By Steve Ngok, Chief Strategy Officer, DoraHacks

The Introduction

For nearly a decade, the established financial order has viewed crypto with skepticism and disdain. To observers in ivory towers, the industry appeared as little more than a casino—a chaotic theater of speculation divorced from the real economy. For a long time, this criticism had merit.

But surveying the landscape of 2026, the early confusion has given way to structural clarity. The industry hasn't merely grown; it has bifurcated.

We are witnessing a decisive schism. On one side lies continued speculation: prediction markets, exchanges, volatility optimization. This remains a vibrant, if noisy, arena. But distinct from this, a more sober reality has emerged.

Stablecoins have become the TCP/IP of money. They are eating cross-border payments, devouring FX inefficiencies, and enabling entirely new economic primitives for AI agents.

In this landscape, early DeFi's "move fast and break things" mantra has been replaced by demands for determinism, compliance, and institutional scale. This is why the Circle and Arc(https://www.arc.network/) ecosystem has emerged as the dominant stack. They didn't just build a blockchain; they built an Economic Operating System. They did the hard, unglamorous work of regulatory integration and liquidity plumbing so you don't have to.

If you're a founder in 2026, you don't need to reinvent the wheel. The rails are laid by DoraHacks(https://dorahacks.io/) and its partners. The regulatory moat is dug. The liquidity is deep. The question is no longer whether we can put real-world assets on-chain, but what happens when money becomes as programmable as bits.

Here is where the alpha lies. Time to build for the future.

