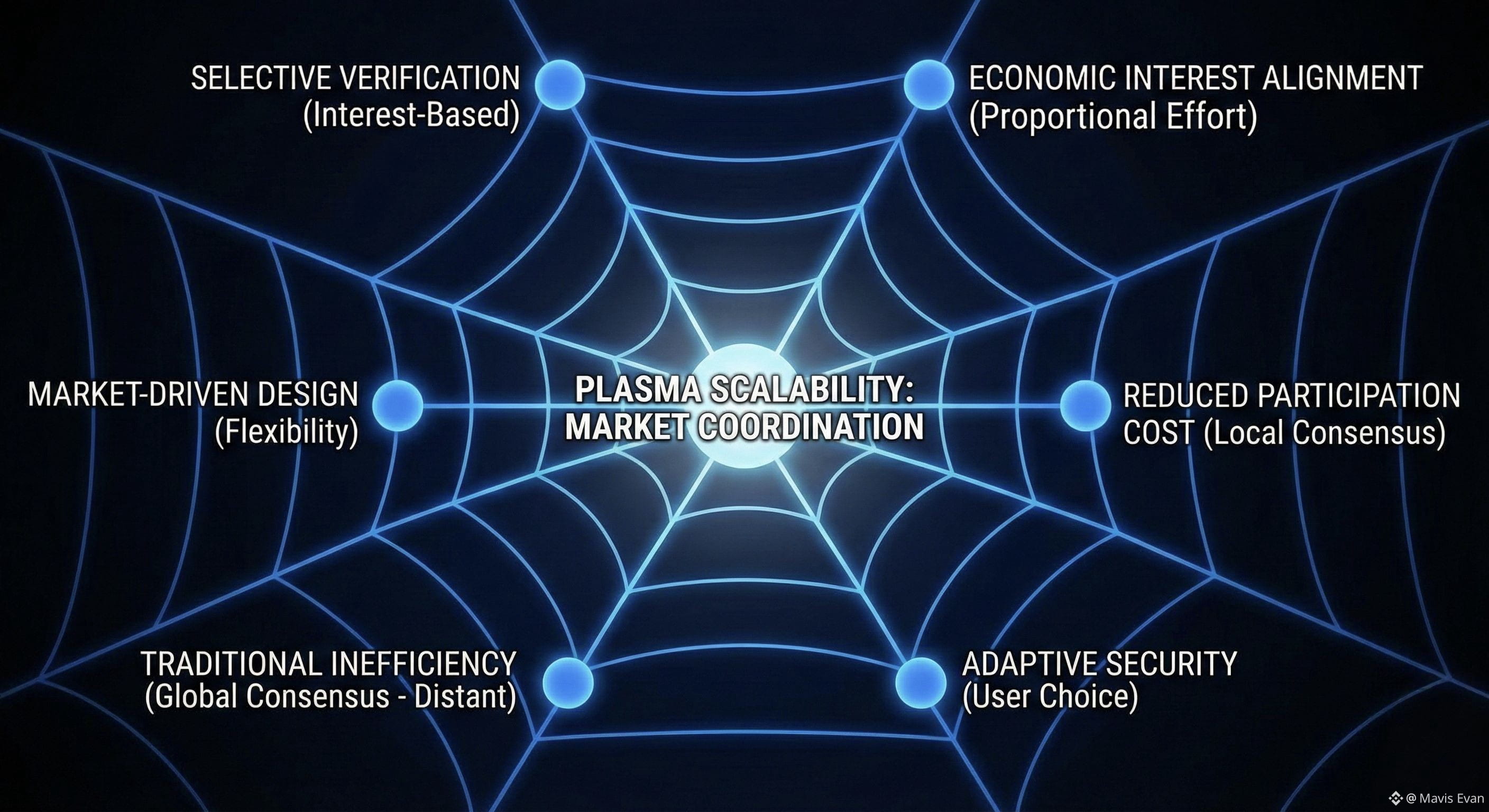

Plasma approaches scalability from a perspective that traditional blockchain designs often overlook. Instead of treating scale as a purely technical challenge to be solved with faster blocks or larger throughput, Plasma frames scalability as an economic and market coordination problem. This shift in thinking is critical, because blockchains are not just databases. They are financial systems where incentives, risk, and behavior matter as much as code.

