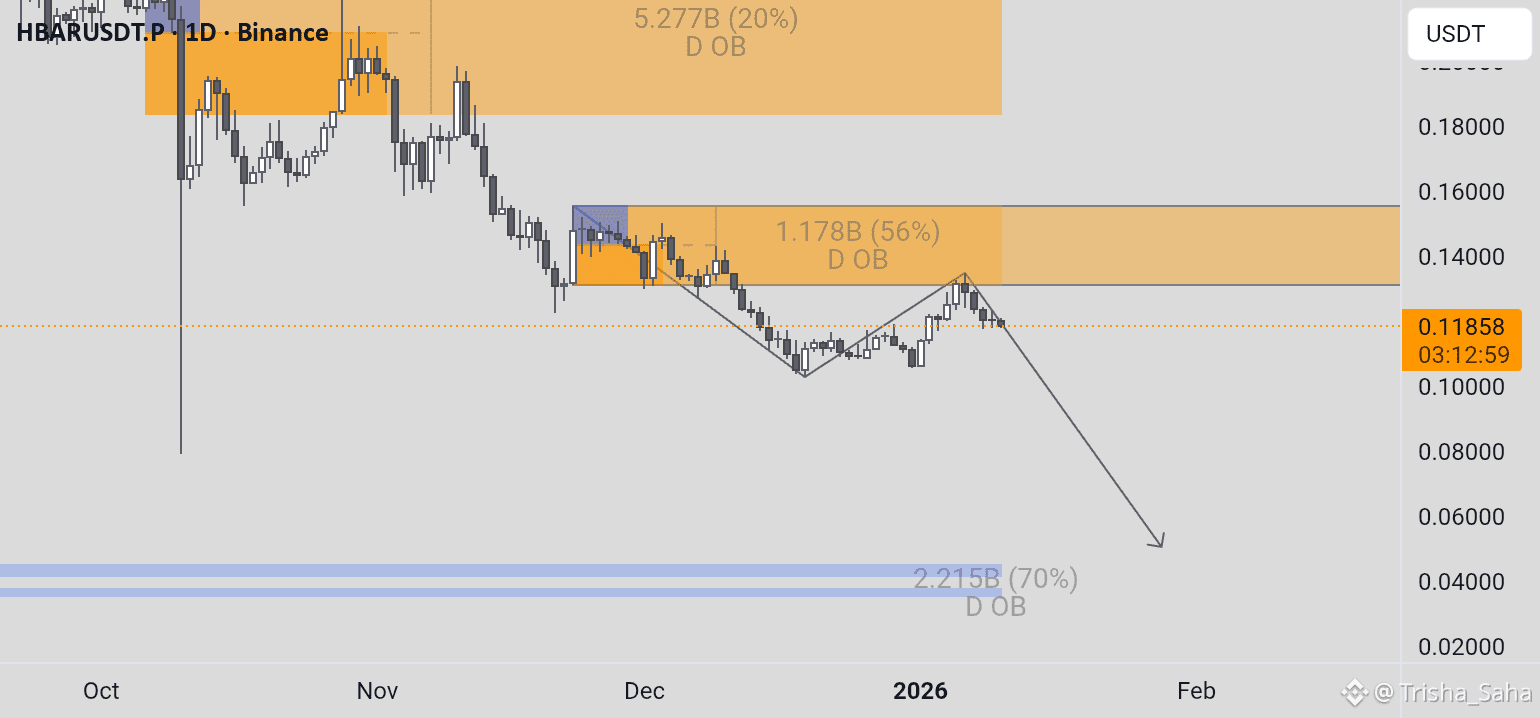

1. Main Trend and Market Structure

Bearish (Downward) Trend: The chart shows a consistently downward price structure since October.

Supply Zone Rejection: The price recently touched the Daily Order Block (DOB) area in the $0.14000-$0.15000 range and experienced quite strong rejection.

2. Supply Area (Upper Resistance)

Upper Resistance: There is a large block (5.277B) in the $0.18000-$0.22000 range. This is a very thick, major supply area.

Immediate Resistance: The orange area around $0.15000 (1.178B) serves as a barrier for the current price. As long as the price remains below this zone, the bias remains negative.

3. Movement Prediction (Price Anatomy)

Downward Target: There is an indicative arrow line projecting further price declines towards the area below $0.05000.

Key Support: At the bottom, there is a thin blue line (2.215B) around the $0.05000 level, which is likely a liquidity target or the next rebound area.

4. Technical Summary

Current Price: $0.11859.

Sentiment: Bearish. The price failed to break through the middle supply block and is likely forming a lower high.