Dusk Network does not begin with a manifesto. It begins with an observation that most people in finance instinctively understand. Real financial activity is not loud. It does not announce itself to the world. Most transactions happen quietly, with only the parties involved knowing the details. At the same time, when regulators, auditors, or counterparties ask for proof, that proof must exist and it must be reliable. Dusk builds from that reality. It does not frame privacy as rebellion or transparency as virtue. It treats both as tools that are useful in different moments. Some transactions should be public. Others should remain private. And some should stay private until there is a clear reason to reveal specific details. That framing alone puts Dusk in a different category from many crypto projects that start with ideology first and practicality later.

What makes Dusk interesting is how deliberately it reflects the way finance already works. In traditional systems, most records are closed by default. Access is granted on a need-to-know basis. When scrutiny is required, information is disclosed selectively, not dumped into the public domain. Dusk mirrors this behavior at the protocol level. Transactions can be shielded, yet still verifiable. Proof can be shown without exposing everything. This may sound subtle, but it solves a real tension that has followed crypto for years. Full transparency is powerful, but it breaks down quickly when sensitive data, commercial secrecy, or legal obligations enter the picture. Dusk does not try to force the world to adapt to blockchain ideals. Instead, it adapts blockchain design to the world as it already exists.

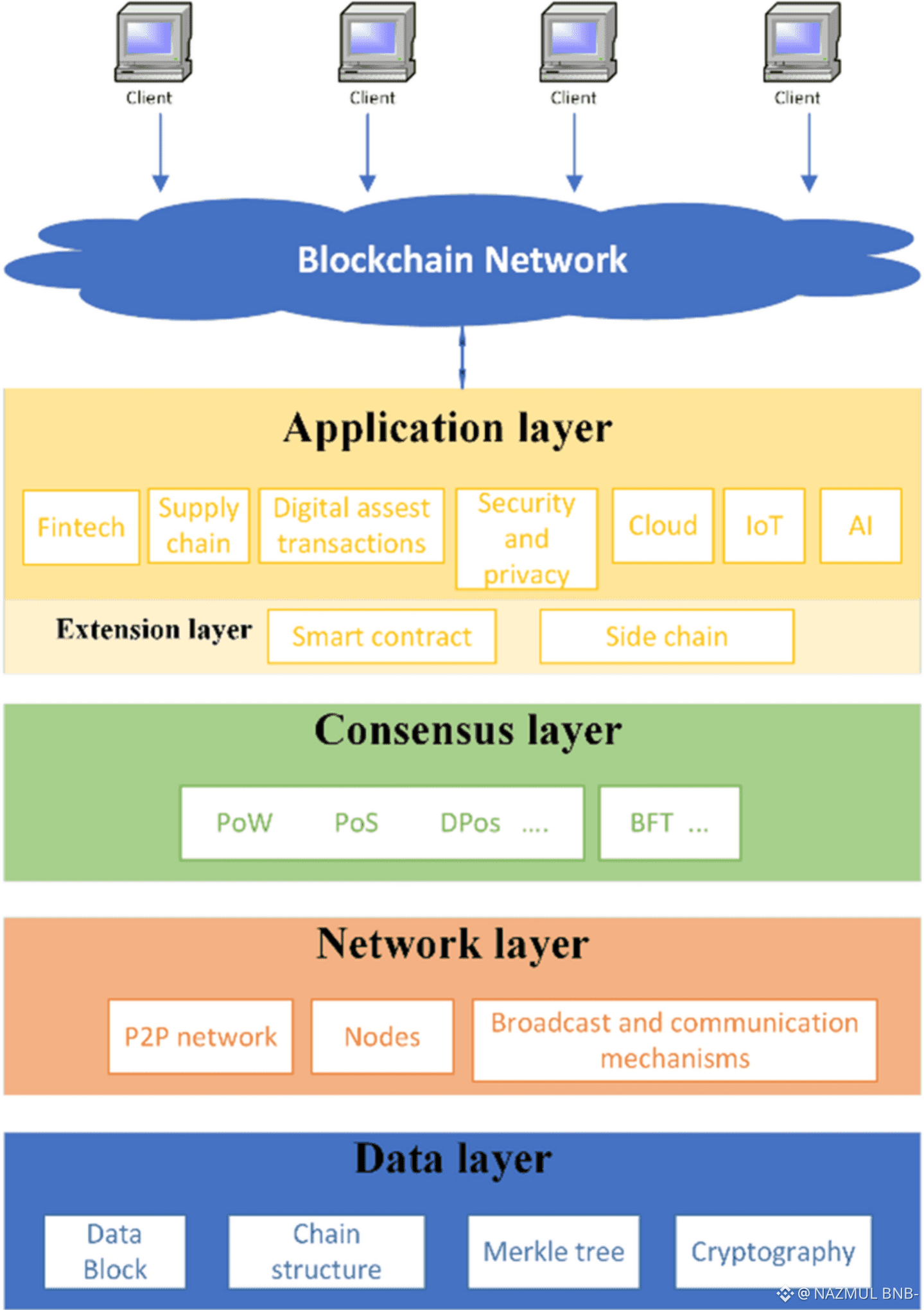

That same realism shows up in Dusk’s architecture. Rather than bundling everything into one dense layer, the network separates settlement from execution. The base layer focuses on correctness, finality, and privacy. Its job is to make sure transactions are valid, settled, and protected. On top of that, execution environments handle application logic. This includes an environment that feels familiar to developers who already know Ethereum-style tooling. The result is a system where experimentation happens at the edges, while the core remains stable and difficult to tamper with. This mirrors how financial infrastructure is built outside crypto. Clearing and settlement systems are boring by design. They change slowly because mistakes there are costly. Innovation happens on top, not at the foundation. Dusk seems comfortable with that tradeoff.

