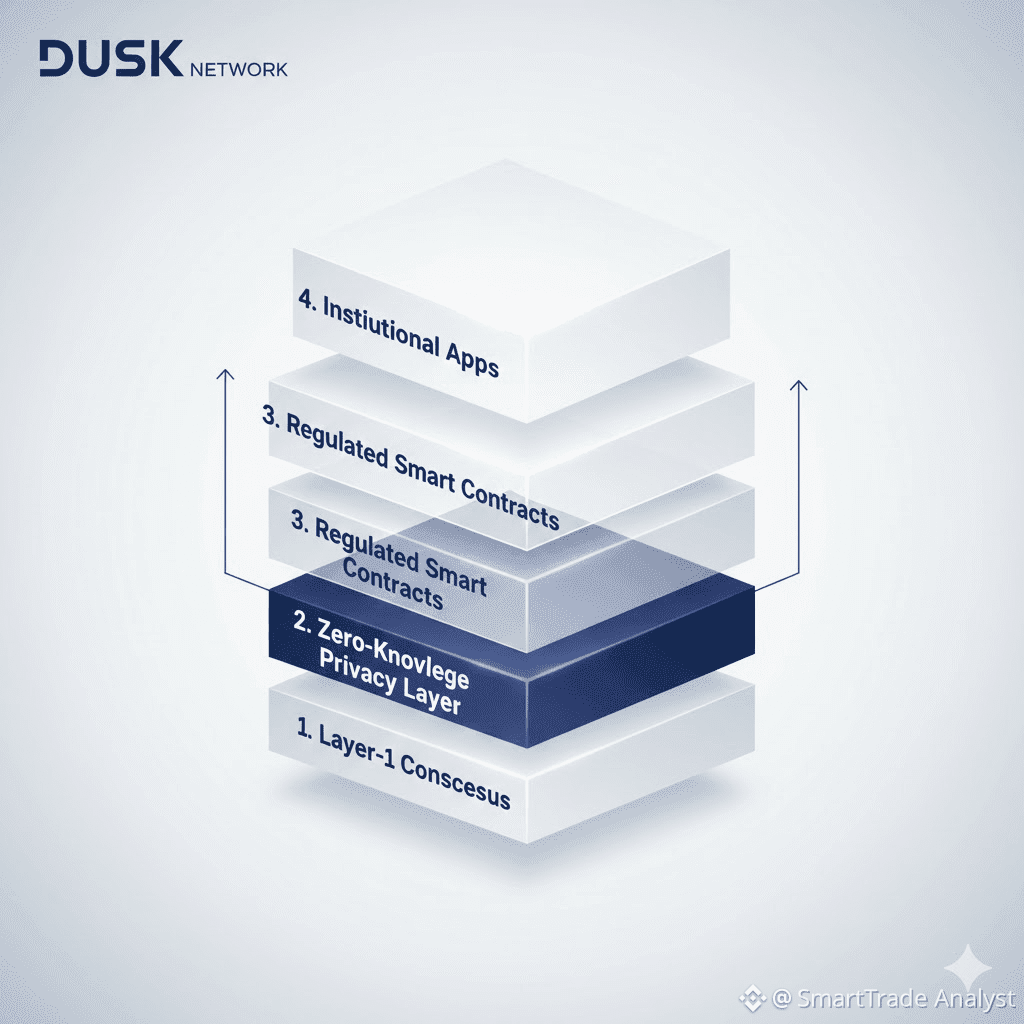

As the blockchain industry matures, the focus is shifting from pure speculation to real-world utility. However, a major barrier remains for large-scale institutional adoption: Public Transparency vs. Financial Confidentiality. Most public ledgers like Bitcoin or Ethereum are "open books." For a bank or a private corporation, exposing every transaction, balance, and counterparty is a non-starter. This is where Dusk Network ($DUSK ) changes the game.

The ZK-Proof Revolution

At the heart of Dusk is Zero-Knowledge Proofs ($ZKP ). This technology allows a user to prove that a transaction is valid (e.g., they have enough funds and are authorized to trade) without revealing any underlying data. It’s like showing a digital "green light" without handing over your entire bank statement.

Bridging the Gap: Compliance & Regulation

Unlike "privacy coins" that often face regulatory heat, Dusk is built to be Regulated DeFi. It allows for:

KYC/AML Integration: Users can be verified without their Confidential Smart Contracts: Business logic remains private, protecting corporate secrets.

Real-World Asset (RWA) Tokenization: Bringing stocks, bonds, and real estate on-chain in a legal, private manner. ID being stored on-chain.

Dusk isn't just another Layer-1; it is the infrastructure for a new financial system. By solving the privacy-compliance paradox, it provides the secure "highway" that institutions need to finally move trillions of dollars into the Web3 ecosystem.

Conclusion

Dusk isn't just another Layer-1; it is the infrastructure for a new financial system. By solving the privacy-compliance paradox, it provides the secure "highway" that institutions need to finally move trillions of dollars into the Web3 ecosystem.