Track I: The Global Capital Expressway

From Simple Remittances to Programmable Settlement

1. The Core Thesis

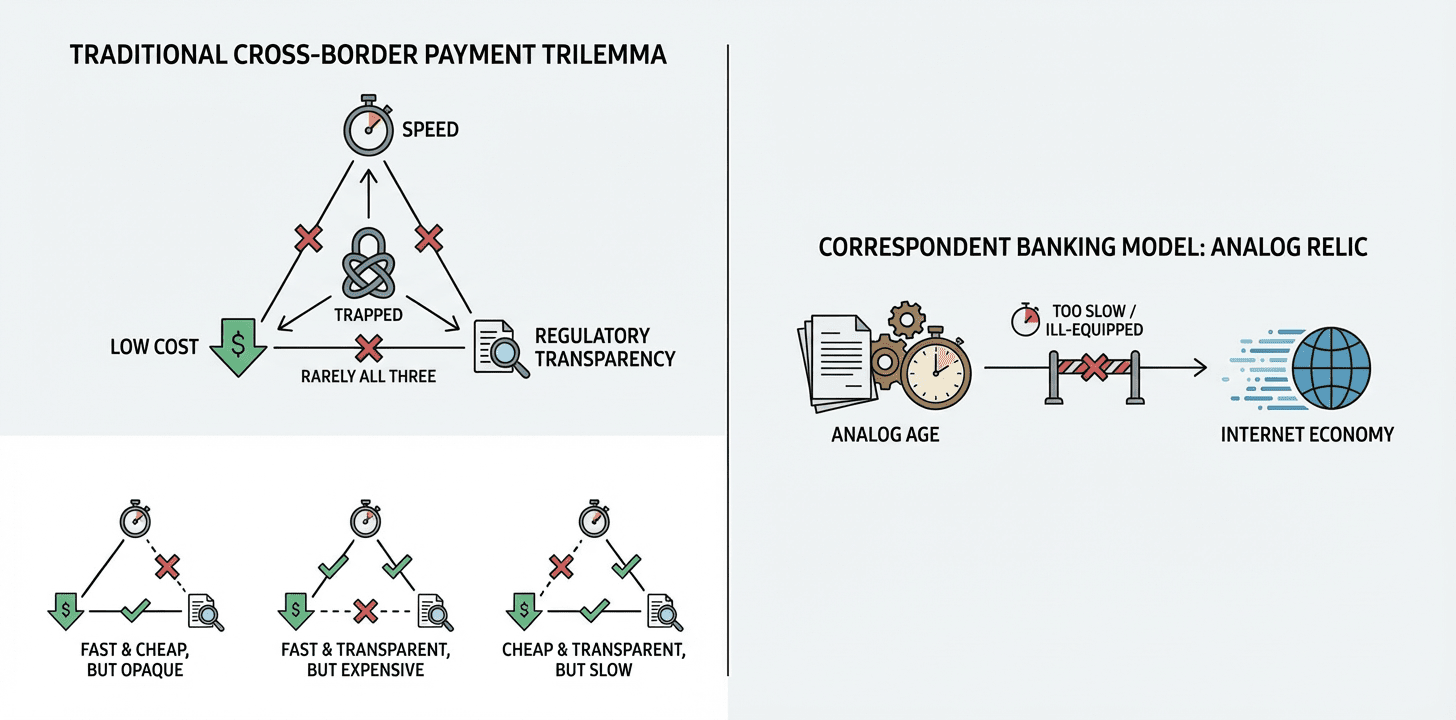

The traditional cross-border payment system is trapped in a structural trilemma: you can have speed, you can have low cost, or you can have regulatory transparency, but you rarely get all three. The current correspondent banking model is a relic of the analog age, ill-equipped for the velocity of the internet economy.

The Circle and Arc ecosystem has finally solved this coordination problem:

CPN (Circle Payments Network) solves the "Last Mile," connecting the digital ledger to the global banking system.

CCTP & Gateway solve liquidity fragmentation, unifying assets across fragmented blockchains.

Arc provides the "Matching and Clearing Engine": delivering the sub-second certainty and low latency that Wall Street demands.

The Mission: To use Arc as the central clearing layer for global capital, building the next generation of commercial payment applications that render the SWIFT network obsolete.

2. The High-Value Opportunities

We are looking beyond basic payroll or merchant checkout. The real opportunity lies in re-architecting B2B flows and platform economics.

A. Programmable Trade Finance

The Thesis: "Funds arrive the second the cargo does."

The Problem: International trade runs on friction. Exporters wait 30–90 days for payment or rely on expensive, paper-heavy Letters of Credit. Trust is slow and costly.

The Solution:

Escrow: The importer locks USDC in a smart contract on Arc.

Trigger: An Oracle feeds real-time logistics data (API) to the chain. "Cargo Signed" = "Payment Triggered."

Settlement: The contract autonomously releases the USDC.

Exit: CPN converts the USDC to local currency (e.g., Vietnamese Dong) and wires it to the exporter instantly.

Why Arc? Only Arc’s sub-second finality and near-zero fees make it economically viable to trigger payments based on high-frequency logistics updates.

The Builder Profile: Experts in supply chain ERP and logistics data.

B. The Internal Treasury Engine

The Thesis: "Stop burning millions on internal wires."

The Problem: A multinational like Toyota or Siemens has subsidiaries in 50 countries. When Brazil owes Germany, and Germany owes the US, they send wires back and forth, bleeding money on FX fees and float.

The Solution:

On-Chain Pooling: Subsidiaries convert local cash to USDC via CPN and pool it in a central Arc Treasury.

Netting: A "Netting Algorithm" runs on Arc, calculating exactly who owes what to whom on a ledger.

Settlement: You only move the difference.

Off-Ramp: Subsidiaries pull liquidity back to local fiat only when needed.

Why Arc? Privacy tooling protects internal financial data, while high throughput handles the complex math of real-time netting.

The Builder Profile: Fintech architects and Enterprise SaaS founders.

C. The "Web3 Stripe Connect"

The Thesis: "A universal payout router for the gig economy."

The Problem: Platforms like Uber, Airbnb, or Upwork struggle to pay a global workforce. Sending $50 to a freelancer in the Philippines is often too expensive to justify.

The Solution:

Aggregate: The platform loads a single pool of USDC onto Arc.

Distribute: One API call triggers thousands of payouts.

