STON.fi and Omniston: the quiet financial layer forming around $TON

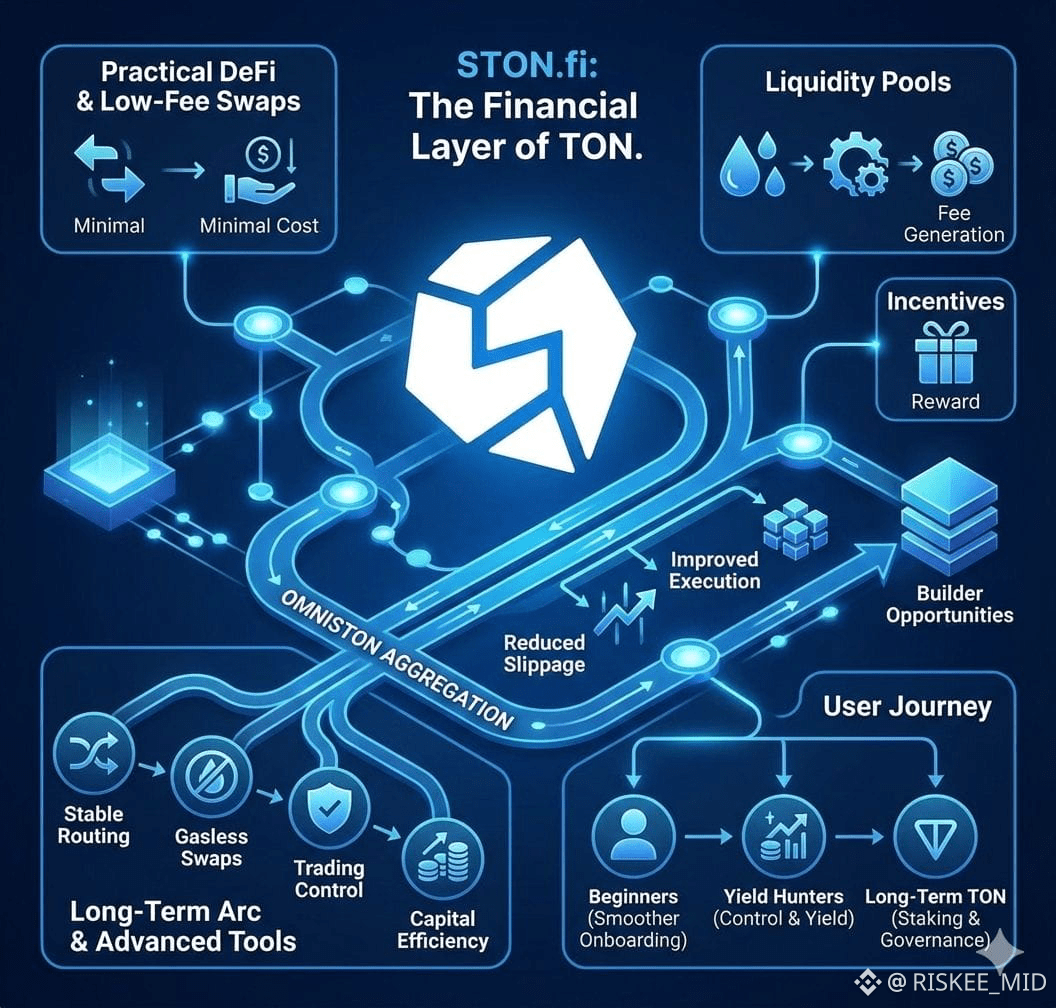

The TON ecosystem has moved fast from experiments to real, usable DeFi — and STON.fi is a big reason why. What used to feel like scattered exchanges and toy products now reads like a layered financial stack: low-friction swaps, composable liquidity, and an aggregation layer (Omniston) that ties everything together so trades and strategies actually work in the wild. Below I’ll explain what’s happening, why it matters for different users (beginners, builders, yield hunters, long-term TON holders), and the trade-offs to watch.

What STON.fi is building (short version)

STON.fi is a TON-native decentralized exchange and DeFi hub that combines AMM pools, staking/farming, and an aggregation layer called Omniston to route and optimize swaps across liquidity sources. The project has public docs, a developer guide for Omniston, and a blog that tracks feature rollouts — Omniston is already powering swaps and has a live widget and integration guides for builders.

