Institutional optimism for Ethereum is returning strongly as Wall Street most influential figures simultaneously name ETH for this year growth cycle.

🔸 Speaking at latest shareholder meeting, Tom Lee stated that Ethereum is at the center of a new wave of financial infrastructure innovation. 2026 is forecast to be the pivotal moment for the network comprehensive explosion.

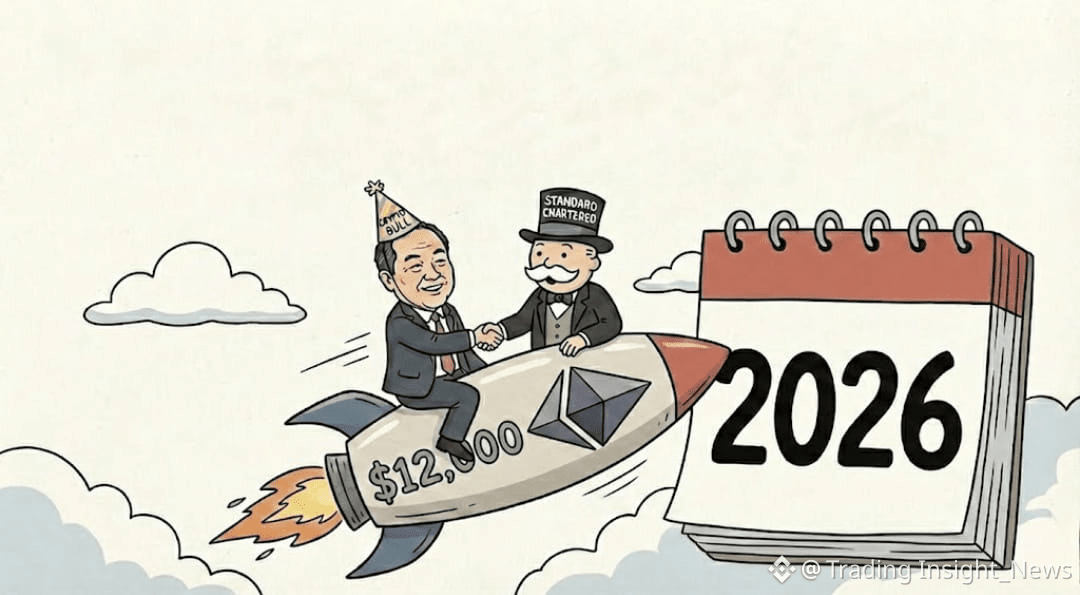

🔸 Both Tom Lee and Standard Chartered Bank share a common vision 2026 is the Year of Ethereum. Driven by the RWA Tokenization trend and institutional adoption, the ETH/BTC ratio is likely to revisit its 2021 highs, with ETH price potentially hitting $12,000.

🔸 Tom Lee also highlighted the financial correlation If ETH hits $12,000, his company is stock could theoretically reach $500, directly benefiting the company is business model.

With Wall Street whales starting to place big bets on an ETH/BTC resurgence, is smart money quietly rotating from Bitcoin to Ethereum to catch the RWA wave?

News is for reference, not investment advice. Please read carefully before making a decision.