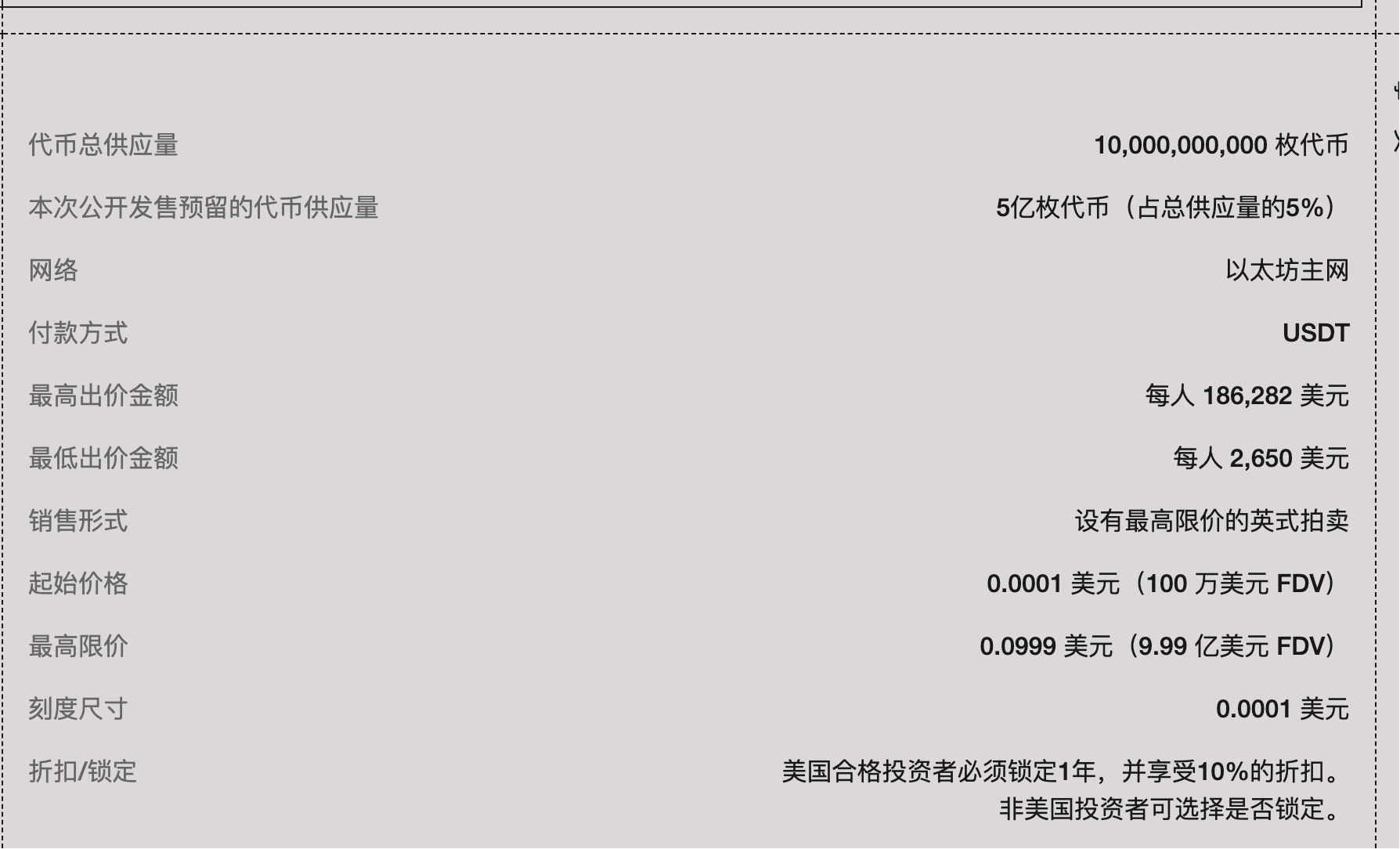

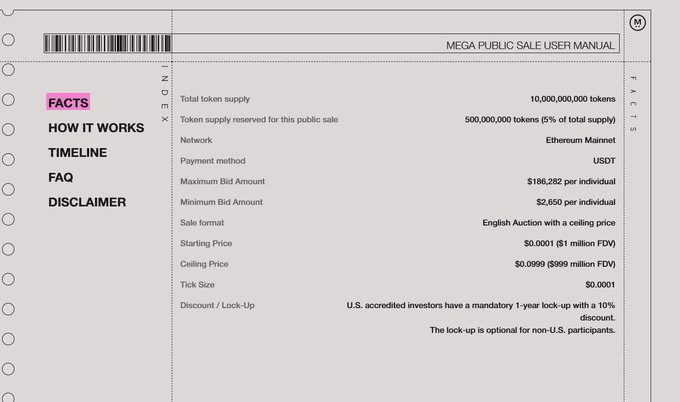

MegaETH's public sale for the $MEGA token will start on October 27 at Echo Sonar, using an English auction.

Starting FDV is only $1 million, with a hard cap of $9.99 billion. The Hyperliquid futures market has already inflated its FDV to $6 billion, an astonishing premium.

The innovative 'priority scoring' mechanism gives early testnet users and NFT holders a significant advantage.

