Traders, buckle up! The financial rollercoaster starts early and doesn’t let up — today is stacked with market-moving events that could send shockwaves across global assets. ⚡🌍

🕣 8:30 AM — JOBLESS CLAIMS + U.S. GDP 📉💼

Expect fireworks as the latest employment data and GDP numbers hit the screens. Markets will react instantly to growth and labor signals.

🕘 9:00 AM — FED $6.9B LIQUIDITY BOOST 💵🏦

The Fed injects billions into the system — a liquidity jolt that could send stocks soaring or bonds reeling. Keep your eyes glued to the tickers.

🕙 10:00 AM — PCE INFLATION INDEX 🔥💰

The core inflation gauge that the Fed watches closely. Any surprises could trigger massive volatility in USD, treasuries, and equities.

🕟 4:30 PM — FED BALANCE SHEET DROP 📉💣

Watch for a sharp adjustment in Fed holdings — a subtle move here can ripple through credit markets and borrowing costs.

🕡 6:30 PM — JAPAN CPI DATA 🇯🇵💹

Global traders pivot to Tokyo as Japan releases consumer price data, revealing inflation pressures in Asia’s second-largest economy.

🕙 10:00 PM — JAPAN RATE CALL ⚖️🔥

The Bank of Japan could shock markets with policy signals — impacting yen, equities, and international capital flows.

🌍💥 Bottom Line: Today is a high-voltage economic marathon. Every headline could ignite spikes, crashes, and volatility storms across the globe. Traders: strap in, stay alert, and expect fireworks! 🚀⚡📈

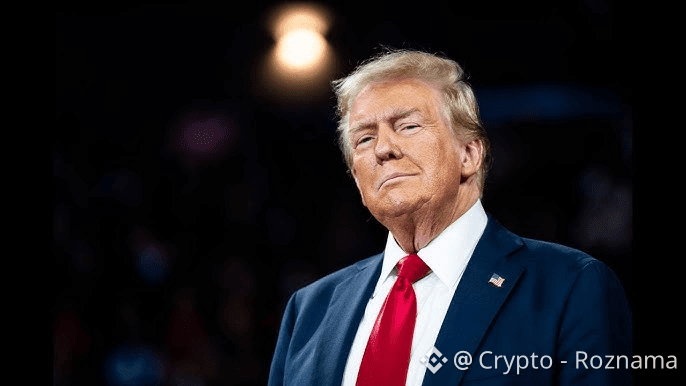

#TrumpCancelsEUTariffThreat #WhoIsNextFedChair #MarketRebound #trump