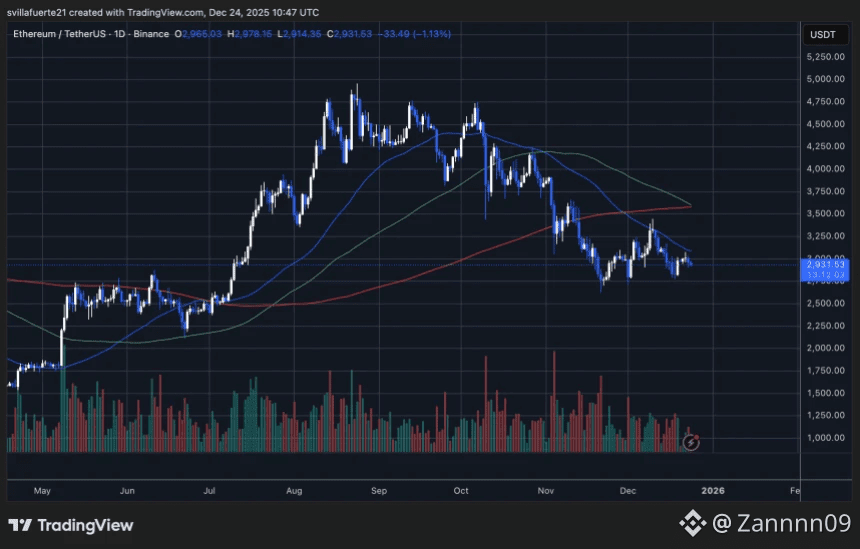

Ethereum ($ETH) is currently trading in a consolidation phase after facing firm rejection near its upper resistance zone. Price recently pushed into the $3,160–$3,170 area but failed to sustain upside momentum, signaling that selling pressure remains active at higher levels.

Since that rejection, ETH has shifted into sideways price action, reflecting market hesitation rather than strong trend continuation. This behavior suggests traders are reassessing direction after the recent move.

Market Structure & Key Levels

From a structural perspective, ETH is clearly range-bound:

Resistance: $3,150–$3,170

Support: $3,050–$3,070

As long as price remains below the resistance band, upside attempts appear to be short-term relief bounces rather than the start of a sustained rally. Additionally, declining volume supports the case for range trading or controlled downside rather than aggressive upside continuation.

A decisive reclaim and hold above $3,170 would improve the structure and open the door for higher price targets. Until then, price action favors caution near resistance.

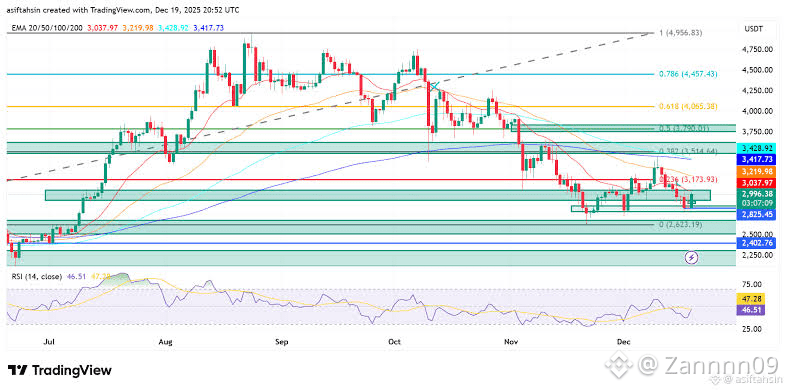

ETH Short Trade Plan (Tactical Setup)

Bias: Short below resistance

Short Entry Zone:

$3,140 – $3,170

Take Profit Targets:

TP1: $3,080

TP2: $3,030

TP3: $2,980

Stop Loss:

$3,220 (above resistance invalidation)

Risk Parameters:

Leverage: 20x – 40x

Margin Allocation: 2% – 4%

👉 Risk management note: Consider securing partial profits at TP1 and moving stop loss to breakeven to protect capital.

Outlook$

Unless Ethereum reclaims resistance with strong follow-through, the current structure supports range-bound or controlled downside movement. Traders should remain disciplined and avoid chasing price into resistance zones without confirmation.

#ETH #Ethereum #CryptoAnalysis #priceaction #Binance