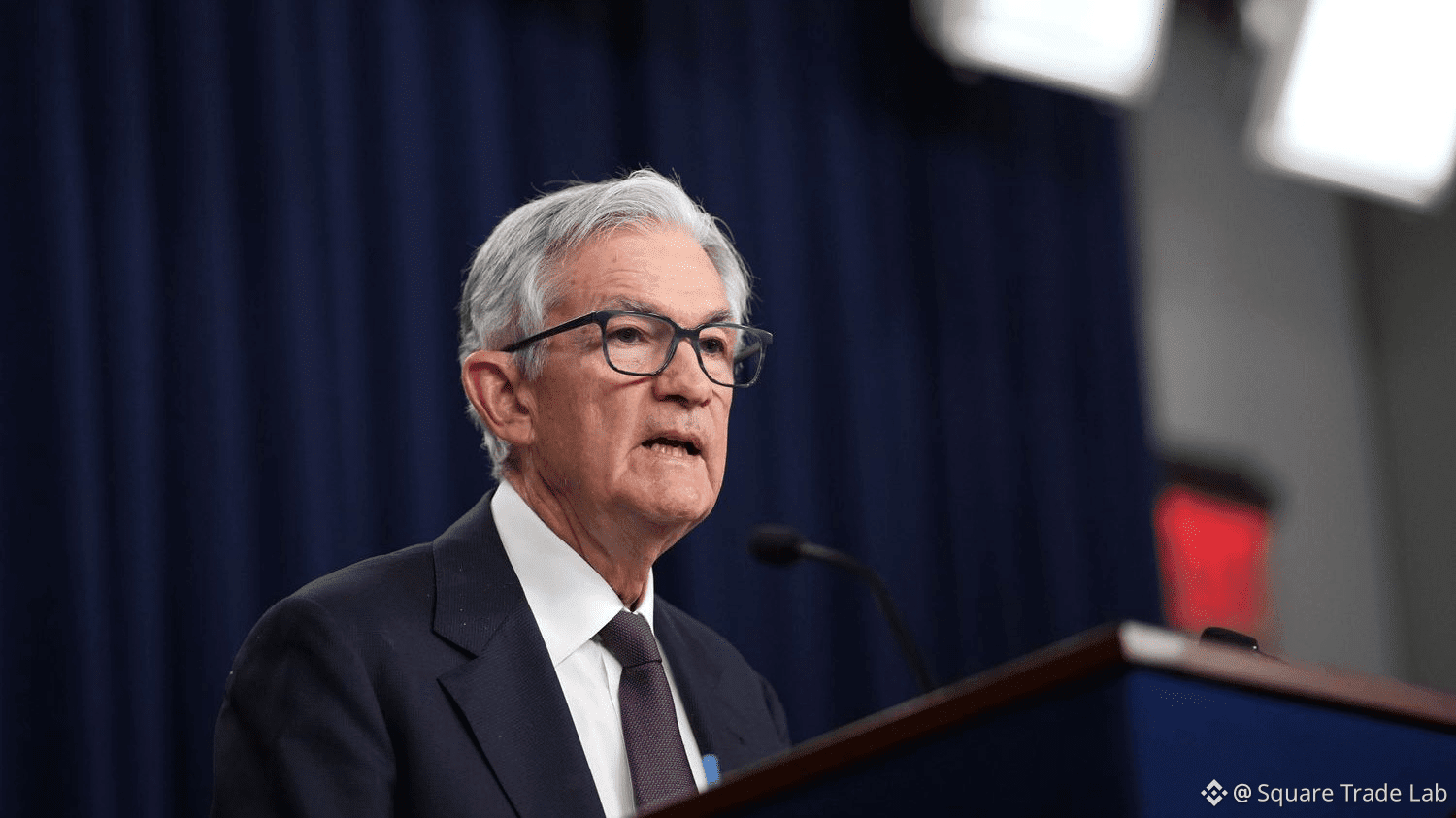

🚨 JUST IN: Federal Prosecutors Open Criminal Investigation Into Fed Chair Jerome Powell — NYT

According to a report by The New York Times, U.S. federal prosecutors have opened a criminal investigation into Federal Reserve Chair Jerome Powell.

While no formal charges have been announced and the scope of the investigation remains undisclosed, the implications of this development are extraordinary and potentially far-reaching for global financial markets.

This is not a routine political headline.

This is a systemic trust event.

Why This Is an Unprecedented Development

The Federal Reserve is designed to operate:

Independently from political pressure

Above partisan influence

Shielded from legal and criminal scrutiny

A sitting Fed Chair becoming the subject of a criminal investigation is virtually without precedent in modern U.S. history.

Jerome Powell is not just another official. He directly oversees:

U.S. interest rate policy

Quantitative tightening & liquidity conditions

Emergency market backstops

Inflation guidance and forward expectations

The credibility of the U.S. dollar system

Any legal cloud over this position immediately weakens institutional confidence.

Why Markets Care (Even Without Charges)

Markets do not wait for verdicts.

Markets price risk, uncertainty, and credibility erosion.

Even if Powell is ultimately cleared:

The investigation itself damages Fed authority

Forward guidance becomes less effective

Monetary policy credibility is questioned

Political influence fears resurface

This introduces policy instability, which markets dislike more than bad news.

Potential Macro & Market Implications

📉 U.S. Dollar & Treasuries

Increased volatility in Treasury yields

Rising risk premium on U.S. debt

Foreign capital may reassess exposure to dollar assets

Long-term concerns about Fed independence

📊 Equity Markets

Financial stocks most exposed

Rate-sensitive sectors face uncertainty

Reduced confidence in policy signaling

Higher volatility across indices

🌍 Global Markets

Emerging markets react to USD instability

Central banks reassess dollar reliance

Safe-haven capital seeks alternatives

Why This Is Structurally Bullish for Bitcoin & Crypto

Bitcoin was created for exactly this type of scenario.

Crypto exists because:

Centralized monetary power can fail

Institutional trust is fragile

Political systems influence money

Fiat systems depend on credibility

When:

The Fed’s leadership is questioned

Monetary authority credibility weakens

Legal and political risks enter policy-making

👉 Decentralized, neutral, trustless assets gain relevance.

Historically, Bitcoin performs strongest during:

Institutional credibility crises

Monetary policy confusion

Sovereign trust erosion

Long-term inflation and debt concerns

This is not about short-term price action.

This is about narrative and capital rotation.

What Investors Should Watch Next

Key upcoming catalysts:

Official DOJ clarification

Federal Reserve response

White House positioning

Bond yield reactions

Dollar Index (DXY) behavior

Volatility spikes in BTC & ETH

Crypto markets often front-run traditional markets during macro stress.

Bottom Line

Whether or not charges emerge is secondary.

The real issue is this:

Once trust in monetary leadership is questioned, capital looks for insurance.

And in the modern financial system,

that insurance increasingly looks like Bitcoin and crypto.

Coin & Market Hashtags