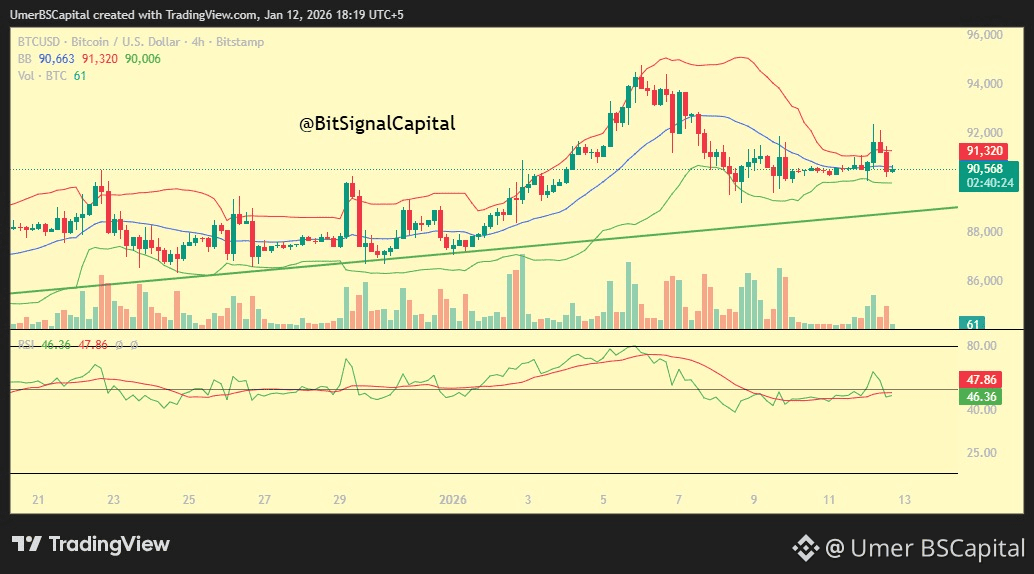

Bitcoin (BTCUSDT) on the 4-hour timeframe is currently trading inside a tight consolidation range after completing a strong impulsive rally followed by a healthy correction. This structure typically appears before a high-volatility expansion.

🔍 Market Structure Overview

Previous impulse: ~88,000 → ~95,000

Corrective move: ~95,000 → ~90,000

Current price is ranging between 90,200 support and 92,500 resistance

This price behavior suggests the market is in a decision zone, where neither buyers nor sellers have full control.

📊 Indicator Insights

RSI (14): Neutral around 49–50

No overbought or oversold conditions

Momentum is paused, not reversed

Bollinger Bands: Contracting (volatility squeeze)

Compression often precedes a strong directional breakout

📈 Bullish Scenario (Confirmation Required)

4H candle close above 92,500

RSI reclaim above 55

Upside Targets:

93,800 → 95,000 → 96,200

📉 Bearish Scenario (Risk Scenario)

4H candle close below 90,200

RSI breakdown below 45

Downside Targets:

88,800 → 87,200 → 85,500

🧠 Trading Insight

Until a confirmed breakout occurs, this remains a range-bound market. Over-trading inside consolidation increases risk. Patience and confirmation are critical.

Disclaimer: This analysis is for educational purposes only. No guaranteed outcomes. Always manage risk responsibly.