with Privacy-Preserving Blockchain Technology

The convergence of blockchain technology with regulated financial markets is accelerating globally. Among the most promising innovations is DuskTrade, Dusk Network’s first real-world asset (RWA) application, launched in collaboration with NPEX, a regulated Dutch exchange holding Multilateral Trading Facility (MTF), Broker, and ECSP licenses. This partnership represents a pioneering step in Europe’s first blockchain-powered security exchange, where tokenized securities are issued, traded, and settled on-chain.

A standout feature of DuskTrade is its privacy-preserving yet fully auditable design, exemplified by the use of obfuscated order books. This article explores how DuskTrade could reshape market transparency, institutional risk management, and the issuance of compliant financial instruments, establishing a new paradigm for regulated European financial markets.

1. The Challenge of Transparency in Financial Markets

Financial markets have long struggled with the tension between transparency and confidentiality:

Transparency is required to ensure fair pricing, reduce systemic risk, and satisfy regulatory obligations.

Confidentiality is critical for institutional investors, who rely on secret trading strategies, portfolio compositions, and order flows to maintain competitive advantage.

Traditional exchanges and over-the-counter markets operate on closed systems where confidentiality is protected, but this often comes at the expense of efficiency, settlement speed, and interoperability. On public blockchains, transparency is enforced by default, potentially exposing sensitive trading information to competitors or the broader public.

DuskTrade addresses this problem through cryptographic innovations that provide privacy for institutions while maintaining full regulatory auditability.

---

2. DuskTrade + NPEX: The Foundation of a European Blockchain Security Exchange

The partnership between Dusk and NPEX brings together cutting-edge blockchain technology with regulated exchange infrastructure:

NPEX: Licensed in the Netherlands, providing MTF, Broker, and ECSP licenses.

DuskTrade: DLT-powered platform enabling tokenized securities and compliant on-chain operations.

By combining blockchain technology with a fully regulated exchange, DuskTrade enables:

Issuance of tokenized financial instruments under a single regulatory umbrella.

Trading and settlement in near real-time (seconds instead of days).

Cross-institutional composability, allowing multiple financial organizations to operate on the same ledger with a single source of truth.

This foundation makes DuskTrade uniquely positioned to balance privacy, transparency, and regulatory compliance, bridging traditional finance with decentralized finance (DeFi).

---

3. The Role of Obfuscated Order Books

A key innovation of DuskTrade is the obfuscated order book, powered by Hedger, Dusk’s privacy engine:

3.1 How Obfuscated Order Books Work

Orders are encrypted before submission, hiding details like price, quantity, and trader identity.

Matching algorithms operate on encrypted data, enabling transactions without revealing sensitive information.

Once matched, settlement proofs confirm the validity of trades without exposing full order book details.

This approach contrasts sharply with traditional DEXs, where order books are fully public, making large institutional trades vulnerable to front-running or market manipulation.

---

3.2 Institutional Benefits

1. Confidential Trading

Orders remain private until executed, protecting sensitive strategies.

Reduces risks associated with large block trades or portfolio adjustments.

2. Reduced Market Impact

By keeping intent confidential, obfuscated order books prevent adverse price movements during large trades.

Encourages liquidity provision without fear of revealing positions.

3. Compliance with Regulation

While private to participants, trades remain fully auditable by regulators.

Supports AML/KYC obligations without exposing all trading data publicly.

---

4. Market Transparency Redefined

At first glance, privacy and transparency seem contradictory. However, DuskTrade demonstrates that they can coexist:

Private transaction details ensure institutions can trade confidently.

Auditable proofs allow regulators to verify compliance without seeing sensitive details.

Settlement and reporting data can be shared selectively with authorized parties.

This design redefines market transparency:

Transparency is regulatory-focused, not public.

Market integrity is maintained while preserving institutional confidentiality.

Enables the issuance and trading of tokenized RWAs on a blockchain without compromising privacy.

---

5. Implications for Institutional Risk Management

DuskTrade’s privacy-preserving model introduces several innovations for risk management:

5.1 Real-Time Auditable Settlements

On-chain settlement drastically reduces counterparty risk.