Why this feels “practical” instead of theoretical

Low-fee, fast swaps that lower the entry barrier.

TON’s low transaction cost environment plus STON.fi’s UX make simple token swaps cheap and easy. That reduces friction for newcomers and encourages experimentation without big fee risk. (See STON.fi’s app/docs for pool and fee info.)Liquidity that actually gets used (not just parked).

Liquidity pools on STON.fi are designed to be composable: LPs earn fees, farming programs and impermanent-loss protection help bootstrap depth, and pools can be created with different modes (v1/v2) to suit different token types. That means capital sitting in pools can be productive rather than idle.Aggregation — Omniston tightens the loop.

Omniston aggregates liquidity from multiple DEXes and RFQ resolvers, running automated routing to find the best execution and reduce slippage for larger trades. That’s critical: a single DEX is limited by its own pools; aggregation lets traders access the best price across the ecosystem, and lets builders build on top of unified liquidity rather than fragment it. Omniston is documented for devs and already powering swaps.Builder-focused primitives and integration paths.

Omniston provides a widget and SDK/quickstart guides so wallets, dashboards, games or other apps can embed optimized swap flows with minimal code. That product-first developer experience accelerates composability: third-party products don’t need to recreate routing logic, they can plug into existing aggregated liquidity.

Features pointing to higher volume and better capital efficiency

STON.fi and Omniston roadmap items you’ll see in practice (and that matter economically):

Stable-focused routing — better pricing for stable-to-stable trades reduces slippage and keeps stable liquidity productive.

Gasless or gas-minimising UX — removing the wallet-fee friction for simple user flows is huge for onboarding. STON.fi docs and community write-ups discuss gas-minimizing UX patterns.

Cross-DEX RFQ/resolver support — letting external liquidity providers or RFQ services compete improves price discovery for irregular or large trades. Omniston’s docs describe the RFQ integration approach.

These features together push the network toward higher throughput use cases (trading, yield strategies, and product integrations) because trades execute with less slippage and incentives can be targeted to deepen the right pools.

Who benefits and how

Beginners: simpler, cheaper swaps + better price execution mean less chance of “bad” trades or sticker shock from fees. Onboarding becomes smoother when a single click gives near-best-market pricing.

Yield hunters / LPs: more routing options and deeper aggregated liquidity reduce volatility of returns for some strategies; farming and impermanent-loss programs provide additional yield overlays. But yield-seekers should still evaluate pool composition and TVL.

Builders: Omniston’s widget, SDKs and docs remove heavy lifting for swap UX and routing — you can embed a strong swap experience without building aggregators yourself. That accelerates new products (wallets, games, dashboards) and keeps liquidity concentrated and efficient.

Long-term TON participants: staking, governance, and features like stTON (liquid staking variants) keep on-chain activity aligned with network economics — usage feeds governance influence and vice versa.

Risks & what to watch for

Practical DeFi is still DeFi. A few straightforward risks to keep in mind:

Smart-contract risk. Aggregators and DEX contracts matter: Omniston’s escrow contracts were audited, which is reassuring, but audits reduce — not eliminate — risk. Always check audit reports and keep exposure reasonable.

Impermanent loss & market risk. LP incentives and IL-protection programs help, but they don’t remove market risk. Understand the pair composition and the time horizon for your capital.

Concentration risk. Aggregation improves price efficiency, but over-concentration of liquidity in a single protocol can create systemic risk if something goes wrong. Diversify and monitor TVL/volume metrics.

Quick practical tips

If you’re swapping: compare routes and take advantage of Omniston’s aggregated quotes — you’ll usually get better execution than single-DEX swaps.

If you’re providing liquidity: read pool docs (v1 vs v2), check APR/TVL, and consider programs that reduce impermanent loss.

If you’re a builder: try the Omniston widget or quickstart guide to add swaps to your app without building routing logic.

Conclusion

STON.fi + Omniston is an example of DeFi maturing from a set of isolated features into a practical financial layer: cheap, composable swaps; aggregated liquidity for better execution; and integration tooling that keeps builders and users inside a cohesive stack. For TON, that means the ecosystem moves from experimentation to routine financial activity — which, if managed carefully, is exactly what a thriving blockchain economy needs.