Route: The smart contract acts as a router. Crypto-native user? Send to wallet. Traditional user? Route through CPN to their local bank.

Why Arc? Batch processing capabilities allow for "micropayments" that are mathematically impossible on legacy rails.

The Builder Profile: Payment gateway engineers and platform aggregators.

D. The Programmable Corporate Card

The Thesis: "Give your AI agent a credit card, but control the spending with code."

The Problem: Companies need to buy software globally, but corporate cards are dumb. They lack granular control, and you can't easily give one to an AI agent or a temporary contractor.

The Solution:

The Pool: A corporate USDC treasury on Arc.

The Card: Instantly issue virtual Visa/Mastercard credentials via CPN.

The Rules: Embed logic in the smart contract: "This card only works for AWS," or "Max spend $100/day."

The Settlement: Transactions are settled instantly on-chain via StableFX.

Why Arc? It moves financial control from the bank's policy department to the company's code repository.

The Builder Profile: Expense management and B2B fintech teams.

3. The Technical Blueprint

For the developer, the architecture is now standardized. Here is how you build it:

Step 1: On-Ramp. Use the CPN API to generate Virtual IBANs. Fiat flows in; USDC is automatically minted to an Arc address.

Step 2: Liquidity. Use the Gateway SDK to sweep USDC from fragmented chains (Ethereum, Solana) into your central Arc application.

Step 3: Business Logic. Deploy your Solidity contracts on Arc.

Payroll: distributeSalary(recipients, amounts)

Trade: releaseFunds(proofOfShipping)

Step 4: Off-Ramp. Call the CPN Payout API to burn USDC and trigger a local bank wire, or use Programmable Wallets to settle directly on-chain.

4. The Conclusion

"Build a bank that runs on code."

Understand your competition: You are competing against the friction of the 1970s banking system.

By combining the speed of Arc with the reach of CPN, you have the power to reduce global settlement costs by 80% and accelerate speed from "T+2 Days" to "T+0 Seconds." This is an entry ticket to a multi-trillion dollar market.

Track II: The On-Chain FX Revolution

From Manual Conversion to Algorithmic Liquidity Networks

1. The Core Thesis

The traditional Foreign Exchange (FX) market, the largest financial market in the world, is currently held back by an antiquated triad of inefficiencies: Settlement Latency (the T+2 day standard), Gatekeeping (only giants get the best rates), and Opacity (layers of hidden fees).

The combination of Circle and Arc dismantles this structure:

StableFX provides an institutional-grade price feed (RFQ mechanism), meaning "Inquiry equals Execution."

Partner Stablecoins (e.g., MXNB, JPYC, BRLA) provide the necessary local currency anchors.

Arc provides the execution environment where these currencies can be swapped in mere milliseconds.

The Mission: To utilize code to autonomously manage currency risk and eliminate the friction of exchange from cross-border commerce.

2. The High-Value Opportunities

We are looking beyond simple hedging or remittance apps. The real opportunity lies in deep financial engineering applied to global trade.

A. The Autonomous Multi-Currency Treasury

The Thesis: "Democratizing Apple’s treasury capabilities for the SME."

The Problem: A mid-sized cross-border e-commerce firm earns in Euros (EUR), pays server costs in Dollars (USD), and pays salaries in Yen (JPY). Traditional banking charges exorbitant spreads for these conversions, and finance teams often miss optimal windows due to manual processing.

The Solution:

Automated Strategy: The enterprise sets rules on Arc: "If EURC balance > 50,000 and EUR/USD rate > 1.08, automatically swap 50% to USDC."

Instant Execution: Smart contracts monitor StableFX quotes via Oracle and execute immediately when conditions are met.

Payroll: At month's end, USDC is automatically converted to JPYC at the best market rate and distributed to employee wallets.

Why Arc? Only Arc supports this high-frequency monitoring and low-cost execution. Traditional banks cannot offer this level of programmability.

The Builder Profile: Enterprise financial SaaS teams and ERP integrators.

B. The "1inch" for FX

The Thesis: "Best execution, globally and instantly."

