Walrus is more than a decentralized storage platform it's has many other things — it’s also a ecosystem where token holders can contribute to network security and earn yield by staking their WAL tokens.

What Staking Means in Walrus

Walrus uses a delegated proof-of-stake (DPoS) model: storage nodes secure the network, and WAL holders can delegate their tokens to those nodes. The more WAL a node has delegated to it, the more data shards it’s assigned and the greater its role in the network’s committee — the group responsible for handling data availability and integrity each epoch.Here’s how it works in simple terms:

You hold WAL tokens in a compatible wallet

You go to stake-wal.wal app and connect your wallet

You choose a storage node to delegate your WAL to

You confirm the amount and approve the transaction

Once your stake is active, you earn a share of storage fees collected by the network — proportional to how much WAL you delegated and how active the node is.

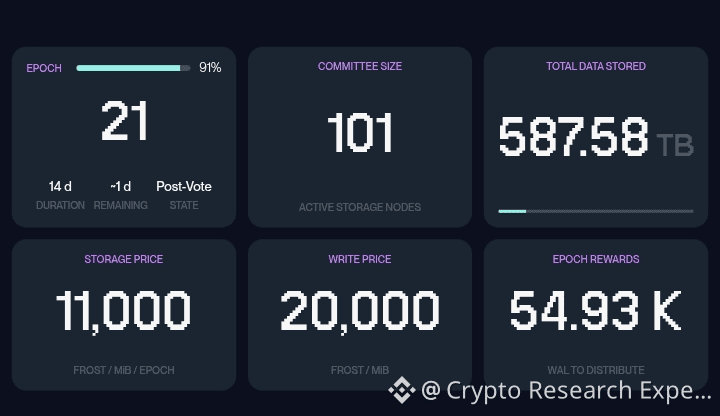

Stake Timing and Epochs

Rewards on Walrus are tied to epochs — periodic time windows (roughly ~2 weeks) that determine committee assignments. To ensure your stake affects the next reward cycle:

Stake before the midpoint of the current epoch .. your stake is counted for the next epoch

Stake after that point .. your stake only takes effect in the following epoch

Unstaking works similarly.If you request to withdraw WAL after the midpoint, your stake remains active through the next full epoch, and your tokens only unlock at the start of the following one.

So, why staked wal it has any benefit?

1.Earn Rewards by staking — you earn part of the storage fees generated as applications and users pay to write and read data on the Walrus network that how you earn because of it system become more stronger . Like you earn by staking in other coins it's the simple and same as that.

2. Support Network Security — Your delegated tokens help strengthen decentralization and influence which storage nodes are selected to serve data.3. Maintain Ownership if you have coin you owned it it without any condition and pressure —

WAL staking through the official portal is non-custodial — you keep your tokens in your wallet and retain control without compromising your privacy .

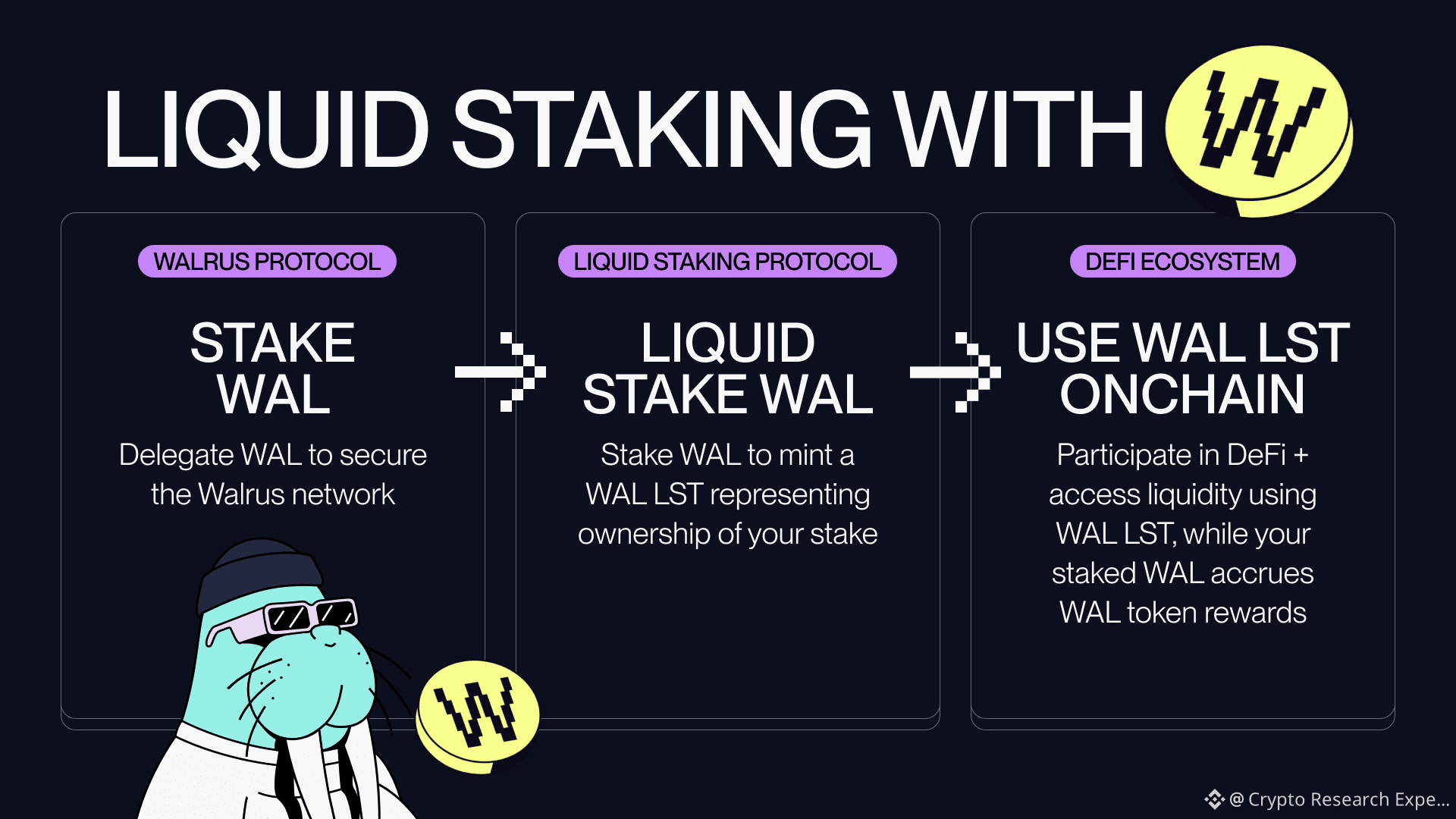

Liquid Staking and Secondary Opportunities

Native staking involves locking WAL for rewards, but too much lockup can limit flexibility That's things walrus predicted and also gives solution . That’s where liquid staking solutions come in: they issue trade able receipt tokens representing your staked WAL, allowing you to continue participating in DeFi while still earning yields .

A Broader Ecosystem Context

Staking on Walrus also connects you to the broader Sui ecosystem. Multiple interfaces — including Winter Walrus and Haedal — let you tap into the liquid staking economy, participate in yield farming, or engage with DeFi pools using stake-derived tokens.

Final Thought

Staking WAL isn’t just about passive income — it’s about participation. By putting your tokens to work, you’re helping like you do a mining of your token and because of it secure a decentralized data infrastructure that underlies real applications, AI systems, NFTs, and more. It's not just of sitting idle, WAL can be actively contributing to network resilience while earning rewards — a true Web3 utility.