The average retail investor is still waiting for "the price to go up" before selling their coins to another less attentive person. What they didn't understand is that while they were shouting against banks, Ripple was becoming the bank.

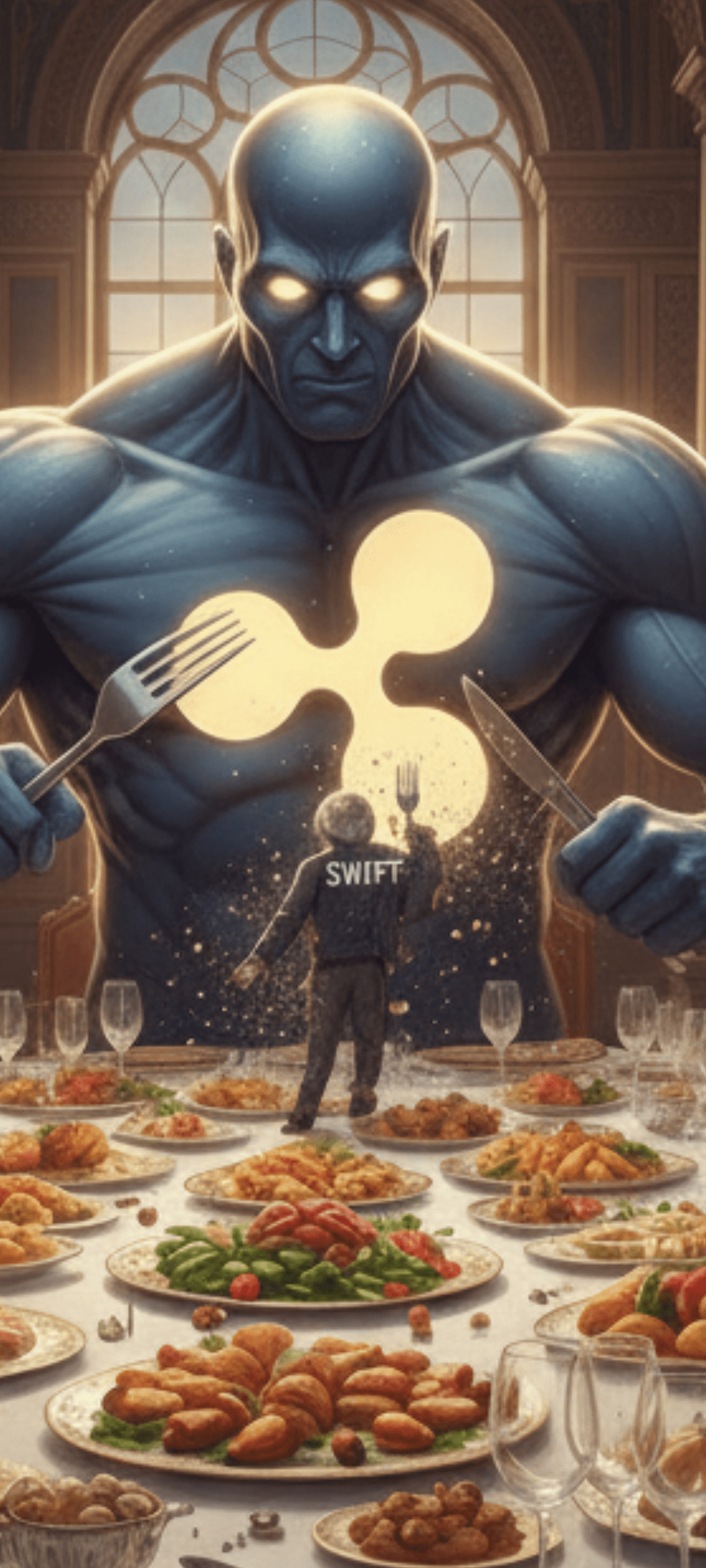

If you have XRP in your wallet, you've stopped being a rebel and become a shareholder in the most powerful infrastructure on the planet. The "Cannibal" mentioned by the IMF has stopped hiding and is now sitting at the table.

Ripple Prime

The retail investor thought Ripple Prime's broker acquisition was just another news story. Mistake. It's the move that will liquidate the competition. By absorbing Hidden Road's infrastructure and obtaining the FCA seal in England, Ripple has created a closed ecosystem.

They don't need you to "trade" XRP on an exchange; they need institutions to move trillions through their own pipelines. With Ripple Prime, they've built Wall Street's VIP window. It's no longer just a cryptocurrency—it's an elite financial entity operating at light speed and under the rules of the system.

Derivatives and Global Debt

Want decentralization? Ripple gave you systemic efficiency. The derivatives market—the quadrillion-dollar monster propping up the global economy—needs fresh blood. Central banks are tired of SWIFT's clogged arteries.

XRP is the "Liquidity Cannibal": it devours transaction costs, eliminates three-day waits, and reduces 20th-century banking models to ashes. As the IMF leadership wisely predicted, this technology didn't come to coexist with the old system; it came to consume it from within so capital can flow again.

The Power Firm: From Treasury to Special Drawing Rights (SDR)

When Rosie Rios—the woman who signed U.S. physical currency—joined Ripple's board, the game was over for skeptics. It wasn't a hiring; it was a transfer of power.

The ultimate goal isn't for XRP to be worth a few dollars so you can trade for a car. The goal is for XRP to become the reserve asset breathing within the IMF's Special Drawing Rights (SDR). A bridge asset connecting Switzerland's gold, Qatar's oil, and Latin America's agriculture in milliseconds.

The Owner of the "Golden Pipelines"

Retail is still searching for "the next gem," without realizing that XRP is already the crown jewel of the BIS and Davos. They're not trying to create another SWIFT; they're building the Internet of Value, and they own the cables.

Holding XRP today isn't about owning a cryptocurrency. It's about holding a perpetual concession over the flow of global money. The system has already chosen its winner, and while retail is distracted, the "Cannibal" of Basel is preparing for the final feast.