The Problem: When converting USDC to EURC, prices vary between Uniswap, StableFX, and Curve. The user rarely knows where the best liquidity lies.

The Solution:

Aggregation: Build a dApp on Arc that connects StableFX (RFQ mode) with on-chain AMMs.

Routing: When a user wants to swap $1M, the algorithm splits the order: 60% via StableFX (for depth) and 40% via AMM.

Atomic Settlement: The user clicks once. The complexity is abstracted.

Why Arc? Its high performance allows for the querying of multiple liquidity sources and trade execution within a single block.

The Builder Profile: DeFi developers and Market Makers.

C. The Tokenized Carry Trade Protocol

The Thesis: "bringing Wall Street’s oldest strategy to DeFi rails."

The Problem: The Carry Trade, borrowing in a low-interest currency to invest in a high-interest one, has historically been the exclusive preserve of hedge funds and banks.

The Solution:

The Mechanism: A user deposits USDC.

The Operation: The protocol borrows a low-rate currency (e.g., JPYC) in the background, swaps it via StableFX, and invests in a high-yield asset (e.g., Tokenized T-Bills).

Risk Management: Utilizing Arc’s automation, the system executes millisecond-level liquidation if exchange rates hit a volatility threshold.

Why Arc? This strategy requires extreme speed. Arc’s Deterministic Finality is the critical safeguard against liquidation failure.

The Builder Profile: Quantitative trading teams and advanced DeFi architects.

D. The "Local-First" Checkout

The Thesis: "Pay in Pesos, Settle in Dollars. Zero Friction."

The Problem: A US-based Shopify merchant wants USDC, but their Mexican customer wants to pay in Pesos (MXN). Current credit card rails charge 3-5% in FX fees for this privilege.

The Solution:

Frontend: The buyer sees the price in MXNB (Mexican Peso Stablecoin).

Payment: The buyer pays MXNB.

Backend: The transaction hits Arc, instantly swaps MXNB to USDC via StableFX.

Settlement: The merchant receives USDC. No banks involved. Total fees < 1%.

Why Arc? Instant confirmation makes the checkout experience silky smooth, no "waiting for block confirmations."

The Builder Profile: Payment gateway developers and e-commerce infrastructure teams.

3. The Technical Blueprint

For the developer, the integration path is clear:

Step 1: Pricing. Integrate the StableFX API (Oracle). This is a stream of executable quotes.

Step 2: Assets. Ensure your smart contracts are compatible with ERC-20 standards for USDC, EURC, and Partner Stablecoins (JPYC, MXNB).

Step 3: Execution. Build a swapCurrency(tokenIn, tokenOut, amount, minRate) function. Inside, call the StableFX settlement contract, passing the signed RFQ quote to finalize the atomic swap.

Step 4: Interoperability (Optional). Use the xReserve pattern. If your strategy requires assets from the Bitcoin network, wrap them into the Arc ecosystem via xReserve to access FX liquidity.

4. The Conclusion

"Forex is the biggest market in the world, and it is still running on 1980s technology."

In this track, you are re-plumbing the vascular system of global trade.

By leveraging StableFX and Arc, you have the opportunity to build the next generation of foreign exchange applications: 24/7 operation, T+0 settlement, and zero banking fees. This is the Crown Jewel of Fintech.

Track III: The Silicon Economy

From Human-Computer Interaction to Machine-to-Machine Commerce

1. The Core Thesis

The current generation of Artificial Intelligence is defined by a structural paradox: infinite intelligence, yet zero financial agency. An AI Agent can plan a complex itinerary for a trip to Tokyo, but it is powerless to book the flight. It can write the code for a server, but it cannot rent the hardware. It is a brain in a jar, brilliant, but severed from the physical economy.

The Circle and Arc ecosystem provides the missing limb:

Circle Programmable Wallets grant each Agent a unique, policy-controlled on-chain identity.

The x402 Protocol serves as the universal "negotiation language" for value (restoring the "Payment Required" status to the web).

