The Scalability Problem in Regulated Trading

Let’s be real—most blockchains try to do everything at once. They process transactions, keep everyone’s data secure, and execute smart contracts, all on a single layer. That’s fine for small stuff, but when trading gets serious, it all slows down. Suddenly, you’re fighting against network congestion and gas fees that shoot through the roof.

Now, add compliance to the mix. For things like Real World Assets (RWAs), every trade needs a regulatory check. Usually, that just piles on more delays. Dusk saw this coming and broke the process into specialized parts to make things work smoothly.

1. Why Modularity Matters

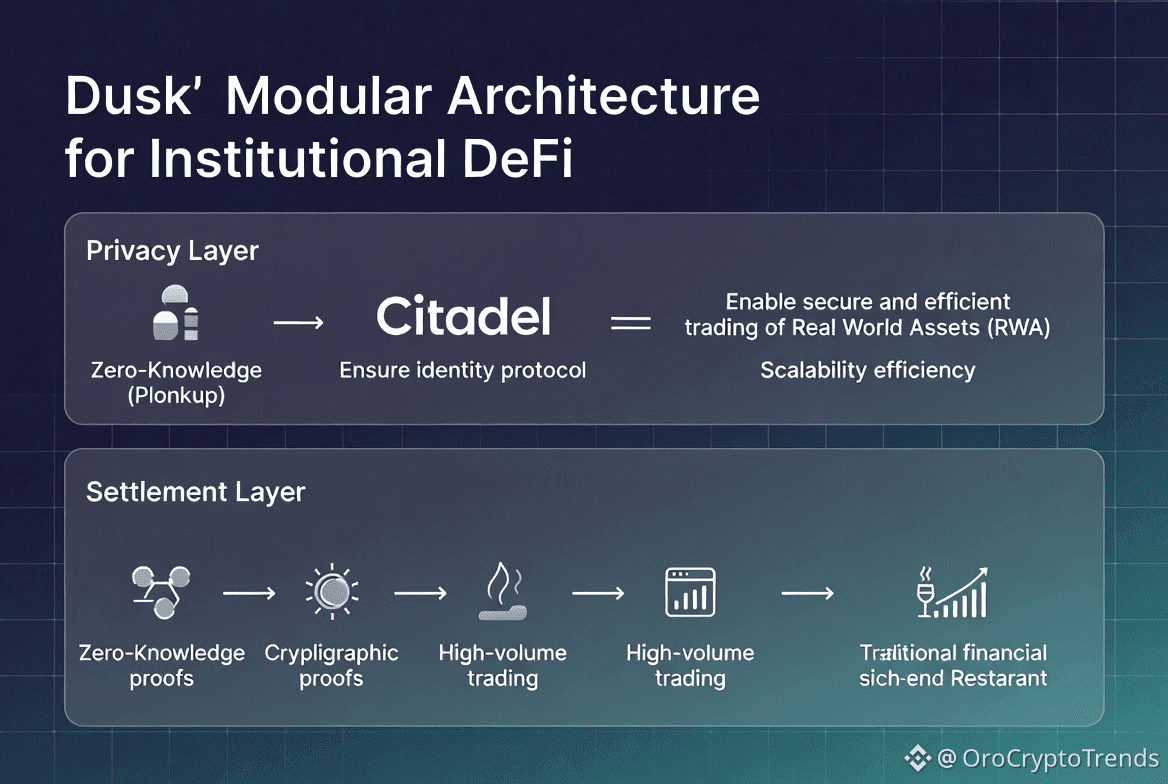

Dusk doesn’t make every node handle every detail. Instead, it splits work between layers—a Privacy Layer and a Settlement Layer. They run side by side, but handle their own business.

Picture a high-end restaurant. In a monolithic setup, one chef takes your order, cooks your meal, serves it, and then washes up. Slow and chaotic. Dusk’s way? Each person has a job. Orders move fast, and the quality stays high.

2. Zero-Knowledge Proofs: The Secret Sauce

Dusk’s speed comes from Plonkup, its own Zero-Knowledge proof system. Usually, privacy features slow things down, but not here. With Dusk, traders can prove they’re allowed to trade—KYC, AML, all that—without showing off their entire balance or strategy to the world.

These proofs are tiny, too, so they barely take up space on the blockchain. That means more trades can fit into each block—exactly what professional traders need.

3. Citadel: The Identity Layer

Verifying who’s who is a huge time sink in high-volume trading. Dusk fixes that with Citadel, its modular identity protocol.

Instead of checking a trader’s ID every single time, Citadel handles it once and creates a cryptographic proof. You use that same proof across all trades and platforms inside Dusk. For high-frequency traders, this cuts out repeat compliance checks and lets trades fly through.

4. Built for Regulated Assets

Speed is just one part of the story. What you’re trading matters, too. Dusk’s architecture is made for Regulated Assets. With its Confidential Security Contract (XSC) standard, the whole stack keeps up with millions of dollars moving in seconds—and every transaction follows the issuer’s rules automatically.

Bottom Line

Dusk isn’t just another blockchain. It’s financial infrastructure built for real market demands. Because it’s modular, Dusk hits the sweet spot: privacy, decentralization, and real scalability. As the world moves to tokenized assets, networks that can handle big volumes and strict compliance will set the pace.

FAQ

Why is modularity better than monolithic design?

Simple—modularity lets each part of the network do what it does best. So when trades spike, things don’t grind to a halt. It’s way more efficient for pro traders.

Does Dusk’s privacy slow things down?

Nope. Thanks to Plonkup, Dusk can run private transactions fast. The proofs are lightweight, so privacy doesn’t cost you any speed.

Is Dusk just for institutions?

Not at all. Sure, it’s built for big players, but anyone can use it. Retail traders get the same high speed, low fees, and privacy.

Final Thought

Finance isn’t just about moving money—it's about moving data, fast and secure. If you’re tracking the RWA space, pay close attention to the infrastructure. Modular networks like Dusk are about to show how you go from a testnet to real, global liquidity.

Want to dig deeper? Check out the difference between execution layers and settlement layers. That’s where the next DeFi wave will break.

Disclaimer: This isn’t financial advice. It’s for education only.