While most people are still immersed in the hangover from New Year's Day 2026, and haven’t even had time to sweep the confetti from last night’s countdown into the trash, the world of Web3 has already staged a ‘hackers vs hunters’ defensive battle worthy of being included in textbooks.

No gunfire, only K lines; no masked robbers, only a crazily fluctuating buy wall.

At four in the morning, an obscure token named BROCCOLI714 was forcefully driven up 10 times by a pair of invisible hands. This is not the carnival of a bull market, but a digital robbery in progress.

Even more absurdly, the biggest winner of this robbery was not the scheming hacker, but a hunter who had already set a trap—Vida. In just a few minutes, he took away $1 million from the hacker's panic and the gaps in Binance's risk control system.

🚨 The alarm at four in the morning

For professional traders, sleep is a luxury, or rather, a standby state that can be interrupted by programs at any time.

Vida's computer emitted a piercing alarm in the early morning. This was not an ordinary market alert, but a 'landmine' he had planted months ago was triggered: the BROCCOLI714 he accumulated at a cost of $0.016 surged over 30% in a short time, accompanied by huge gaps between spot and contract prices.

This is like someone downstairs at your convenience store suddenly spending a thousand dollars to buy a bottle of mineral water and keeps buying. A normal person would think this person is crazy, but a keen observer would immediately realize: he is laundering money, or this money is not even his.

Vida rushed to the screen, and the scene before him convinced him of the latter.

🧱 The crazy 'buy wall'

In the financial market, true major players accumulate quietly, wishing to make the K-line look like a straight line on an electrocardiogram. But BROCCOLI714 went against the grain.

According to on-chain data and order book retrospectives, a suspected stolen market maker account is buying this illiquid small coin regardless of the cost.

A primer for non-high-frequency traders:

The hacker stole from a Binance account with huge funds (about $10 million - $20 million). But he faced a dilemma: Binance's risk control system is extremely strict, and directly withdrawing USDT (the US dollar stablecoin) would certainly be frozen in an instant.

So the hacker chose an old and violent 'transportation' method—wash trading.

It's like pouring from the left hand to the right. He frantically bought illiquid 'junk coins' (like broccoli) at high prices in the spot market, selling the coins from another account he controlled at high prices to the stolen account; or he could 'lose' the money from the stolen account to his private account through opposing positions in the futures market.

What Vida saw was a wall that was both desperate and exciting: on the order book (Bid) of Binance's spot market, there was a staggering buy order of $26 million.

And what was the market value of that coin at the time? $40 million.

This is equivalent to someone standing at the entrance of a community with cash that can buy half of the neighborhood, shouting: 'Who has houses? I will buy at double the price, now, immediately!'

This is definitely not normal investment behavior. This is a hacker desperately trying to launder the stolen money from the account by offloading it through a pump. He doesn't care about the cost; he just wants to clean the money.

🏎️ The art of arbitrage racing against risk control

Seeing through the bottom cards, the rest is execution. But this does not mean that just buying can make money because this is a three-party game: the hacker, the trader, and the trading exchange's risk control (the police) that may intervene at any time.

Vida's operation was like a practical teaching of minimally invasive surgery:

Identifying certainties: Since the hacker placed a buy order of $26 million in the spot market, it means that as long as he does not cancel the order, the price will only rise and not fall. This is certain exit liquidity.

Breaking the circuit breaker: At this point, Binance's futures market had already triggered the 'circuit breaker mechanism' due to excessive price fluctuations, and the contract price was firmly pressed at 0.038, while the spot had soared to 0.07. Prices in external markets like Bybit were also skyrocketing.

Precise sniping: Vida did not blindly go all in but instead used the trading terminal to try going long every 5-10 seconds. He was betting on the moment the circuit breaker ended or the window when risk control had not yet reacted.

As a result, he bet right. At a cost of 0.046, he successfully increased his long position by $200,000.

🎭 The game of chicken

The most exciting part occurred at 4:21 AM.