In conventional blockchains, every participant is forced into the same role. Everyone validates everything, regardless of whether they are economically affected by each transaction. This creates a massive inefficiency. Market participants who have no exposure to a particular trade or contract still pay the cost of verifying it. Plasma breaks away from this model by allowing verification effort to be proportional to economic interest. If a participant is not affected by a specific chain or transaction, they do not need to observe it in detail.

This selective verification model aligns closely with how real markets operate. A trader does not monitor every transaction in the global financial system. They monitor the markets and instruments they are exposed to. Plasma applies this logic directly to blockchain infrastructure. Users watch the chains that hold their funds or affect their positions. Everything else can be abstracted away unless it becomes relevant.

This approach dramatically reduces the cost of participation. Instead of requiring global consensus on every state update, Plasma allows local consensus within individual chains. These chains operate independently under shared enforcement rules defined at the root level. The root blockchain does not care about the internal details of each Plasma chain during normal operation. It only requires that valid commitments are submitted and that rules can be enforced if challenged.

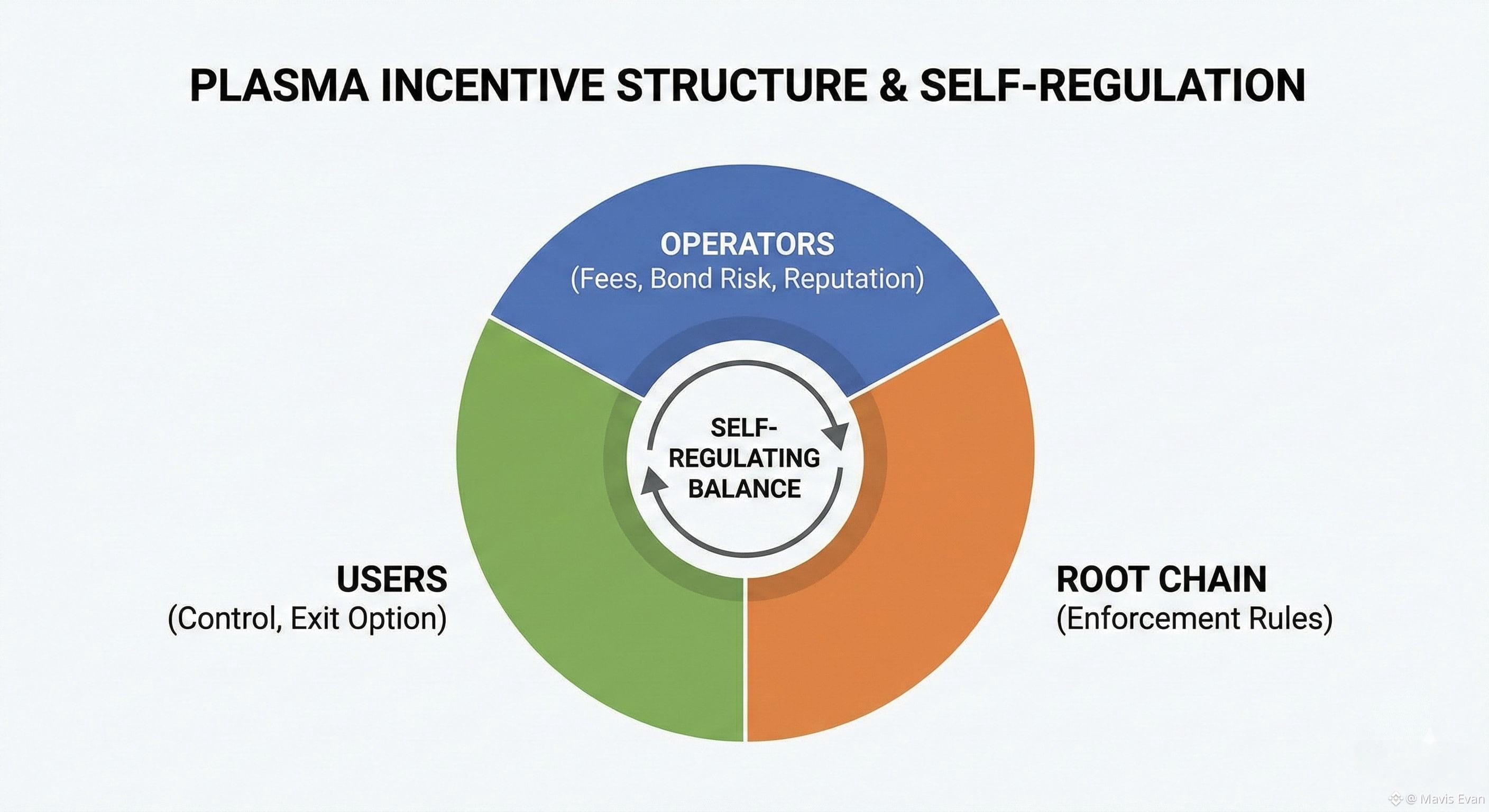

The economic incentives embedded in Plasma are what make this possible. Operators earn fees by processing transactions and maintaining availability. Validators or operators who behave dishonestly risk losing bonded assets and future revenue. Users retain control because they can exit if they lose confidence. This triangular balance between operators, users, and the root chain creates a self-regulating environment where rational behavior dominates.

Plasma also acknowledges an uncomfortable truth about decentralized systems. Perfect availability cannot be guaranteed without extreme costs. Instead of pretending otherwise, Plasma designs around this reality. If data becomes unavailable, the system does not collapse silently. It forces a decision. Users either retrieve the data and continue operating, or they exit. This creates a hard economic boundary around unacceptable behavior.

From a trading and liquidity standpoint, this is a powerful design choice. Markets thrive on speed and reliability. Plasma allows fast execution as long as the system behaves normally. The moment abnormal behavior appears, the cost shifts onto the system rather than the users. Operators who cause disruptions face exits, reputational damage, and economic loss. Users are protected by predefined escape routes.

