Disclaimer: This FAQ Page is for general information and educational purposes only. It does not constitute legal terms or any form of legal agreement between you and Binance. It should not be construed as financial, legal or other professional advice. The information on this page may be outdated. For legal terms applicable to Futures and Options Trading Services, please refer to the Terms of Use, the Exchange Rules (including the Exchange Procedures) and the Clearing Rules (including the Clearing Procedures) which come into effect on 5 January 2026. Additional terms and conditions will also be set out in the Contract Specifications applicable to the relevant Derivatives contract.

Futures contracts are contractual agreements that obligate the contract holder and issuer to fulfill the contract.

In contrast, Options contracts are standardized contracts that allow investors to trade an underlying asset at a predetermined price before a specific date (the expiration date for the options) without the obligation to do so.

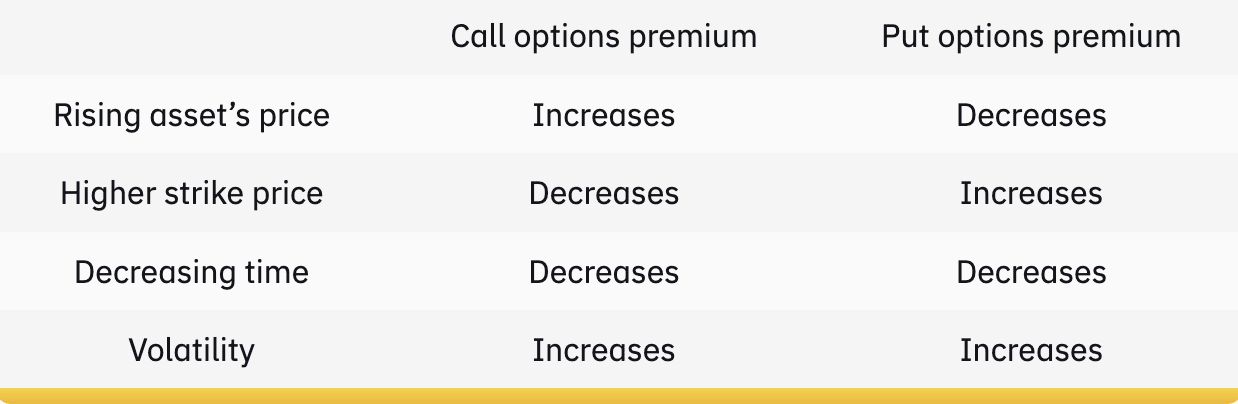

The value of the Option premium is affected by multiple factors.

Simply put, we may assume that an option's premium depends on at least four elements: the underlying asset’s price, the strike price, the time left until the expiration date, and the volatility of the corresponding market (or index).

These four components present different effects on the premium of Call and Put Options, as illustrated in the following table.

Options contracts are widely used as hedging instruments. A basic example of a hedging strategy is for traders to buy Put Options on coins they already hold. If the coin price declines and their holdings’ overall value decreases, exercising the Put Option can help them mitigate losses.

Options Greeks are instruments designed to measure some of the multiple factors that affect the price of an option contract. Specifically, they are statistical values used to measure the risk of a particular contract based on different underlying variables.

Following are some of the primary Greeks and a brief description of what they measure:

Delta: Measures how much the price of an option contract will change in relation to the underlying asset’s price. For instance, a delta of 0.6 suggests that the premium price will likely move to $0.60 for every $1 increase in the asset’s price.

Gamma: The ratio of the change in the option’s delta for a given change in the underlying asset or futures price.

Theta: Measures the price change in relation to a one-day decrease in the contract’s time.

Vega: The ratio of a change in an option’s price to a change in the volatility of the underlying security.

Rho: The ratio of the change in an option’s price to a change in the interest rates.

You can transfer assets to and from your Binance Options Wallet via the Spot Wallet.

For more details, please refer to How to Trade Options on Binance.