In the evolving blockchain landscape, one critical problem remains unresolved:

How do we combine privacy, regulatory compliance, and decentralization—without sacrificing any of them?

Most public blockchains were designed for open participation and transparency. While this works well for permissionless finance, it becomes a structural limitation for institutions, regulated markets, and digital securities.

This is exactly where Dusk Network stands apart.

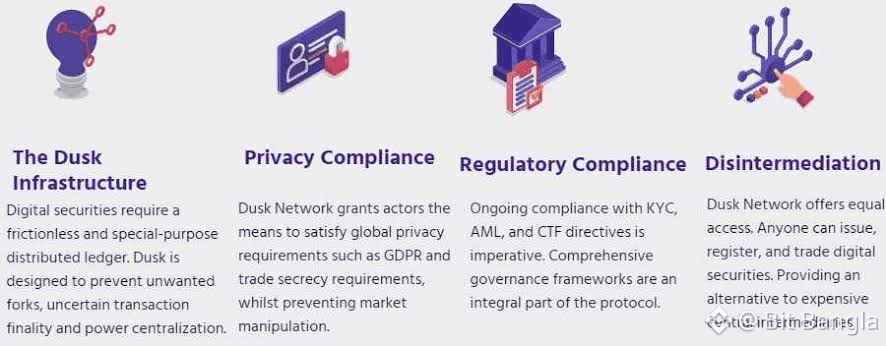

Rather than retrofitting compliance and privacy later, Dusk is purpose-built from the ground up to serve regulated financial use cases. The image above captures Dusk’s philosophy through four foundational pillars that define its long-term relevance.

1. The Dusk Infrastructure — A Purpose-Built Layer-1

Digital securities are fundamentally different from speculative tokens.

They require:

✔️ Deterministic transaction finality

✔️ Resistance to unwanted forks

✔️ Predictable governance

✔️ Decentralization without validator power concentration

Dusk Network is designed as a special-purpose Layer-1 blockchain optimized for financial markets. Its infrastructure minimizes uncertainty and instability, making it suitable for environments where capital, compliance, and trust matter.

This is not a general-purpose experiment.

This is financial-grade blockchain infrastructure.

2. Privacy Compliance — Confidentiality Without Compromise

On most public blockchains, transparency is absolute.

Every transaction, balance, and interaction is publicly visible.

For institutions, this creates severe challenges:

🔘 Violations of GDPR and data protection laws

🔘 Exposure of trade secrets

🔘 Increased risk of market manipulation

Dusk Network introduces Confidential Security Contracts (XSC) to solve this.

With XSC:

◽ Sensitive financial data remains private

◽ Compliance requirements are still verifiable

◽ Privacy is enforced at the protocol level

Here, privacy is not a loophole—it is a regulated feature.

Dusk proves that privacy and compliance are not opposites, but complementary pillars of modern finance.

3. Regulatory Compliance — Built In, Not Added Later

Many blockchain projects promise to “adapt” once regulation arrives.

Dusk assumes regulation from day one.

The protocol is designed to support:

🔘 Continuous KYC, AML, and CTF compliance

🔘 Integrated governance frameworks

🔘 Audit-ready financial operations

This makes Dusk uniquely positioned for Regulated DeFi (RegDeFi)—a sector where institutions can participate without legal uncertainty.

Compliance on Dusk is not external infrastructure.

It is native to the protocol itself.

4. Disintermediation — Equal Access to Financial Markets

Traditional finance relies heavily on intermediaries:

▫️ Issuance is expensive

▫️ Settlement is slow

▫️ Access is permissioned

Dusk Network changes this dynamic by enabling:

◽ Permissionless issuance of digital securities

◽ Open registration and trading

◽ Reduced dependency on centralized intermediaries

This is not just decentralization for ideology’s sake.

It is financial democratization through cryptographic guarantees.

Final Perspective

Dusk Network is not designed for hype cycles or short-term speculation.

It is built for:

🔘 Tokenized assets

🔘 Institutional participation

🔘 Regulated financial markets

🔘 Long-term sustainability

If the future of finance is private, compliant, decentralized, and global,

then Dusk Network is not merely relevant—

It is inevitable.

💬 What’s your take?

As institutions move toward tokenization and regulated DeFi, where do you see Dusk Network positioning itself in the next few years?

“Privacy + Compliance will define the next era of finance. Dusk Network is already there.”