Most people entering crypto do it for freedom the freedom to move value instantly to self custody wealth and to escape the slow gatekept machinery of traditional finance.

Yet the closer DeFi gets to serious capital the more it runs into a hard wall of regulations compliance obligations and privacy concerns that were never designed for open transparent blockchains.

On one side sits a world of anonymous wallets composable protocols and twenty four seven liquidity.

On the other a world of licenses KYC files and regulators who are legally obliged to say no when they cannot see enough.

Somewhere between these extremes a new model has been quietly taking shape one that does not ask institutions to abandon rules nor users to surrender all privacy.

This is the space where Dusk positions itself not as another speculative chain chasing yield but as infrastructure for regulated DeFi that actually speaks the language of financial law.

At the core of Dusk’s design is a simple but powerful idea privacy and compliance are not opposites if you structure them correctly at the protocol level.

Instead of making every transaction permanently public Dusk uses advanced zero knowledge proofs so that sensitive data remains hidden while still proving that all required rules were followed.

In practice this means a transfer a trade or an issuance can be verified as legal and valid without broadcasting who did what or how much to the entire world.

Where most DeFi protocols bolt on compliance at the application layer via whitelist hacks off chain agreements or custodial wrappers Dusk bakes it into the network itself.

The result is a layer one chain where KYC auditability and regulated asset behavior are network native properties not afterthoughts.

To make this work Dusk leans heavily on programmable privacy and confidential smart contracts that are tailored for financial instruments.

Its Confidential Security Contract XSC standard allows issuers to encode regulatory rules directly into tokenized assets such as who can hold them how transfers are restricted or what kind of reporting is possible.

At the same time those contracts are executed privately with transaction details concealed yet provably consistent with predefined constraints.

This is a subtle but crucial shift from the everything visible everything composable mindset that defined the first wave of DeFi.

Dusk is not trying to be yet another generalized smart contract platform.

It is deliberately optimized for securities bonds money market funds and other instruments that live under the full weight of MiFID MiCA and similar regulatory regimes.

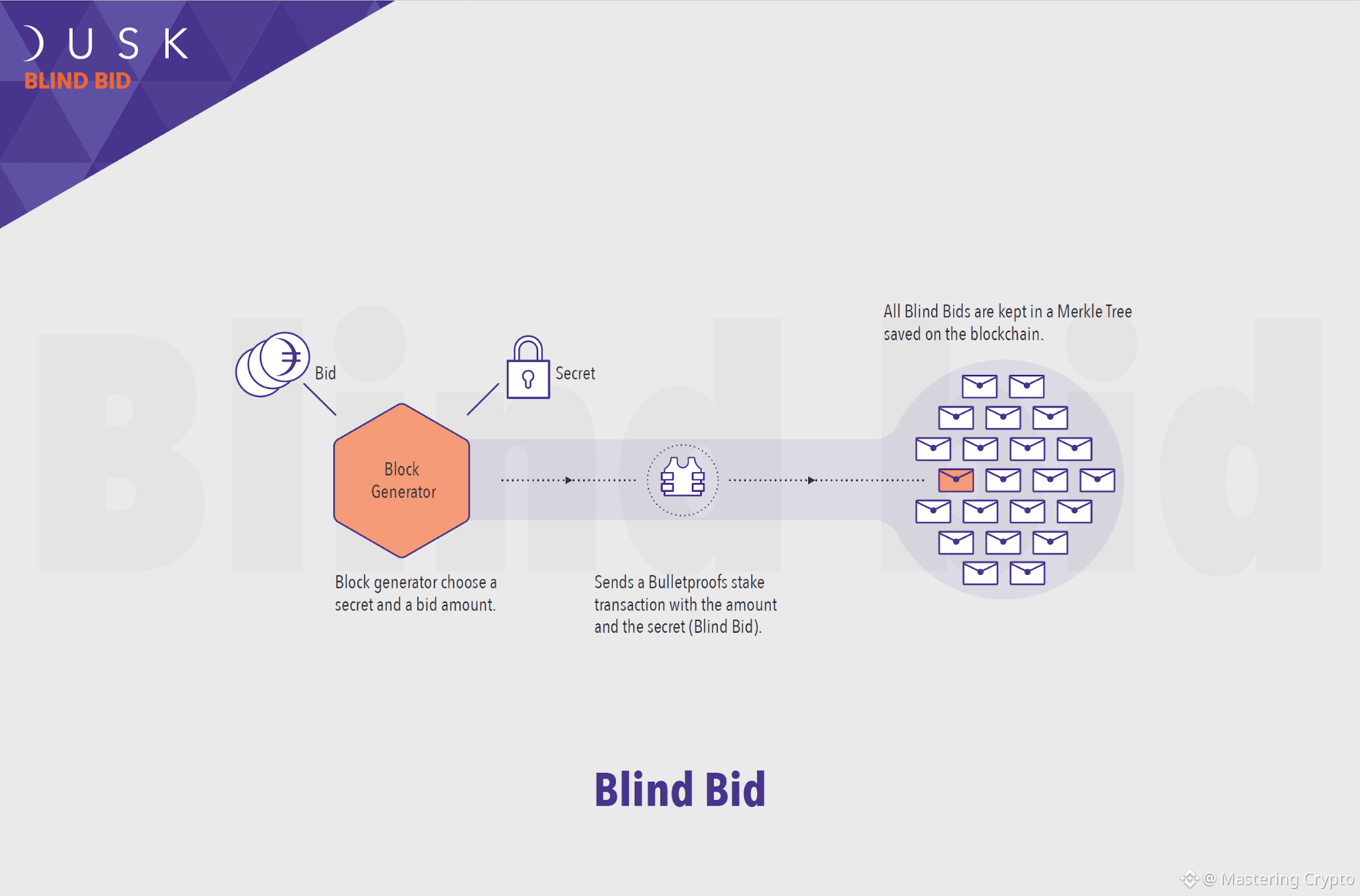

Under the hood Dusk’s consensus and network architecture are engineered to support this level of confidentiality without sacrificing speed or finality.