Gas Station resolves the UX friction, abstracting away the complexity of ETH and Gas so that payment feels like a simple API call.

Arc provides the high-concurrency, deterministic environment required for machine-speed transactions.

The Mission: To construct the infrastructure and applications that allow AI to autonomously earn, spend, and manage assets. To grant economic sovereignty to the machine.

2. The High-Value Opportunities

We are looking beyond simple "crypto-browsers." We are looking for the fundamental rails of a machine-native GDP.

A. The API Negotiator

The Thesis: "The death of the monthly subscription; the birth of real-time bidding."

The Problem: Developers are currently forced to manually subscribe to dozens of APIs (OpenAI, Twilio, SerpApi), managing a chaotic ring of keys and credit card limits.

The Solution:

Dynamic Gateway: Service providers publish APIs on Arc with dynamic, load-based pricing.

The Agent: Before calling data, the user’s AI Agent queries via x402: "Price check?"

The Settlement: The provider responds: "0.002 USDC." The Agent verifies its budget and executes the payment instantly.

Pay-As-You-Go: No subscriptions. No breakage. Millisecond settlement.

Why Arc? High-frequency micropayments are economically impossible on legacy rails. On Arc, they are the standard.

The Builder Profile: API aggregators and developer tool architects.

B. The "Pay-per-Context" Gateway

The Thesis: "Solving the 'New York Times vs. OpenAI' legal deadlock."

The Problem: Large Language Models (LLMs) need fresh data, but publishers are blocking scrapers because they aren't getting paid. The legal system is gridlocked.

The Solution:

Compliance: Publishers deploy x402 headers on their content.

Micro-Access: When an AI scraper visits, it doesn't hit a paywall; it autonomously pays 0.01 USDC to the publisher's Arc wallet for the legal right to ingest that specific article.

Revenue Flow: Capital flows instantly to creators and platforms, creating a sustainable "AI-Media" ecology.

Why Arc? The negligible transaction fees make the $0.01 economy viable.

The Builder Profile: Media-tech firms and Web3 browser plugin developers.

C. The "Budgeted Butler" Protocol

The Thesis: "Trust through code, not faith."

The Problem: You want your AI to buy your coffee and book your flights, but you will never give a hallucinating chatbot your credit card.

The Solution:

Scoped Permissions: Leverage the "Policy Engine" of Circle Programmable Wallets.

The Rules: Issue the AI a sub-wallet with strict on-chain logic: "Max spend 50 USDC/day," "Transfer only to whitelisted addresses (Starbucks, Uber)," "Transactions > $100 require human biometric approval."

Autonomy: Inside these guardrails, the AI operates with total freedom.

Why Arc? On-chain policy execution is transparent and immutable, offering a flexibility that traditional bank risk models cannot match.

The Builder Profile: Smart home hubs and Personal Assistant App developers.

D. Flash Bounties for RLHF

The Thesis: "The Reverse Turing Test."

The Problem: AI still gets stuck. It fails to read a blurred CAPTCHA or misunderstands the nuance of sarcasm.

The Solution:

The Request: The AI Agent encapsulates the difficult task into a "Micro-Bounty" and broadcasts it to Arc with a 0.5 USDC reward.

The Human: A "micro-worker" anywhere in the world taps the notification, solves the CAPTCHA, or labels the data.

The Payment: The AI verifies the input and releases funds instantly.

Why Arc? This creates a global, frictionless labor market settled in USDC.

The Builder Profile: Data labeling platforms and crowdsourcing networks.

3. The Technical Blueprint

For the engineer, the assembly instructions for a Silicon Economic Entity are as follows:

Step 1: Identity. Use the Circle Programmable Wallets API to instantiate a Smart Contract Account (SCA) for the AI.

Critical: Configure Spending Policies (e.g., maxAmountPerDay = 10 USDC).

Step 2: Protocol. Integrate the x402 (HTTP 402) standard.

When the AI makes a request, the server returns 402 Payment Required along with a destination address and amount. The AI parses this and signs the transaction.