Tokenized securities can settle within seconds, compared to days in traditional markets.

Instant verification of trades reduces operational risk and reconciliation costs.

5.2 Confidential Exposure Management

Institutions can manage large positions privately, reducing the likelihood of market impact.

Obfuscated order books prevent adversarial trading strategies that exploit visible order flows.

Confidential settlement ensures that risk exposure is contained within regulated channels.

5.3 Regulatory-Aligned Risk Oversight

Hedger provides zero-knowledge proofs demonstrating compliance without revealing trade details.

Regulators can verify capital requirements, trading limits, and compliance adherence efficiently.

Streamlined audit trails support risk reporting and compliance transparency simultaneously.

---

6. Issuance of Compliant Financial Instruments

DuskTrade enables tokenized RWAs under full regulatory supervision:

6.1 Single Regulatory Umbrella

DuskTrade leverages NPEX licenses to ensure issuance, trading, and settlement of assets under one regulatory framework.

This simplifies legal compliance, reducing the need for multiple approvals or jurisdictional checks.

6.2 Privacy-Preserving Issuance

Issuers can tokenize assets while keeping investor lists, holdings, and allocations private.

Auditors or regulators can verify issuance correctness via encrypted proofs, ensuring both privacy and compliance.

6.3 Examples of Tokenized Instruments

Tokenized bonds and equities: Traditional instruments can be issued and traded on-chain.

Structured products: Complex financial instruments can be programmed as smart contracts with privacy-preserving settlement.

Alternative assets: Real estate, private equity, and infrastructure projects can be represented as tokens with controlled transparency.

---

7. Operational Advantages Over Traditional Systems

DuskTrade’s privacy-preserving blockchain approach offers several practical benefits:

7.1 Faster Settlements

Settlement times reduce from days to seconds, increasing capital efficiency.

Minimizes counterparty and liquidity risk in institutional trading.

7.2 Cost Reduction

By automating settlement and compliance, operational costs drop significantly.

Fewer intermediaries are needed, including custodians, clearing houses, and brokers.

