Most traders only notice storage when it breaks.

A chart won’t load during a volatile hour. A project’s “official” dashboard suddenly shows blank history. A dataset that powered a strategy disappears because the hosting bill wasn’t paid or the team changed providers. None of that feels like a blockchain problem at first, but it is. Because markets don’t run only on transactions. They run on information, and information needs somewhere reliable to live.

This is the exact gap Walrus is trying to close inside the Sui ecosystem. Not by making storage a side utility, but by treating data itself like a first-class asset: programmable, verifiable, retrievable, and economically secured.

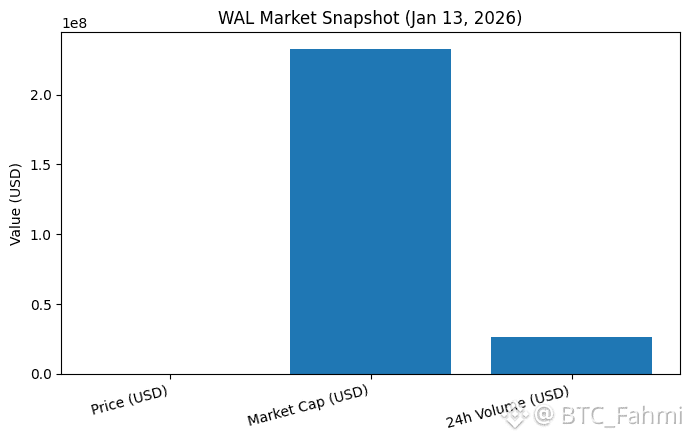

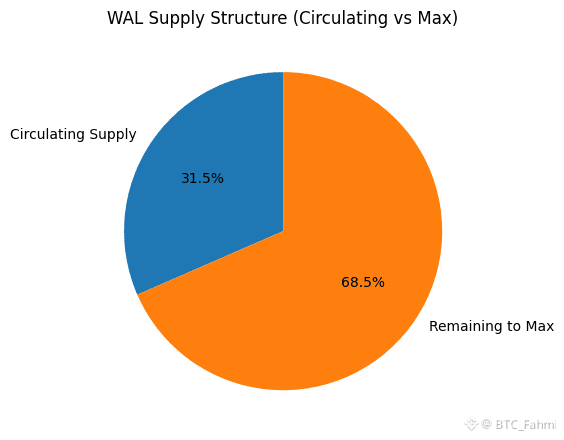

At the time of writing today, WAL trades around $0.15 with roughly $26M in 24-hour volume and about a $233M market cap, with ~1.577B WAL circulating and 5B max supply. That tells you something practical as an investor: people are already trading it with meaningful liquidity, but it’s still early enough in market structure terms that narratives can shift quickly.

But price isn’t the core story. Storage is.

Most blockchains are built to store state, not files. They can safely store “who owns what” and “what happened when,” but trying to store real content directly on-chain becomes expensive and slow. So crypto projects usually take the shortcut: store metadata on-chain, store the real content in Web2 storage, and hope the link never breaks. That works… until it doesn’t.

Walrus approaches the problem differently. It’s designed as a decentralized storage protocol built closely with the Sui ecosystem and aimed at storing large unstructured data blobs with reliability and fault tolerance, while enabling programmability around stored content. Sui’s own ecosystem documentation describes Walrus as content-addressable storage, meaning data is retrieved using an identifier derived from the content itself, not from a location like a server path.

That sounds technical, but here is the trader version: the storage object becomes harder to fake, harder to censor, and easier to verify. If the data changes, its identity changes. That’s exactly what you want when your edge depends on the integrity of information.

A real-life example makes this clearer.

Imagine you’re in a small trading group that tracks newly launched tokens. Your group buys access to a “whale watch” dataset, plus a custom heatmap that flags abnormal inflows to exchanges. For months, it works. Then one day, during high volatility, the dataset fails to refresh. You later find out the provider stored archives on a centralized bucket and quietly restructured the backend. The data isn’t “wrong,” it’s just missing, and your strategy collapses for that session.

This is not a hypothetical. It’s a common infrastructure failure mode in crypto. Traders rarely call it storage risk, but that’s what it is.

Walrus’s promise is that apps on Sui don’t have to depend on fragile Web2 storage for critical content. If a dApp’s user-generated trading signals, backtests, or AI model outputs are stored in a decentralized way, the app becomes less breakable during stress. That alone is a meaningful shift, because most losses in crypto do not come from being “wrong.” They come from execution friction, missing information, or broken tooling when timing matters most.

There’s another angle that investors tend to underestimate: programmable storage changes what can be monetized.

Data is not only something you store. It’s something you trade around. The Walrus positioning is explicitly about enabling “data markets,” where stored data becomes reliable and governable. In plain terms, that means you can build systems where access, usage rights, deletion rights, and content lifecycle rules are enforceable in a crypto-native way, not via terms of service and trust.

For investors, this opens a very specific long-term question: if Sui continues attracting consumer apps, games, social platforms, AI-integrated dApps, and trading tools, where does all that content live? And who earns yield or fees from keeping it available?

That’s where the token mechanics matter, without turning into hype.

Walrus launched mainnet in 2025, and the public messaging emphasized “programmable storage” for developers and Sui ecosystem integration. Storage networks typically need economic incentives because availability is not free. Nodes need to be paid, and users need predictable pricing. WAL sits in the middle of that coordination problem: aligning storage providers, users, and applications.

From a trader’s perspective, WAL’s market behavior will likely stay tied to three things.

First, ecosystem adoption. Not partnerships on paper, but actual apps using Walrus by default. The quickest signal here is not “announcements.” It’s usage patterns: storage costs, retrieval frequency, developer tooling integration, and whether major Sui apps choose Walrus over alternatives.

Second, reliability reputation. Storage is brutally unforgiving. A chain can recover from a temporary performance issue. A storage protocol that loses data credibility is permanently damaged. For long-term holders, this is the real due diligence area: reading technical docs, watching incident history, and tracking node decentralization over time.

Third, the broader market trend that’s quietly building behind the scenes: AI + crypto data pipelines. Walrus leans directly into that, presenting itself as infrastructure for the “AI era” data economy. If that theme strengthens across the industry, storage isn’t a niche anymore. It becomes core.

My honest opinion, as someone looking at this through a trader-investor lens, is that Walrus is less interesting as a token chart and more interesting as a stress-test of whether Web3 can finally stop pretending storage is optional. The strongest blockchains will not be the ones with the loudest throughput numbers. They’ll be the ones where the entire stack holds up when everyone is panicking at once: execution, data, tooling, and access.

If Sui wants to host serious applications that normal people can rely on, Walrus is not a “nice to have.” It’s the missing piece of the infrastructure story.

And in crypto, the unsexy infrastructure layer is often where the most durable value ends up accumulating—slowly, quietly, and only obvious in hindsight.