Step 3: Gas. Configure Gas Station and Paymaster.

The AI holds only USDC. The Paymaster abstracts the gas fees in the background, ensuring the AI's logic loop is never broken by a lack of native tokens.

Step 4: Logic.

Deploy verification contracts on Arc. Ensure that successful payment triggers an Oracle or Event Listener to release the API key or service access off-chain.

4. The Conclusion

"Give your AI a wallet, not just a prompt."

Right now, your AI is like a genius locked in a library: it knows everything, but it can affect nothing in the physical world.

By combining the speed of Arc with the identity layer of Circle Wallets, you are handing that genius a key. You are architecting the GDP of the Machine Economy.

Track IV: Economic Leapfrog & Inclusion

From "Waiting for Aid" to "Accessing the Global Grid"

1. The Core Thesis

Traditional financial inclusion has failed not because of malice, but because of math. The unit economics of the legacy banking system are broken: the Customer Acquisition Cost (CAC) and service overhead for a user in a developing market far exceed the profit generated by their deposits. Banks simply cannot afford to open an account for $50.

The Circle and Arc ecosystem fundamentally alters this equation:

Arc's Negligible Gas Fees make a $1 transfer economically rational, not just charitable.

Circle User-Controlled Wallets resolve the "Key Management" barrier, replacing terrifying seed phrases with familiar social logins and passkeys.

USDC solves the "Volatility" problem, protecting the vulnerable from local currency inflation.

The Mission: To build the "Leapfrog Stack", minimalist, anti-inflationary, and disintermediated financial tools that serve the bottom 50% of the global population.

2. The High-Value Opportunities

We are talking about sustainable, scalable business models for the next billion users.

A. Reputation-Based Micro-Lending

The Thesis: "Digitizing the social capital of the village to access global liquidity."

The Problem: A fruit vendor in Kenya needs $100 for inventory. She has no credit score, so she is forced into predatory loans. Meanwhile, DeFi protocols sit on billions of dollars of idle capital that cannot be deployed without over-collateralization.

The Solution:

ROSCA 2.0: Move the traditional "rotating savings and credit association" onto Arc.

The SBT: If a member repays on time, this behavior is minted as a Soulbound Token (SBT), a digital credit score.

The Bridge: High-reputation ROSCA groups are bundled together to borrow from global DeFi pools at competitive rates (e.g., 10%), bypassing local loan sharks (100%+).

Why Arc? Only Arc can handle the high volume of micro-repayment data while providing the transparent audit trail required by global lenders.

The Builder Profile: Emerging market Fintech founders and DeFi protocol architects.

B. Pay-As-You-Go Asset Networks

The Thesis: "Streaming money for streaming utility."

The Problem: A low-income family cannot afford the upfront cost of a solar panel or a motorbike, despite having a steady cash flow to pay for it over time.

The Solution:

IoT + Blockchain: Connect the physical asset (solar panel) to an internet controller.

Micro-Unlocking: The user pays 0.50 USDC via their Arc wallet.

Smart Contract Logic: Payment confirmed -> Signal sent -> Device unlocks for 24 hours.

Ownership: If payment stops, the device locks. Once the total principal is paid, an NFT represents full ownership transfer.

Why Arc? The friction of traditional payments makes daily micropayments impossible. Arc makes them trivial.

The Builder Profile: IoT hardware hackers and ReFi (Regenerative Finance) entrepreneurs.

C. The Programmable Aid Protocol

The Thesis: "Ensuring donor funds buy medicine, not alcohol."

The Problem: Humanitarian aid is plagued by two cancers: intermediary corruption (skimming off the top) and misuse of funds at the bottom.

The Solution:

Restricted Assets: Issue a "Wrapped USDC" on Arc specifically for aid.

Allow-Listing: Code the token so it can only be transferred to whitelisted wallets (verified pharmacies, schools, grocery stores).

Auto-Redemption: Vendors who receive the token can swap it 1:1 for liquid USDC instantly.