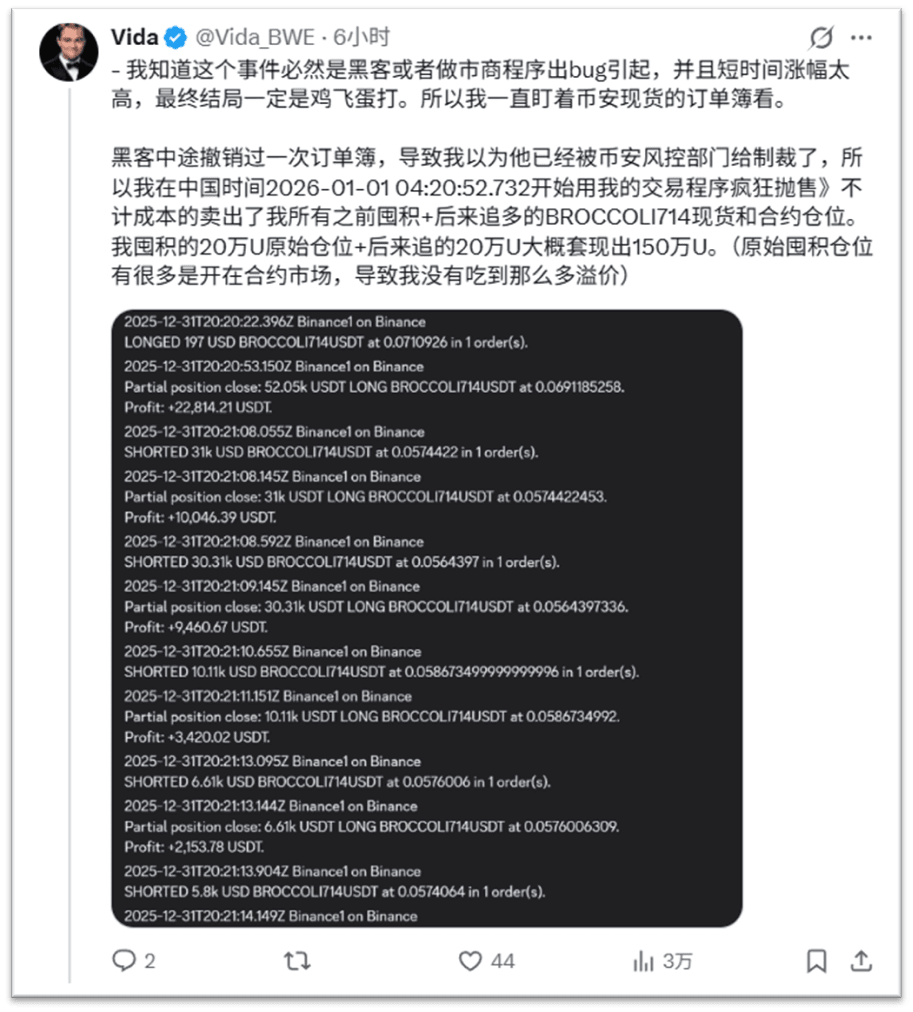

The hacker suddenly removed that huge buy order. For the followers, it was like the pillar supporting the building suddenly disappeared. Panic spread instantly, and Vida thought the exchange's risk control had intervened (i.e., 'the police are here, freezing the account'), so he unhesitatingly let the program sell off crazily, clearing all his spot and futures positions.

In this wave, he pocketed about $1.5 million.

But dramatically, a minute later, the hacker returned! The buy orders were listed again, and the price was directly pumped to $0.15.

This is actually a very typical psychological profile: the hacker is also afraid. He is also testing the response of risk control or adjusting his strategy for moving funds. That minute of canceling the order was the hacker's hesitation, and also Vida's escape pod.

