I still remember the moment when the choice finally clicked for me. I was comparing blockchains that claimed to be “ready for institutions,” and almost all of them leaned heavily on the EVM. Familiar. Proven. Comfortable. Yet something felt off. When you look closely at regulated finance—real securities, compliance rules, predictable settlement—you realize that familiarity alone isn’t enough. That’s when Dusk’s decision to build its core execution layer on WASM instead of EVM started to make deep, practical sense.

At first glance, this choice might seem counterintuitive. The EVM dominates mindshare. It powers most DeFi, countless dApps, and a massive developer ecosystem. So why would Dusk deliberately step away from that gravity? The answer, I’ve come to believe, lies in what regulated financial logic actually demands—not what crypto culture is most used to.

Dusk isn’t trying to be everything to everyone. It’s trying to be correct, predictable, and compliant in environments where mistakes are expensive and ambiguity is unacceptable. That single design goal explains almost everything about why WASM sits at the heart of Dusk’s execution model.

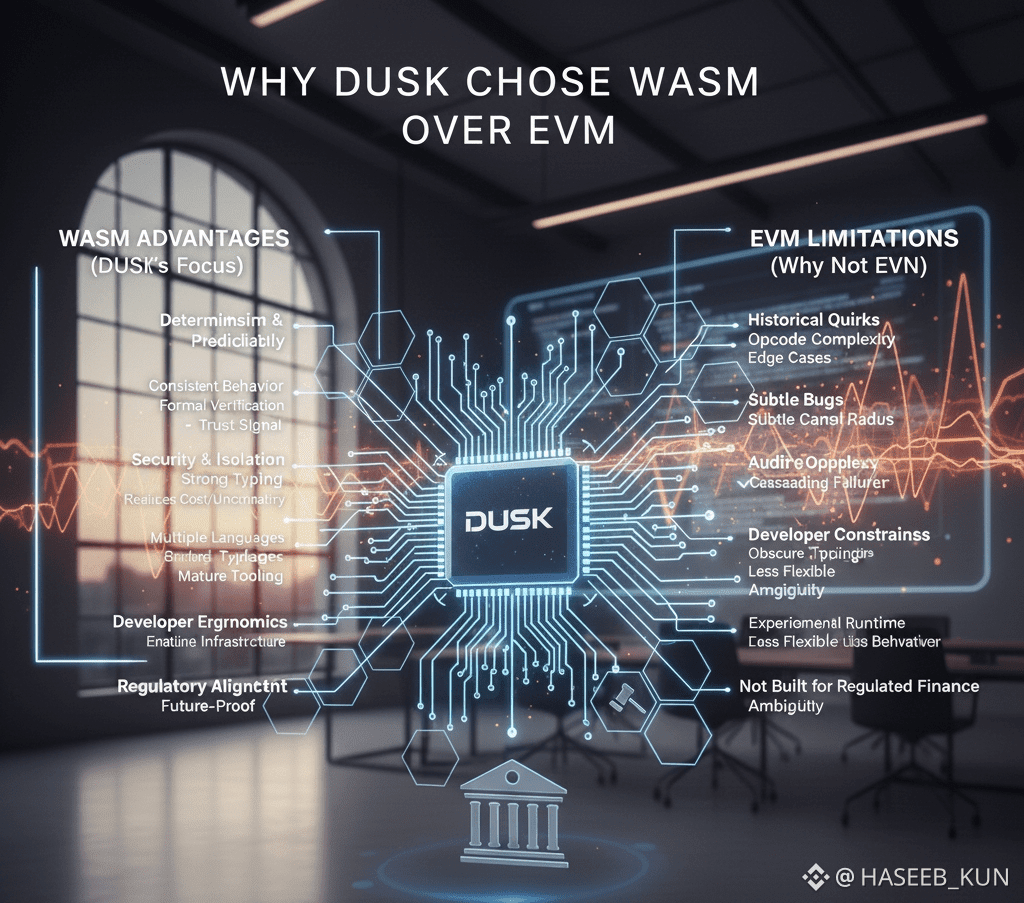

When I think about financial infrastructure, I don’t think about speed alone. I think about determinism. In regulated markets, contracts must behave the same way every time, across every node, without surprises. The EVM, by design, carries historical quirks: gas variability, opcode complexity, and edge cases that made sense for early experimentation but become liabilities when you’re executing sensitive financial logic.