Privacy: Use Zero-Knowledge proofs so the public sees the flow of funds to valid categories, without exposing the identity of the refugee.

Why Arc? Programmable Money is the ultimate solution to the Principal-Agent problem in charity.

The Builder Profile: GovTech developers and NGO technical partners.

D. Direct-to-Biller Remittances

The Thesis: "Don't send cash; settle the bill."

The Problem: A migrant worker sends money home for school fees. The cash is received, but due to urgent needs or lack of discipline, it is spent on other things. The sender wants control over the allocation of capital.

The Solution:

Aggregation: The platform integrates with utility and education providers in the destination country.

Direct Payment: The sender in the US pays USDC in the app.

Settlement: Arc settles the transaction in the background, converting via CPN to local fiat and paying the electric company directly.

Certainty: The sender receives an instant digital receipt: "Bill Paid."

Why Arc? It acts as a global settlement layer that bypasses the slow, opaque correspondent banking chain.

The Builder Profile: Cross-border payment startups and Digital Nomad service providers.

3. The Technical Blueprint

In this track, User Experience (UX) is survival. Your users have low-end devices and spotty internet.

Step 1: The Invisible Wallet. Use Circle User-Controlled Wallets with PIN or Biometric recovery. If you ask a user to write down 12 words, you have already lost.

Step 2: Gas Sponsorship. You must configure a Gas Station. The user should know they received "10 Dollars," not that they need "Arc Token" for gas. Abstract the blockchain away completely.

Step 3: The Lite Stack. Build Progressive Web Apps (PWAs) or Telegram Mini Apps. The binary must be small; the interface must be fast.

Step 4: Offline Tolerance. Design for latency. Allow users to sign transactions offline and broadcast them when the network reconnects.

4. The Conclusion

"Technology has no conscience, but builders do."

On Wall Street, being 1 millisecond faster might mean an extra million dollars in profit. But in the developing world, saving $1 in fees and moving money instantly means a family eats dinner tonight.

This track is about using code to eliminate the "Poverty Premium." By leveraging the power of Arc and Circle, you are building a ladder to economic freedom.

The Conclusion

The Time to Build is Now

History doesn't repeat but it rhymes. In the late 90s, we laid fiber optic cables that allowed the internet to scale. In the 2000s, Stripe and PayPal built the logic layer that enabled e-commerce to explode. Today, we're at a similar inflection point for the financial internet.

The opportunities outlined above - Borderless Payment Rails, Programmable FX, The Machine Economy, and Financial Inclusion - are not theoretical science projects. They are immediate, addressable markets worth trillions of dollars.

The legacy banking system's friction - 3-day settlement times, predatory remittance fees, walled gardens - is an anomaly that technology is now correcting.

Circle and Arc have provided the "AWS" for this financial revolution: scalable, compliant, and ready for deployment. Infrastructure risk has been removed. What remains is execution risk.

We are looking for founders who aren't interested in launching the next meme coin, but who are obsessed with unbundling the bank, rewiring global trade, and giving AI agents their own economic sovereignty.

The Economic OS is open. The API is live. It's time to build.

About DoraHacks

DoraHacks(dorahacks.io) is the leading global hackathon community and open source developer incentive platform. DoraHacks provides toolkits for anyone to organize hackathons and fund early-stage ecosystem startups.

DoraHacks creates a global hacker movement in Web3, AI, Quantum Computing and Space Tech. So far, more than 30,000 startup teams from the DoraHacks community have received over $300M in funding, and a large number of open source communities, companies and tech ecosystems are actively using DoraHacks together with its BUIDL AI capabilities for organizing hackathons and funding open source initiatives.

Website: https://dorahacks.io/

Twitter: https://twitter.com/DoraHacks

Discord: https://discord.gg/gKT5DsWwQ5

Telegram: https://t.me/dorahacksofficial

Binance Live: https://www.generallink.top/en/live/u/24985985

Youtube: https://www.youtube.com/c/DoraHacksGlobal