Heard about a way to make money with no risk? Then we have to try interest margin arbitrage! It would be a shame to let it slip by for nothing! Hello everyone, I'm Brother Hao, and today I'll give you a thorough guide on Lista DAO's no-risk interest margin arbitrage, teaching you step by step from interest rate analysis to profit calculation, ensuring you make money effortlessly, especially suitable for players holding blue-chip assets.

Oh dear, the money in my hands is like a leaky bag, if I don't quickly plug the leaks, the hard-earned money will eventually run out! And Lista DAO is our magic tool for 'plugging leaks' in funding, relying on the interest margin of low borrowing and high saving, allowing money not only to be preserved but also to steadily appreciate, with zero risk to leverage high returns.

The core logic is absurdly simple, yet the returns are solid: on the Lista DAO borrowing platform, lend stablecoin USD1, with a borrowing rate of only 1.95%. This rate is highly competitive in the decentralized lending sector, far below the industry average, and supports blue-chip assets like BNB, ETH, and BTCB as collateral. The over-collateralization mechanism fundamentally eliminates default risk, truly achieving risk-free arbitrage.

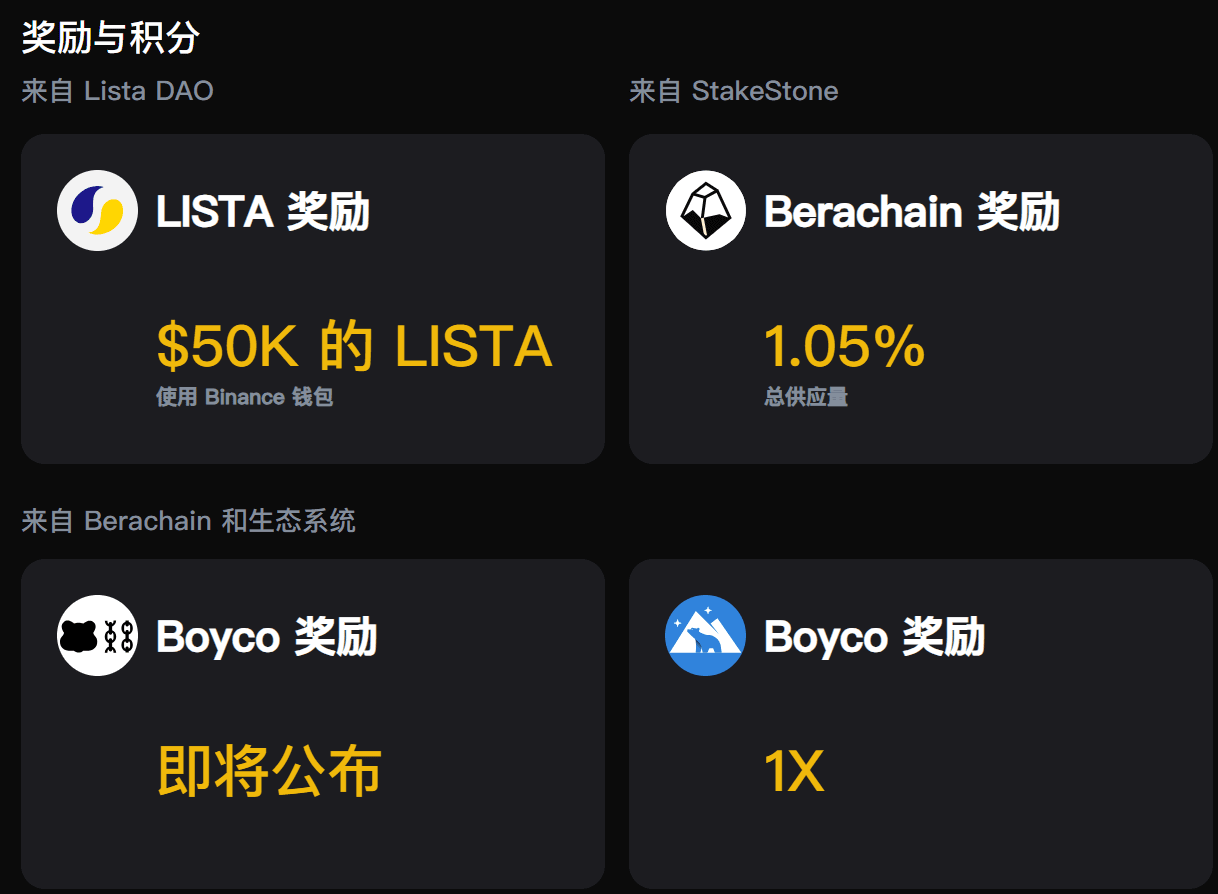

After receiving USD1, directly transfer it to Binance Earn to lock in a 20% annualized return. After deducting a 1.95% borrowing cost, the net profit steadily reaches over 18%. Let's calculate clearly: if you pledge 100,000 equivalent blue-chip assets and borrow 50,000 USD1, the annual borrowing cost is only 975 dollars, while the Binance financial return can reach 10,000 dollars, netting a profit of 9025 dollars, with profits clear at a glance.

The project's strength is reliable enough, with the current TVL remaining high, ensuring maximum liquidity and security. A mature liquidation mechanism and fund isolation plan make the arbitrage process worry-free. This guide is like an accurate map, with each step clear and controllable: first analyze the advantages of borrowing rates, then calculate the net profit, and finally strengthen the safety defense line based on blue-chip collateral.

Recently, it has garnered significant attention in the community, with the injection of $40M WLFI funds further solidifying the project’s ecological stability, and increasing the recognition of this arbitrage strategy. The entire logic is closed-loop and risk-free, revitalizing idle blue-chip assets while allowing for stable interest differential profits, making it a financial tool par excellence.

Has everyone calculated this profit? Has anyone figured out a more flexible arbitrage strategy? Leave a few comments in the comment section, managing finances means learning to 'plug leaks', and keeping every bit of profit in hand!@ListaDAO #USD1理财最佳策略ListaDAO $LISTA