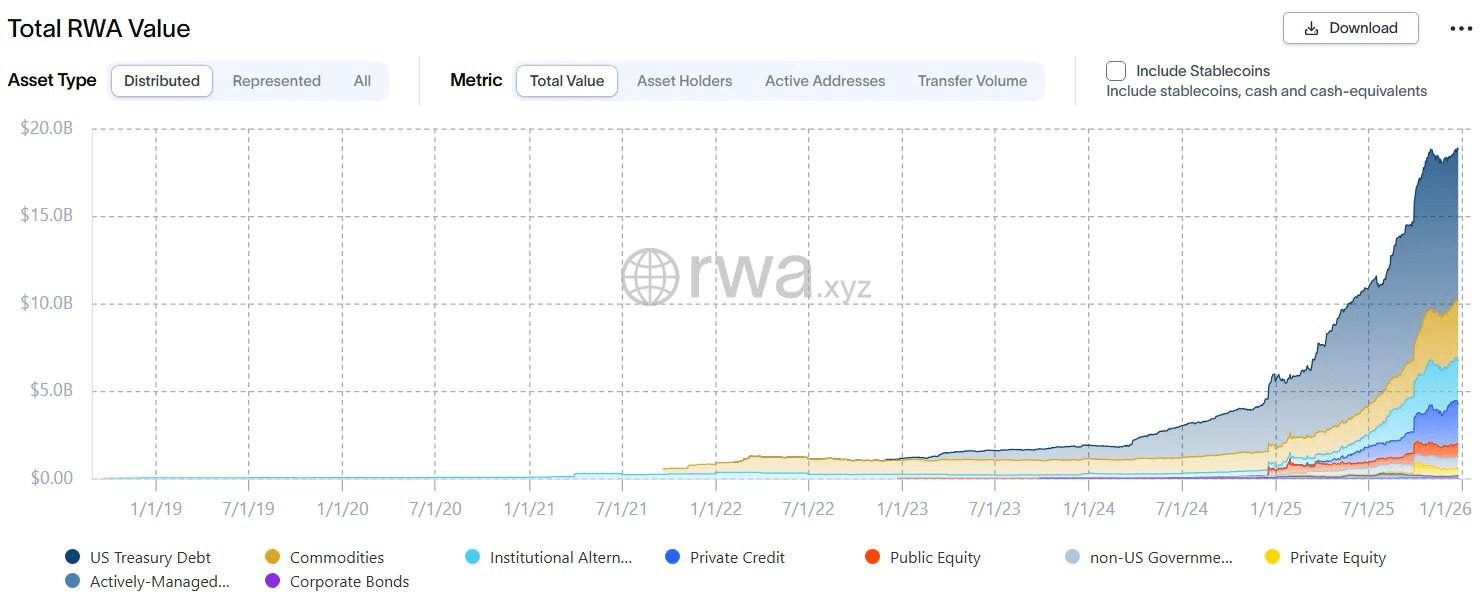

RWA = bonds, funds, real assets in on-chain

Stablecoins are the foundation of a new financial infrastructure

The year 2026 could be crucial for the mass adoption of crypto

⚠️ Why this matters: money from traditional finance enters crypto not because of memes, but through understandable regulated products, which is why exchanges with licenses gain a significant advantage.

Right now, crypto is gradually transforming from a wild west into a clear financial market. RWA + stablecoins is not about making quick profits overnight, but about big money that comes in for the long term.

However, the crypto market remains very young, so we still have plenty of flash crashes, liquidations, speculation, and manipulation. We will still have time to earn and lose a lot of money before this market becomes adequate (it never will)