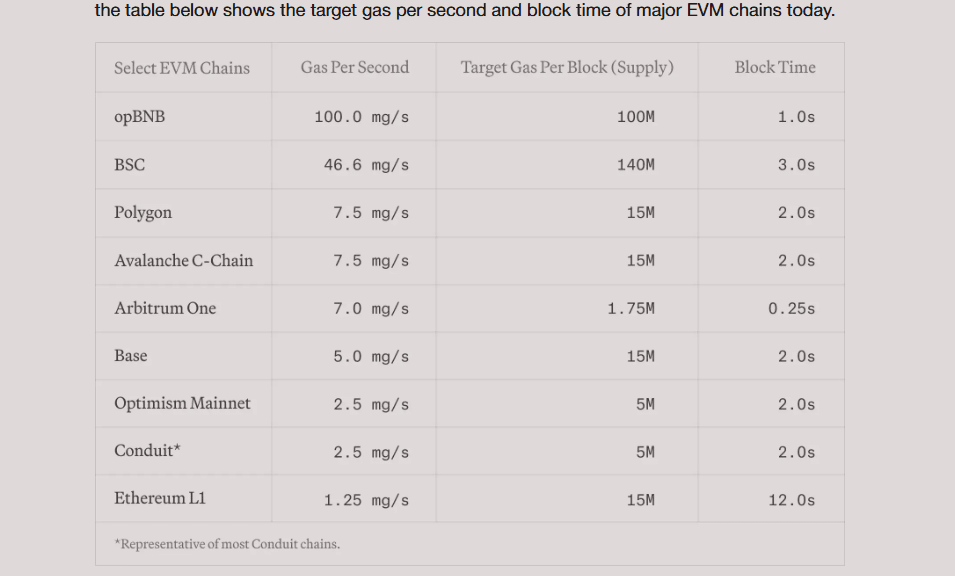

MegaETH, touted as the 'world's first real-time blockchain' L2 project, is creating market excitement with sub-millisecond latency and over 100,000 TPS narratives. However, more important for investors to study deeply are its unique public sale mechanism and the valuation game behind it.

Public sale mechanism breakdown: Not just an English auction of 'highest bidder wins'

MegaETH's public sale is a carefully designed financial game aimed at balancing the interests of whales, the community, and the project party.

1. Dual-mode allocation: Community contributors are the biggest winners.

Ordinary English auctions are a game of capital, but MegaETH has added a 'priority score':

Score = 0.4 Testnet points + 0.3 NFT weight + 0.2 On-chain activity + 0.1 Yap points

What does this mean?

Whales: You can certainly bid high, but in the lower price range, your allocation weight may not be as high as an ordinary user with a higher Score.

Community users: If you participated early in the testnet or hold relevant NFTs, you will have a higher probability, possibly at a lower price, of obtaining an allocation.

This is a direct reward for early ecosystem supporters and is the core alpha of this token sale.

Price anchoring and 'cooling-off options': A new way of risk control

Clear range: The price range is locked at $0.0001 - $0.0999, setting psychological expectations from the 'floor price' to the 'ceiling price' for the market. Notably, during oversubscription, everyone is allocated at the highest price of $0.0999, which suppresses price discovery, indicating that the project party intends for widespread distribution rather than maximum fundraising.

Built-in put option: From November 5 to 19 is the 'cooling-off period', during which winners can choose a full refund after knowing the final price. This greatly reduces your participation risk; if secondary market sentiment cools, you can exit safely.

What is the value support? Is the $6 billion FDV a bubble or reasonable?

The $6 billion FDV futures pricing on Hyperliquid is an expected ticket that the market casts with real money. Is this valuation reasonable?

Technical narrative: 'Real-time blockchain' and sub-millisecond latency target high-frequency trading (HFT) and other scenarios with very high performance requirements, areas that other L2s have yet to touch.

MEV capture: High performance means higher on-chain activity, especially arbitrage and liquidation, leading to substantial MEV. The economic model of $MEGA is designed to capture this value, which is key to its long-term value.

Valuation comparison: Compared to L2 giants like OP and ARB with market-to-sales ratios (P/S) of about 60-80 times, if MegaETH is calculated at a $6 billion FDV, its P/S is about 63 times, which is reasonably high but not out of control, reflecting the market's premium for its 'performance king' status.

Institutional endorsement: The lead investment from Dragonfly Capital and the suspected participation of Vitalik Buterin provide strong fundamental confidence.

Trader's perspective: How to participate in this value game?

For users with a high Score (early participants):

Strategy: Your advantage lies in the lower price range. Your goal is to use priority to win bids at the lowest possible price in the first half of the auction, aiming for higher post-launch returns.

Expectations: Your expected IRR (internal rate of return) is the highest, which is the dividend you deserve.

For ordinary users/whales:

Analysis: Your bidding strategy needs to be more prudent. Assess the space between the final settlement price and the expected $6 billion FDV (approximately $0.6 token price).

Risk control: Make full use of the 'cooling-off period'. If the final settlement price is too high, compressing profit margins after going live, decisively exercise the right to a refund.

Focus: Closely monitor the changes in futures prices on Hyperliquid, as this is a real-time barometer of market sentiment.

The MegaETH token sale is a typical combination of 'high narrative intensity + innovative mechanism'. If its technology can deliver, it will represent a paradigm shift in the L2 field. In the short term, this is a value game centered around auction mechanisms and community incentives.