The protocol builds on proof of stake style mechanisms and specialized schemes like Segregated Byzantine Agreement and Succinct Attestation to achieve fast irreversible settlement while layering zero knowledge proofs into the validation process.

This means that every block can enforce both economic integrity and compliance rules in a single flow rather than relying on off chain after the fact checks or manual interventions.

For end users and institutions the experience feels less like sending a transaction into a public gossip network and more like interacting with a purpose built digital securities rail where privacy and regulation coexist by default.

The regulatory angle goes even deeper than technology.

Through its partnership with NPEX and other licensed venues Dusk ties its protocol directly into a framework of market licenses such as multilateral trading facilities brokerage permissions and upcoming DLT based trading and settlement licenses.

Instead of siloed app by app approvals the network can underpin an entire stack of regulated activities under one shared legal umbrella.

Tokenized assets licensed front ends and compliant back end infrastructure can all interoperate on chain without each team having to renegotiate the regulatory wheel.

This is where the phrase regulated DeFi stops being marketing and starts to look like a genuine operating model for on chain capital markets.

In a broader industry context Dusk’s approach lands right in the middle of several converging trends.

Real world assets have shifted from niche experiments to a major thesis as institutions look for programmable exposure to treasuries credit and private markets on public rails.

At the same time regulators in Europe and beyond are tightening expectations under frameworks like MiCA while still exploring how DLT can make markets more efficient.

Public chains optimized only for DeFi yields and memecoins struggle to meet those expectations especially when every transaction is an open book.

Privacy coins meanwhile often sit on the opposite side of the spectrum offering strong confidentiality but little in the way of built in regulatory tooling.

Dusk fits into the gap neither camp addresses well the need for compliant programmable markets that do not turn every financial interaction into public data.

When thinking about this model it is hard not to reflect on how DeFi has matured over the last cycles.

Early on the ethos rewarded maximum openness permissionless experimentation and a healthy disregard for the constraints of traditional finance.

That phase produced powerful primitives but also a landscape that is difficult for regulated institutions to touch without wrapping everything in opaque intermediaries.

A network like Dusk does not ask the DeFi community to abandon its values.

It asks it to accept that serious capital operates under rules that will not disappear just because technology moved fast.

For builders who want their protocols to plug into actual securities flows settlement systems and institutional liquidity this is less a compromise and more an expansion of what DeFi can mean.

There is of course a trade off in anchoring a blockchain so explicitly to regulation.

Some users will see protocol level KYC and auditor access implemented through selective viewing keys and controlled transparency as antithetical to the cypherpunk roots of the space.

Others may worry about regulator overreach or the long term implications of embedding legal frameworks into code that is meant to be neutral and global.

Those concerns are not trivial and any honest assessment of regulated DeFi has to acknowledge that it is not designed to replace all of crypto but to serve the segment where legal accountability is non negotiable.

In return Dusk offers something many chains only hint at a credible path for banks brokers and issuers to step into on chain markets without pretending the law does not exist.

From a builder’s standpoint Dusk’s programmable privacy opens some interesting design space that rarely exists in standard EVM environments.

Developers can construct dApps where user flows remain private to the public yet still share verifiable proofs with counterparties or oversight entities when necessary.

Identity can be bound to compliant zero knowledge based attestations instead of raw documents floating around multiple custodians.

Composability also takes on a new flavor.

Instead of just composing liquidity and code applications can compose legal attributes KYC attestations and regulated asset behavior all enforced by the chain itself.

That shift could gradually normalize a world where DeFi front ends brokerage platforms and institutional tools share the same underlying ledger without fragmenting into incompatible silos.

On the user side the lived experience of such a system might feel surprisingly familiar yet subtly more respectful of financial privacy.

An investor can onboard once prove identity in a privacy preserving way and then interact with multiple regulated products without re uploading the same documents to every new platform.

Institutions can meet their KYC and reporting obligations without leaking trade data to the entire market or exposing order books in ways that reveal sensitive strategies.

For market makers and asset managers that balance of confidentiality and auditability can be the difference between we cannot touch this chain and we can integrate this into our stack.

For regulators having a reliable view into compliance relevant parts of the system without turning every user into a glass box may actually improve oversight rather than weaken it.

Looking ahead the paradigm Dusk represents suggests a different trajectory for DeFi’s next decade.

Instead of drawing a hard line between on chain casinos and off chain real finance the industry can move towards a mesh of public infrastructure where regulated and unregulated activity are clearly separated but still interoperable.

Tokenized real world assets licensed venues and privacy aware protocols can share the same base layer giving capital a way to move at blockchain speed while still living inside legal boundaries.

That does not mean every project needs to adopt Dusk’s model nor that all chains should be built this way.

It does mean that the binary debate between absolute anonymity and total transparency is starting to feel outdated.

In that sense Dusk is less a single network and more a hint of where the most serious intersection of crypto and traditional finance is likely to settle.

A regulated DeFi environment where privacy is a feature compliance is native and the line between old and new markets becomes increasingly blurred.