Market Context

TP1: $2.75 (Psychological & 24h high extension)

TP2: $3.10 (Major Fibonacci extension)

TP3: $4.30 (Medium-term institutional target)

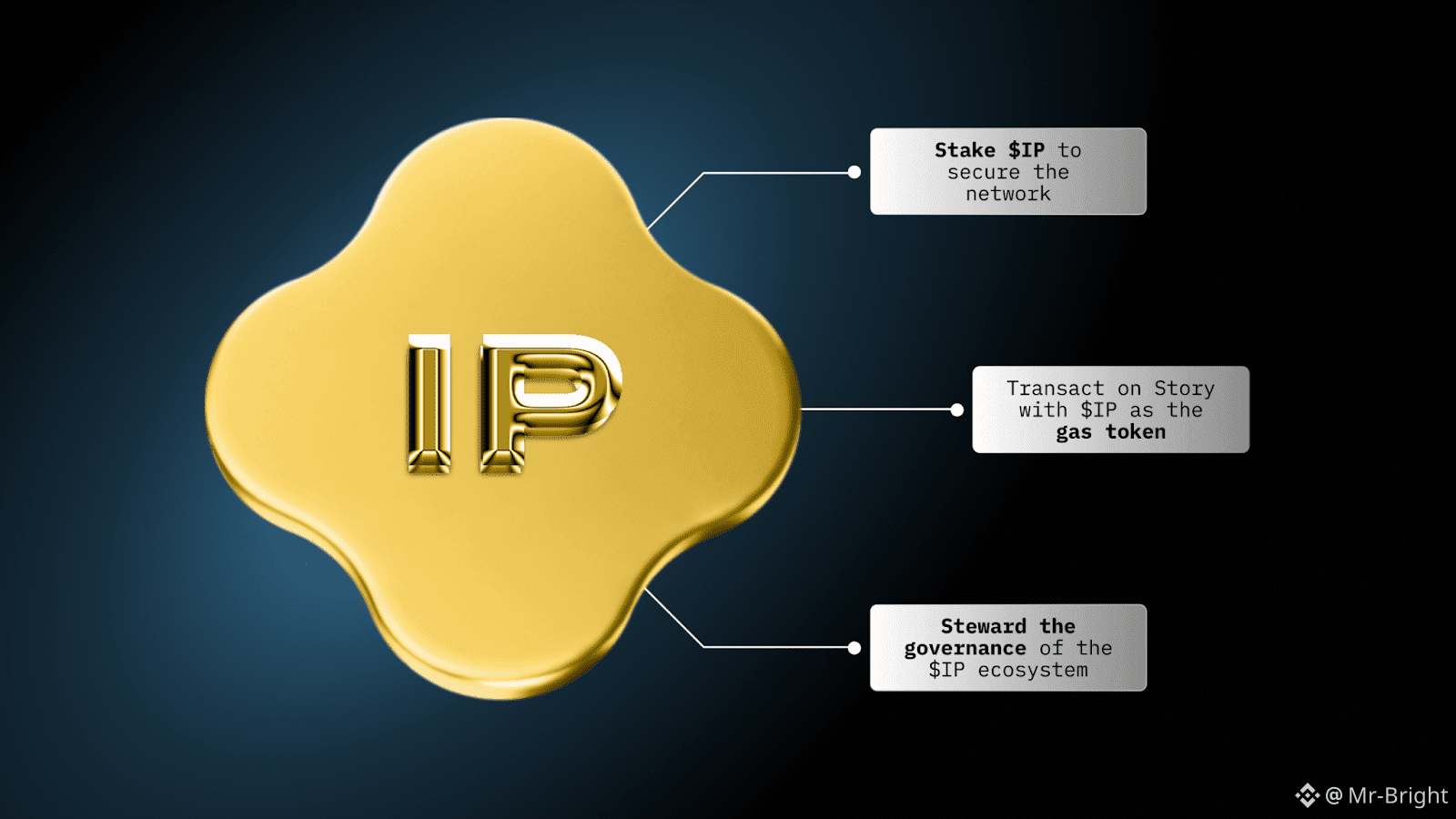

Story Protocol $IP is currently the leading narrative in the AI-Intellectual Property sector. The recent 52% weekly surge is driven by "January Effect" institutional positioning and a liquidity crunch on Korean exchanges (Upbit/Bithumb) ahead of the network upgrade.

Technical Analysis (30m TF)

Trend: Strongly Bullish. The 30m chart shows a "Base-Expansion" pattern.

Momentum: RSI is hovering near 80 (Overbought), suggesting high demand but a potential short-term "cool-off" or retest of the breakout zone.

Support Levels: The primary support has shifted to $2.30 (former resistance) and $2.15.

Strategic Trade Plan

Buy Zone: Look for entries on a pullback to $2.45 – $2.55. Avoid "chasing" the green wick at local tops.

Stop Loss (SL): Below $2.20 to protect against a trend invalidation.

Profit Targets (TP):