What the Ecoinometrics model reveals about this market opportunity.

🧠 What is happening?

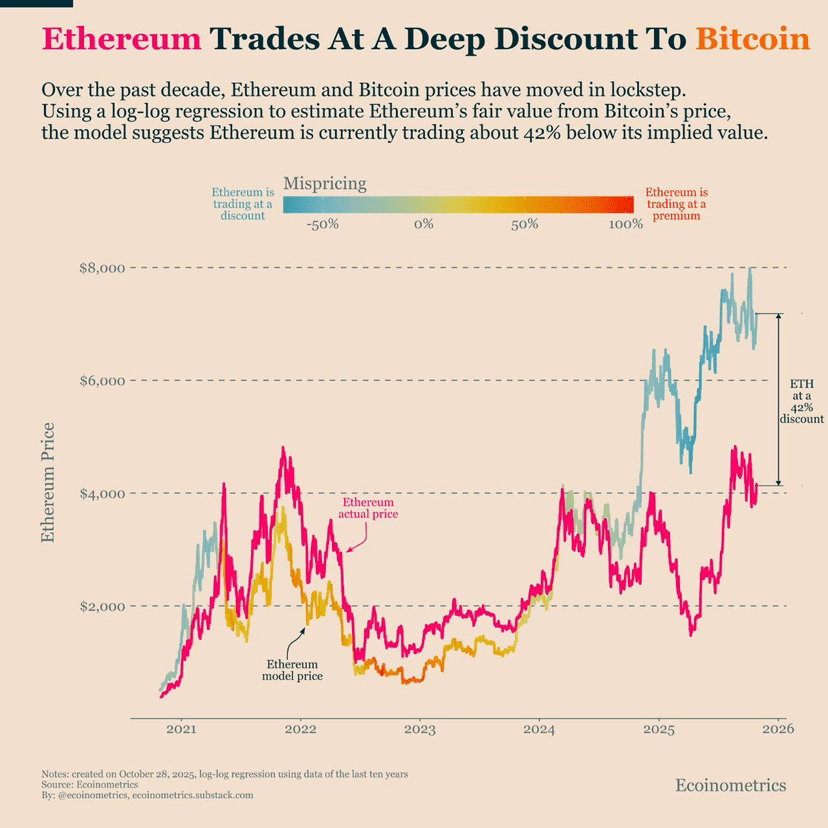

In recent years, the prices of Ethereum (ETH) and Bitcoin (BTC) have followed a similar trajectory, as if they were "dancing together" to the same rhythm. However, according to a recent study by Ecoinometrics, this dance seems to have gone out of sync.

A statistical model shows that Ethereum is being traded at a discount of about 42% compared to its fair value, based on the current price of Bitcoin.

📊 How was this number calculated?

Ecoinometrics used a technique called log-log regression, which basically analyzes how ETH and BTC prices have historically related. With this relationship, the model estimates how much Ethereum should be worth today, considering the price of Bitcoin.

Result? ETH is being traded well below what would be expected.

🖼️ What does the chart show?

🔵 Blue Line – Modeled price of Ethereum, based on Bitcoin

🔴 Pink Line – Actual price of Ethereum in the market

🌈 Background colors – Show the level of “discount” or “premium” of Ethereum relative to the estimated value

👉 By the end of October 2025, the chart shows ETH at a 42% discount.

📉 Has this happened before?

Yes. The chart shows that Ethereum has been both above and below the estimated value at other times, such as:

In 2021, ETH was traded above the model value (premium)

In 2022 and 2023, it was below, but not as much as now

These cycles indicate that the market tends to correct itself over time, which could mean an entry opportunity for those who believe in the recovery of this relationship.

🔍 Why does this matter?

This analysis helps answer an important question for investors:

“Is Ethereum cheap or expensive relative to Bitcoin?”

If the model is correct and the historical pattern repeats, Ethereum may have good room for appreciation in the coming months.

💡 But be careful: this is not a buy recommendation. Statistical models do not guarantee the future and should be used as a complementary tool in decision-making.

🧭 And now, what to do?

If you:

Believes in the technology of Ethereum

Trusts the long-term relationship between BTC and ETH

And is seeking strategic entries based on data…

… so this type of analysis can help you make more informed decisions.

📚 Technical curiosity: what is a log-log regression?

It is a technique used to discover relationships between variables that grow exponentially (like cryptos). By applying logarithms, the model smooths the data and allows for the identification of long-term patterns between the assets.

✍️ Conclusion

Ecoinometrics' analysis provides a data-driven perspective suggesting:

Ethereum is cheap relative to Bitcoin — and this does not go unnoticed by those following the market.

History shows that the market typically corrects these distortions.

If this repeats, we may be facing a window of opportunity.