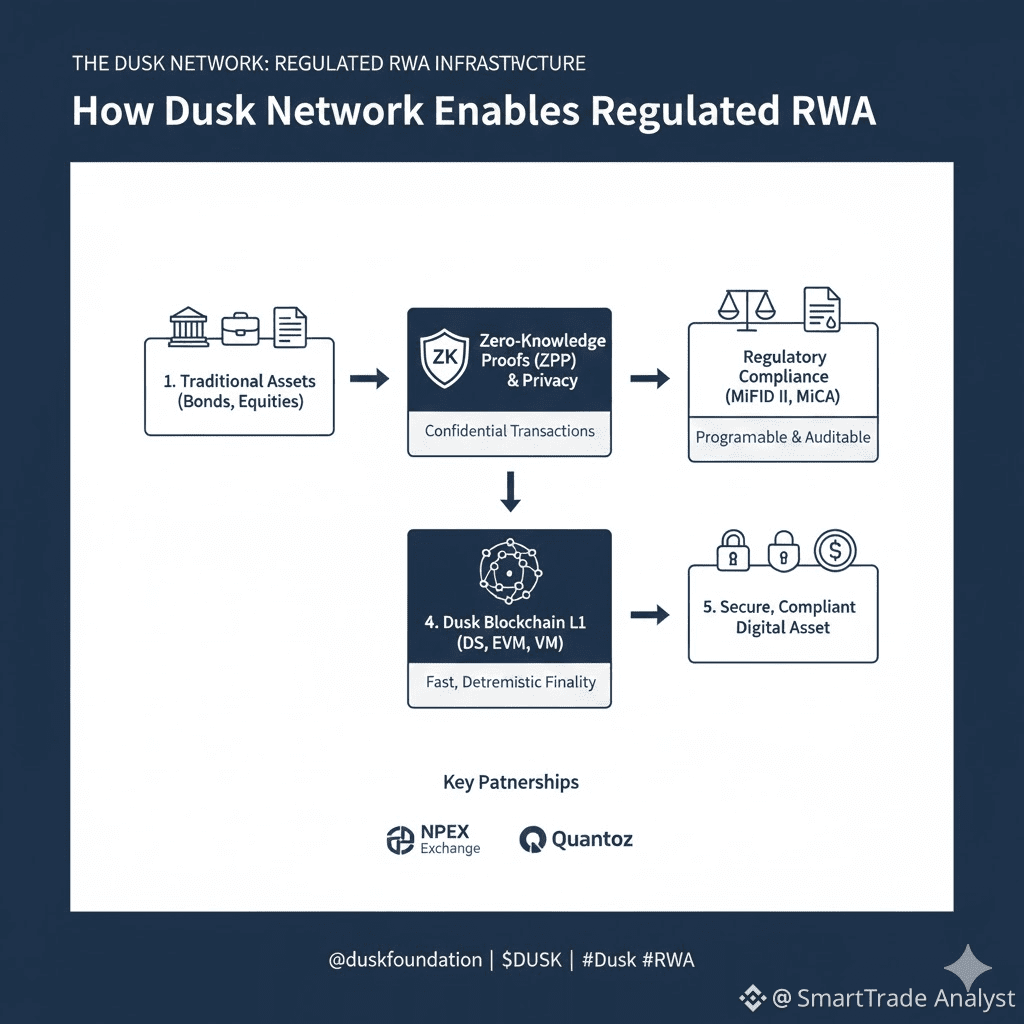

Dusk is a purpose-built Layer-1 blockchain protocol designed specifically for regulated financial markets. It bridges the gap between traditional finance and blockchain by focusing on privacy, compliance, and rapid settlement for real-world assets ($RWA s).

🛠️ The Technical Powerhouse

Dusk is not just another blockchain; it is a financial ecosystem built on cutting-edge tech:

Privacy-First with ZK-Tech: It utilizes zero-knowledge (ZK) technology to ensure private transactions and confidential balances.

Lightning Fast Settlement: Through its unique Segregated Byzantine Agreement consensus, Dusk provides the fast, deterministic finality essential for institutional financial products.

XSC (Confidential Smart Contracts): This allows for hidden balances while ensuring regulators can perform audits through selective disclosure when necessary.

🏛️ Bridging TradFi & DeFi

Dusk aims to bring traditional instruments like equities, bonds, and funds onto the chain in a fully compliant manner:

Institutional Compliance: The protocol is built to align with strict EU regulations, including MiFID II and MiCA.

Embedded Identity: Compliance rules and identity checks are integrated directly into the protocol's core.

Strategic Growth: Partnerships with the Dutch stock exchange NPEX and various custodian banks are already enabling compliant RWA trading.

📈 Investment & Market Insights

Strong Token Utility: The native token $DUSK is actively traded on major exchanges like Binance, HTX, and MEXC.

High Network Trust: Approximately 30% of the circulating supply is currently staked, signaling strong long-term holder confidence.

Upcoming Milestones: With the DuskDS L1 upgrade and the DuskEVM mainnet on the horizon, the project is hitting key technical goals for 2026.

Visual Flow of the Ecosystem:

Regulated Assets ➡ Dusk L1 (ZK-Privacy) ➡ Instant Finality ➡ Global Compliance