7.3 Interoperability

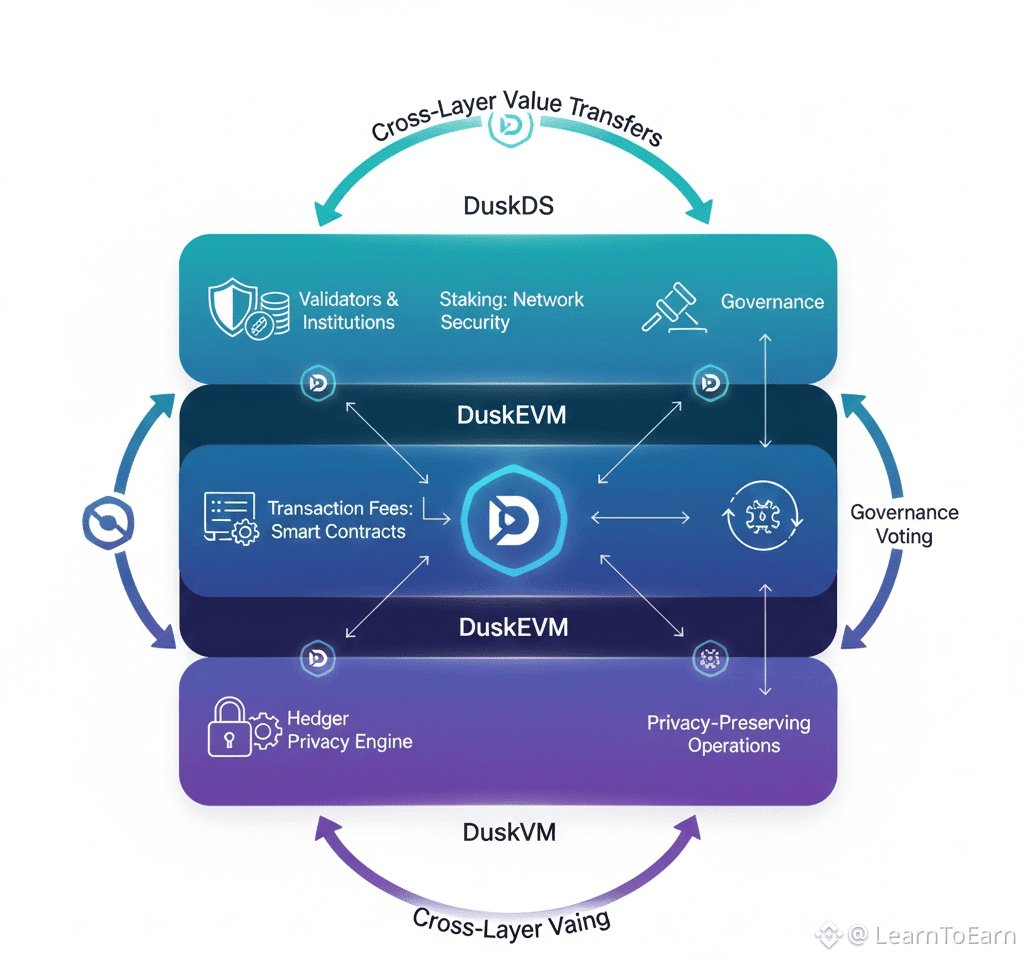

DuskEVM allows smart contracts to interact seamlessly across different applications.

Institutional participants can leverage DeFi composability without leaving the regulated environment.

---

8. Regulatory Implications

DuskTrade’s design sets a precedent for compliant blockchain finance in Europe:

Combines AML/KYC compliance, auditability, and privacy.

Could become a template for future blockchain-powered security exchanges.

Demonstrates that institutional adoption of tokenized assets does not require sacrificing privacy or compliance.

---

9. Potential Challenges and Considerations

While promising, the approach also introduces challenges:

9.1 Complexity of Cryptography

Obfuscated order books and privacy-preserving transactions rely on advanced homomorphic encryption and zero-knowledge proofs.

Institutions must understand and integrate these systems effectively.

9.2 Scalability

Privacy-preserving computations require additional resources.

DuskTrade addresses this with optimized Hedger circuits, but large-scale adoption will require monitoring.

9.3 Regulatory Adaptation

Regulatory bodies need to adapt auditing frameworks to interpret encrypted proofs.

Continuous collaboration between DuskTrade and European regulators is essential.

---

10. Case Study: European Institutional Adoption

Consider a Dutch asset manager issuing tokenized bonds on DuskTrade:

Issuance: Bonds are tokenized, investor allocations are encrypted, regulators verify issuance correctness.

Trading: Orders are placed on obfuscated order books, ensuring confidentiality.

Settlement: Trades settle instantly, with DUSK used for fees and privacy computation.

Audit: Regulators request encrypted proofs to validate compliance without seeing sensitive investor data.

The result: faster, cheaper, more secure, and fully compliant trading with privacy intact—a model previously impossible on traditional or public blockchain systems.

---

11. Long-Term Market Implications

DuskTrade’s design could have profound consequences:

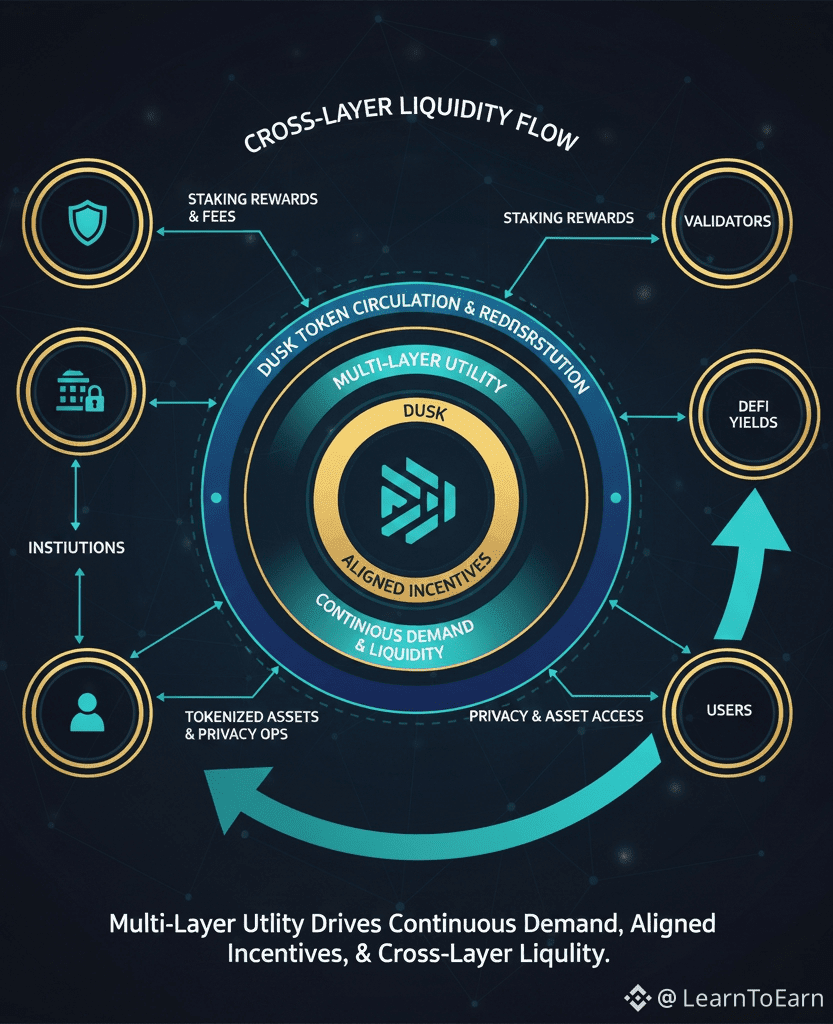

11.1 Market Liquidity

Confidential trading encourages institutional participation, increasing market depth.

Obfuscated order books reduce fear of information leakage, attracting larger trades.

11.2 Risk Reduction

Real-time settlement and auditable privacy reduce counterparty and operational risk.

Encourages more complex financial products to move on-chain.

11.3 Standardization

DuskTrade may serve as a benchmark for regulated blockchain exchanges, influencing European financial infrastructure standards.

11.4 Expansion of Tokenized Assets

The combination of privacy, auditability, and compliance makes tokenization of real-world assets scalable.

Could accelerate adoption of tokenized ETFs, private equity, real estate, and other financial instruments.

---

12. Why DuskTrade is Unique

Key differentiators of DuskTrade include:

Institutional-grade privacy with Hedger-enabled obfuscated order books.

Full regulatory compliance under NPEX licenses.

Native on-chain settlement, reducing counterparty and operational risk.

Cross-layer utility of DUSK for privacy computation, governance, and transaction fees.

Composable DeFi and RWA ecosystem compatible with regulated financial infrastructure.

Unlike traditional exchanges or public DEXs, DuskTrade merges confidentiality, transparency, and regulatory oversight in a single platform.

---

13. Future Outlook

The combination of blockchain, tokenized assets, and privacy-preserving infrastructure could redefine European capital markets:

Regulators gain full auditability without exposing sensitive data.

Institutions can confidently trade tokenized assets, preserving competitive advantage.

Investors benefit from efficient, transparent, and compliant markets.

DuskTrade could become a model for global regulated blockchain exchanges.

---

14. Conclusion

DuskTrade, in collaboration with NPEX, is more than a blockchain platform—it is a revolution in how regulated markets operate:

Obfuscated order books enable confidential trading for institutions.

Privacy-preserving, auditable design reconciles the tension between confidentiality and regulatory oversight.

Tokenized real-world assets can now be issued, traded, and settled on-chain with efficiency, compliance, and confidentiality.

DUSK token integrates across layers to fuel transactions, privacy computation, and governance, ensuring aligned incentives and liquidity.

As Europe leads the way in regulated blockchain finance, DuskTrade sets a precedent for privacy-conscious, fully auditable, and institutionally adoptable tokenized markets.

In doing so, it demonstrates that privacy and transparency are not mutually exclusive—they are complementary elements for a new era of financial infrastructure.