From an institutional perspective, this separation matters. Compliance, data integrity, and auditability are not optional features. They are baseline requirements. By pushing those responsibilities deeper into the protocol, Dusk reduces the risk that a single application bug or rushed update compromises the entire system. Developers still get flexibility. Institutions get reassurance. Neither side is forced to fully trust the other. The protocol carries that burden. That design choice may not generate excitement on social media, but it speaks directly to the kind of users who think in decades rather than cycles.

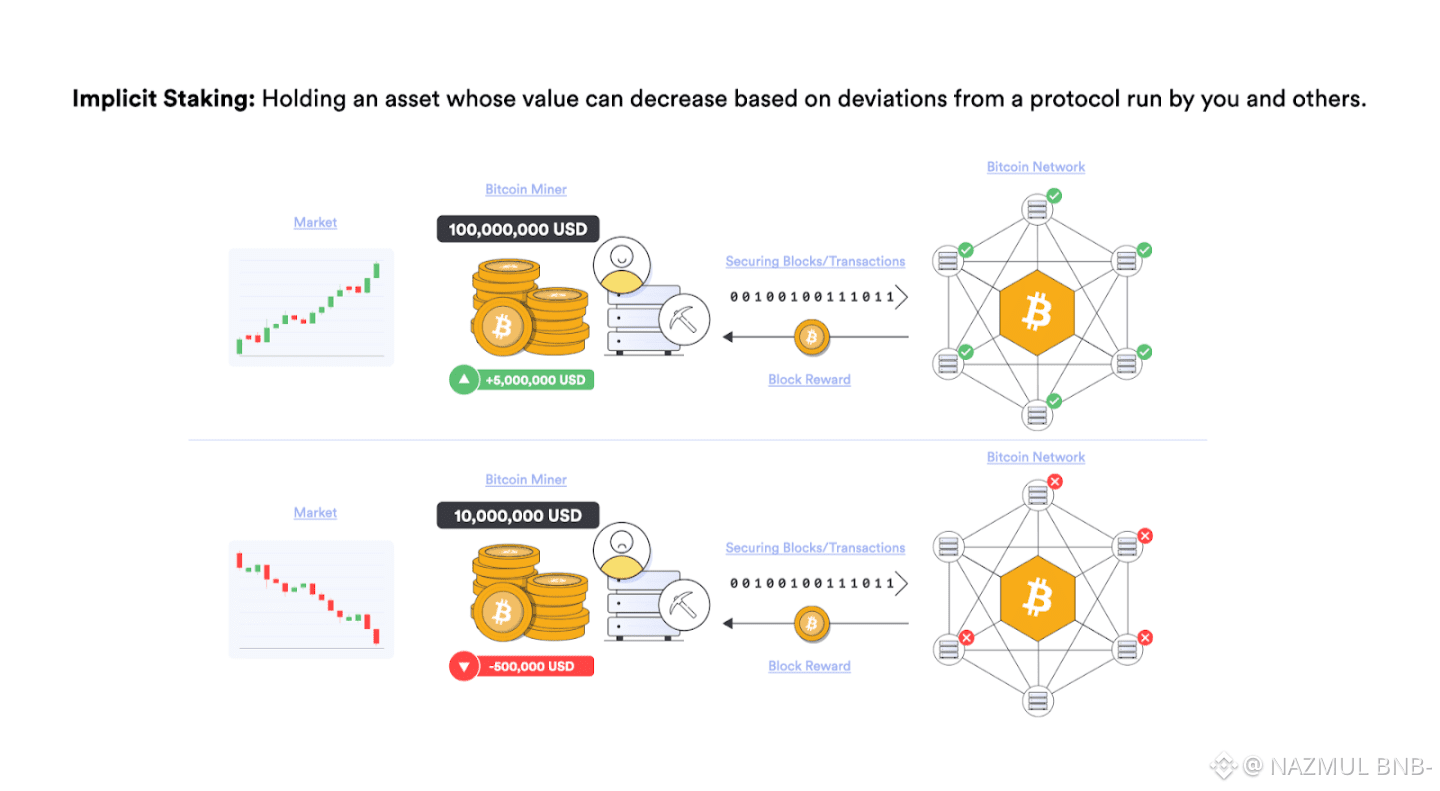

The same long-term mindset appears in the way Dusk treats its token. DUSK is positioned as a working component of the network, not as a spectacle. It is used to pay for activity, to secure the network through staking, and to align participants over time. The emission schedule is long, which signals patience rather than urgency. More telling is the ongoing move from external representations of the token to its native form on the Dusk network. This process is quiet, and that is precisely why it matters. A network becomes real when users are willing to move value onto it because doing so provides practical benefits. It is not about technical demonstrations. It is about utility that justifies the effort. Migration is not flashy, but it is a form of commitment. It shows that the network is no longer theoretical.

What Dusk does not claim is just as important as what it does. It does not position itself as a replacement for the entire financial system. It does not argue that everything must be public or that existing rules should be ignored. Instead, it asks a more restrained question. How much financial activity can move on-chain without breaking the systems that already govern it. That question leads to different design decisions. It favors selective disclosure over radical transparency. It favors infrastructure over narrative. It favors slow adoption over explosive promises. This may feel unromantic in an industry that thrives on bold claims, but it aligns closely with how real financial infrastructure is built and adopted.

In the end, Dusk feels less like a revolution and more like a bridge. It does not demand that institutions abandon their standards. It offers a way to extend them into a cryptographic environment. That approach may never dominate headlines, but it has a different kind of strength. It is designed to survive scrutiny, regulation, and time. For anyone watching crypto mature from experimentation into infrastructure, that may be the most important signal of all.