WASM, on the other hand, feels more like engineered infrastructure than an experimental runtime. It was built with predictable execution, strong sandboxing, and formal verification in mind. Those qualities matter far more than hype when your smart contract is enforcing compliance rules, settlement conditions, or tokenized securities.

What stood out to me is how WASM aligns with regulatory thinking almost naturally. Regulators don’t care how clever your contract is. They care whether it behaves consistently, can be audited, and doesn’t introduce hidden risk. WASM’s deterministic execution model makes it easier to reason about outcomes before deployment. That predictability isn’t just a technical benefit—it’s a trust signal.

Security is another place where the difference becomes obvious. The EVM was never designed for long-term isolation of complex financial logic. Over time, we’ve seen how subtle bugs or unexpected interactions can cascade into systemic failures. WASM, by contrast, operates in a strictly sandboxed environment. Contracts get only what they’re explicitly allowed to access. No more. No less.

From my perspective, that sandboxing is not a luxury—it’s essential. In regulated finance, you want contracts that fail safely, not creatively. WASM reduces the blast radius of errors, which is exactly what institutions look for when evaluating blockchain infrastructure.

Another moment of clarity came when I looked at developer ergonomics. EVM contracts force developers into a narrow tooling lane. WASM opens the door to multiple mature programming languages with strong typing, established tooling, and decades of production use. This matters more than people admit.

Financial software isn’t written once and forgotten. It’s maintained, audited, upgraded, and reviewed repeatedly. WASM allows Dusk developers to work closer to how traditional financial systems are built—carefully, defensively, and with clarity. That alone lowers long-term risk.

I also see WASM as a bridge between worlds. Dusk isn’t rejecting the broader crypto ecosystem; it’s choosing the right layer for the right job. The core execution layer handles regulated, privacy-aware financial logic, where predictability matters most. Higher layers—like DuskEVM—can still support composability and experimentation. This separation feels intentional, not ideological.

One of the most overlooked aspects of this decision is auditability. In regulated environments, code audits aren’t optional. They’re expected. WASM’s simpler execution model makes it easier to analyze behavior formally. Auditors don’t have to account for obscure opcodes or unexpected gas behavior. That reduces cost, friction, and uncertainty.

And uncertainty, in my experience, is the real enemy of institutional adoption. Not volatility. Not innovation. Uncertainty.

The more I studied this design choice, the more I realized that Dusk isn’t optimizing for short-term developer hype. It’s optimizing for long-term credibility. WASM doesn’t trend because it’s flashy; it trends because advanced developers understand where the industry is heading. As blockchains move closer to real financial infrastructure, execution environments must mature accordingly.

This is why WASM narratives are gaining momentum right now. Developers who’ve built large systems know that elegance beats cleverness in the long run. They know that predictable behavior beats expressive freedom when money and law intersect. Dusk simply made that realization early—and acted on it decisively.

From an investor’s point of view, this matters more than it seems. Infrastructure decisions shape risk profiles years down the line. A network built on a predictable, auditable execution layer is easier to integrate into regulated markets, easier to defend legally, and easier to trust operationally. WASM quietly strengthens Dusk’s positioning without loud promises.

I also appreciate the honesty of the choice. Dusk didn’t try to stretch the EVM into something it isn’t. Instead, it acknowledged that regulated financial logic deserves its own execution model. That kind of restraint is rare in crypto—and telling.

When I step back, the story becomes clear. Dusk chose WASM not because EVM is “bad,” but because the job is different. Privacy-preserving, compliant, institution-ready smart contracts require an execution layer that behaves more like financial infrastructure than experimental code. WASM fits that role naturally.

This decision also future-proofs the protocol. As regulations evolve, execution environments will be scrutinized more closely. Determinism, isolation, and auditability won’t be optional features—they’ll be requirements. Dusk’s core layer is already aligned with that reality.

In the end, what resonates with me most is the philosophy behind the choice. WASM reflects a mindset of discipline over convenience. It signals that Dusk is building for durability, not applause. For developers who care about correctness, for institutions who care about risk, and for investors who care about sustainability, that choice speaks volumes.

#Dusk didn’t choose WASM to stand out. It chose WASM to stand firm.

And in a market where so much infrastructure is built on borrowed assumptions, that kind of clarity feels rare—and quietly powerful.