When a Trade Is Done, It’s Done — No Attachment, No Regret 🧠📉

There is a moment in every trader’s journey when profits are already on the screen, confidence is high, and the temptation to do more starts whispering in the background. The numbers look good. The ROI is impressive. Everything feels aligned. And then the question appears:

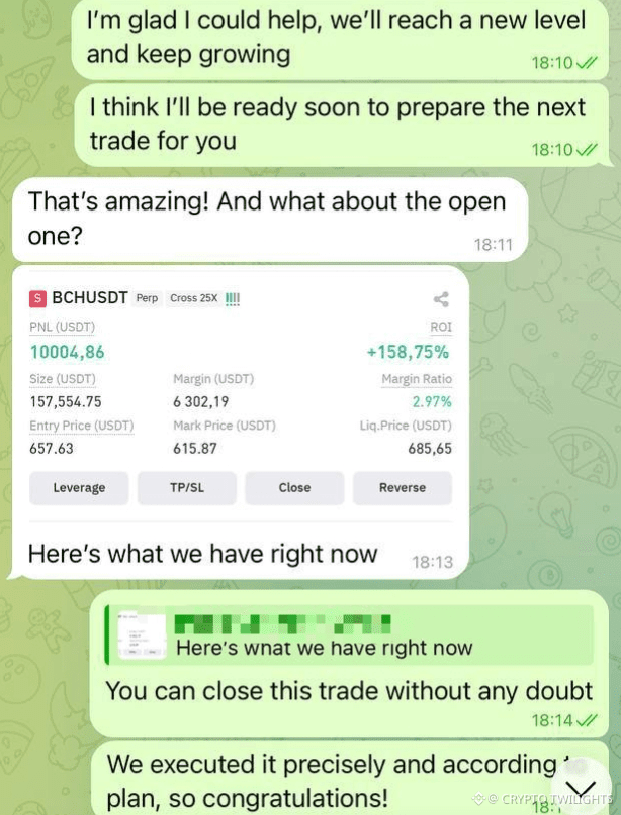

“What about the open one?”

This question sounds simple, but it reveals everything about a trader’s mindset.

At that moment, trading stops being about charts and starts being about discipline.

📊 Profit Does Not Mean Permission to Be Careless

Just because a trade is in profit doesn’t mean it’s safe. Risk doesn’t disappear when PnL turns green. Leverage doesn’t become friendly. Volatility doesn’t suddenly care about your emotions. The market stays the same — only your mindset changes.

Many traders confuse success with entitlement. They think, “I’m up a lot, so I can hold longer.” That thinking is dangerous. The market doesn’t reward confidence; it rewards correct execution.

🧩 Execution Is the Real Skill

Anyone can enter a trade. Many can analyze charts. Very few can exit properly.

Closing a trade at the right time is not luck — it’s skill built through experience, mistakes, and emotional control. When a trade follows the plan from entry to exit, that’s not just a win financially — it’s a mental victory.

Executing precisely according to plan means:

You respected your setup

You managed risk correctly

You didn’t let greed rewrite the rules

That’s how traders grow.

🔁 There Is Always Another Trade

One of the biggest illusions in trading is the fear that this might be the last opportunity. It never is.

Markets open every day. Price moves constantly. Opportunities are endless — but capital and discipline are limited. Protecting those two things matters more than squeezing extra percentage points out of one trade.

Closing a profitable position doesn’t mean you’re done. It means you’re ready for the next one.

🧠 No Emotional Attachment

The moment you start feeling attached to a position, clarity disappears. You stop seeing the market objectively and start defending your trade emotionally.

Professional traders don’t fall in love with positions. They don’t argue with the market. They execute, review, and move on.

A closed trade is a clean slate.

No stress.

No overthinking.

No revenge trading.

📉 Why Many Traders Give Profits Back

Giving profits back usually doesn’t happen because of bad analysis. It happens because of hesitation.

Hesitating to close

Hesitating to follow the plan

Hesitating because “it might go higher”

That hesitation slowly erodes discipline. And once discipline is gone, consistency follows it out the door.

💡 Confidence Comes From Process, Not Numbers

Real confidence isn’t built by big PnL screenshots. It’s built by knowing you did everything right — even if the profit was smaller than it could have been.

A trader who can say, “We executed exactly according to plan” is already ahead of most.

Numbers fluctuate.

Process compounds.

📓 Review, Don’t Celebrate Too Long

Winning trades should be acknowledged, not worshipped. Celebrate briefly, then review:

Was the entry clean?

Was risk managed correctly?

Was the exit logical?

This mindset keeps you grounded. Over-celebration leads to overconfidence, and overconfidence is expensive.

🚀 Growth Is Quiet

Real growth in trading doesn’t look dramatic. It looks boring. Calm decisions. Clean exits. No emotional spikes. Just steady improvement over time.

When you can close a highly profitable trade without doubt, hesitation, or second-guessing — that’s growth.

🧠 Final Thought

The market rewards traders who respect their plans more than their profits. Closing a trade when the job is done is not weakness — it’s mastery.

No attachment.

No noise.

No pressure.

Just execution, learning, and moving forward.

Because in trading, the goal isn’t to win one big trade —

it’s to stay sharp long enough to win many. 📊💪