🎬 The end

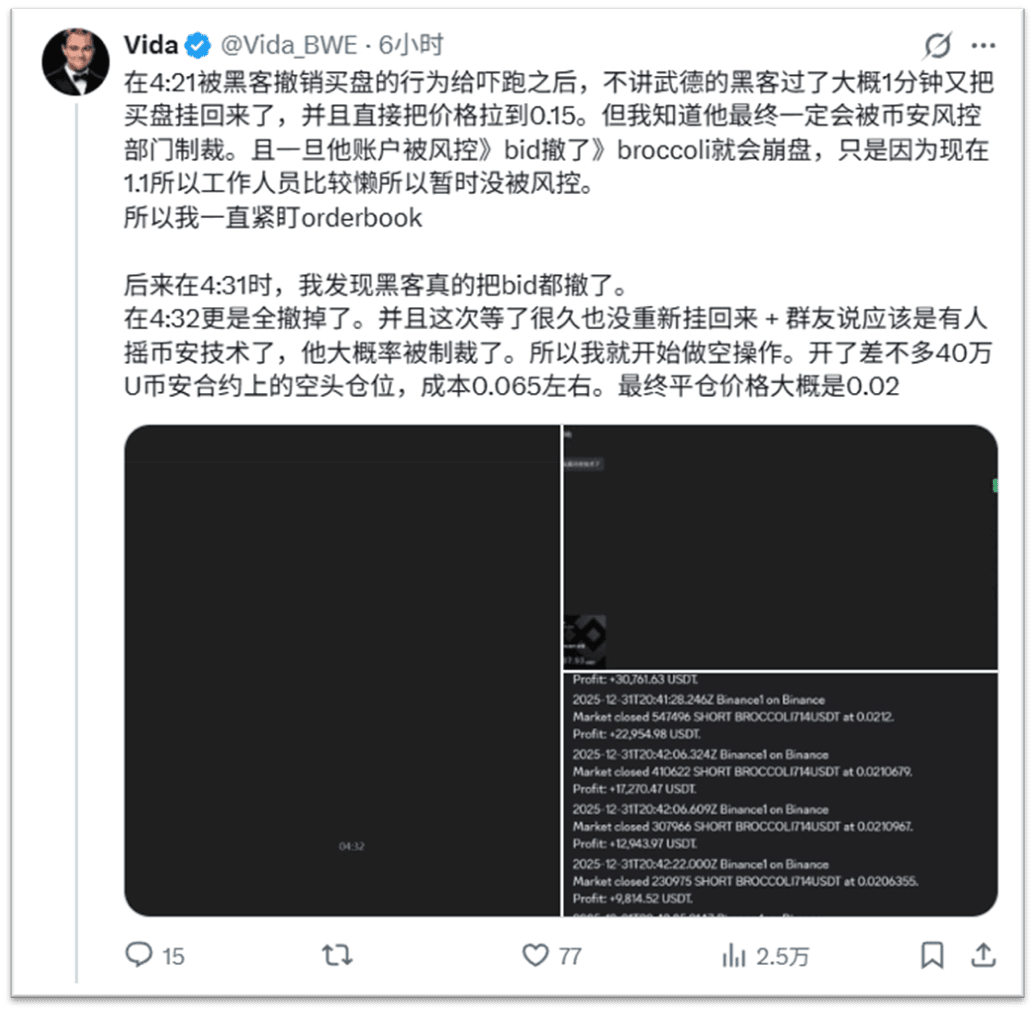

At 4:32, the carnival came to an abrupt stop.

The buy wall completely disappeared and never returned. Messages began to spread in the community that Binance's technical department had been awakened, and the net of risk control was finally tightening.

That account that was buying crazily was put on pause. BROCCOLI714, which lost its financial support, instantly collapsed. At this point, Vida, who had already taken profits and exited, shorted again, stepping hard on the price avalanche from 0.065 to 0.02.

🕯️ Epilogue: The survival rules of the dark forest

This 'first case of the year 2026' ultimately concluded in an absurd way:

After working hard for half a day, the hacker not only likely failed to transfer much money but also became the 'money-dispensing boy' of the community, possibly even losing his own capital.

BROCCOLI714 went from being unknown to skyrocketing 10 times, and then back to dust, all in just one hour.

Only hunters like Vida, armed to the teeth, could take advantage of infrastructure (fully automated alarms, high-frequency monitoring) and insights into human nature to reap the fruits amidst the chaos.

This reminds us again that Web3 is still a dark forest. There are no linear returns that can be gained through hard work, only extreme rewards for cognitive biases and cruel punishments for safety negligence.

For that stolen market maker account, this was undoubtedly a sad new year; but for the onlookers and the traders who made a fortune, this million-dollar 'broccoli' was indeed crispy and flavorful.

In 2026, I wish everyone could become hunters, rather than that piece of broccoli.

This article is based on Vida (@Vida_BWE)'s public review and整理, for information sharing only and does not constitute investment advice.