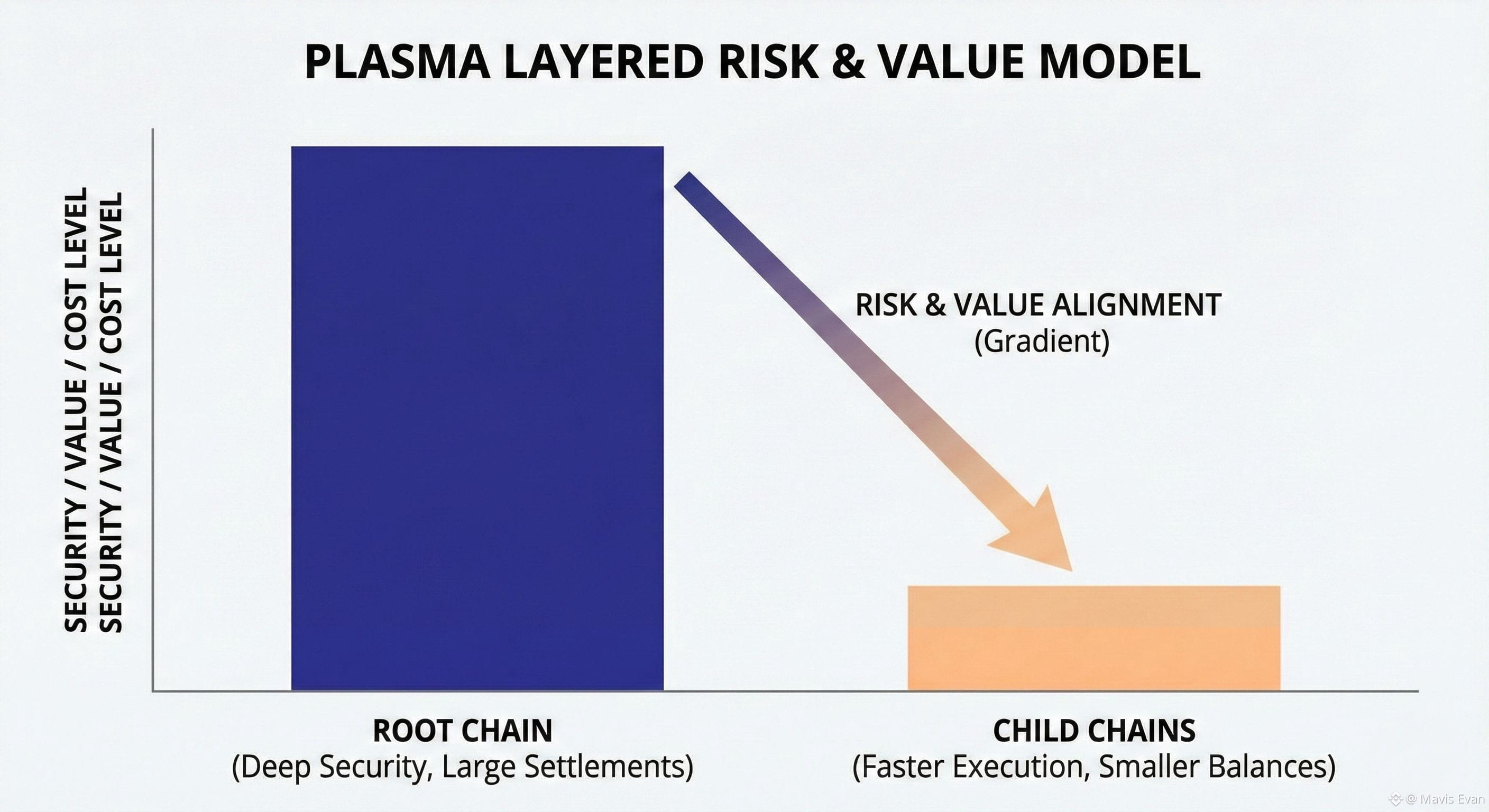

Another key insight in Plasma’s design is that scalability does not require uniform security at every layer. The deepest layer of security exists at the root blockchain. As activity moves further away from the root into child chains, the cost of enforcement decreases, but so does the value typically held at those layers. This creates a natural gradient where small balances and high-frequency activity live deep in the tree, while larger balances remain closer to the root. Risk and value stay aligned.

This layered risk model mirrors traditional financial infrastructure. Retail transactions move quickly with limited oversight, while large settlements pass through slower, more secure channels. Plasma encodes this structure directly into the blockchain architecture, allowing systems to scale organically based on economic behavior rather than artificial constraints.

Plasma’s market-driven design also supports flexibility. Different Plasma chains can implement different rules, fee models, and business logic while still relying on the same root blockchain for enforcement. This allows experimentation without fragmenting security. Successful designs attract liquidity and users. Poor designs fade without compromising the broader system.

By treating scalability as a coordination problem rather than a raw performance issue, Plasma avoids many of the tradeoffs that plague other scaling approaches. It does not force users to choose between speed and security. Instead, it lets them choose how much security they need based on how they participate. This adaptive model is what gives Plasma its long-term relevance in complex, evolving markets.

At its core, Plasma is not trying to make blockchains faster in isolation. It is trying to make decentralized markets function efficiently at scale. By aligning incentives, enforcement, and participation with economic reality, Plasma creates an environment where growth does not automatically erode trust. That balance is what transforms Plasma from a technical proposal into a market-ready framework.