In traditional securities markets, ownership and transfer are not merely financial concepts they are governance constructs. The issuer does not disappear once the instrument is sold. The issuer defines who may hold the security, under what conditions rights accrue, how corporate actions are processed, how information rights are distributed, and under which jurisdictions obligations are enforceable. This is why modern capital markets place issuers at the center of the infrastructure stack, not at the edge.

In traditional securities markets, ownership and transfer are not merely financial concepts they are governance constructs. The issuer does not disappear once the instrument is sold. The issuer defines who may hold the security, under what conditions rights accrue, how corporate actions are processed, how information rights are distributed, and under which jurisdictions obligations are enforceable. This is why modern capital markets place issuers at the center of the infrastructure stack, not at the edge.

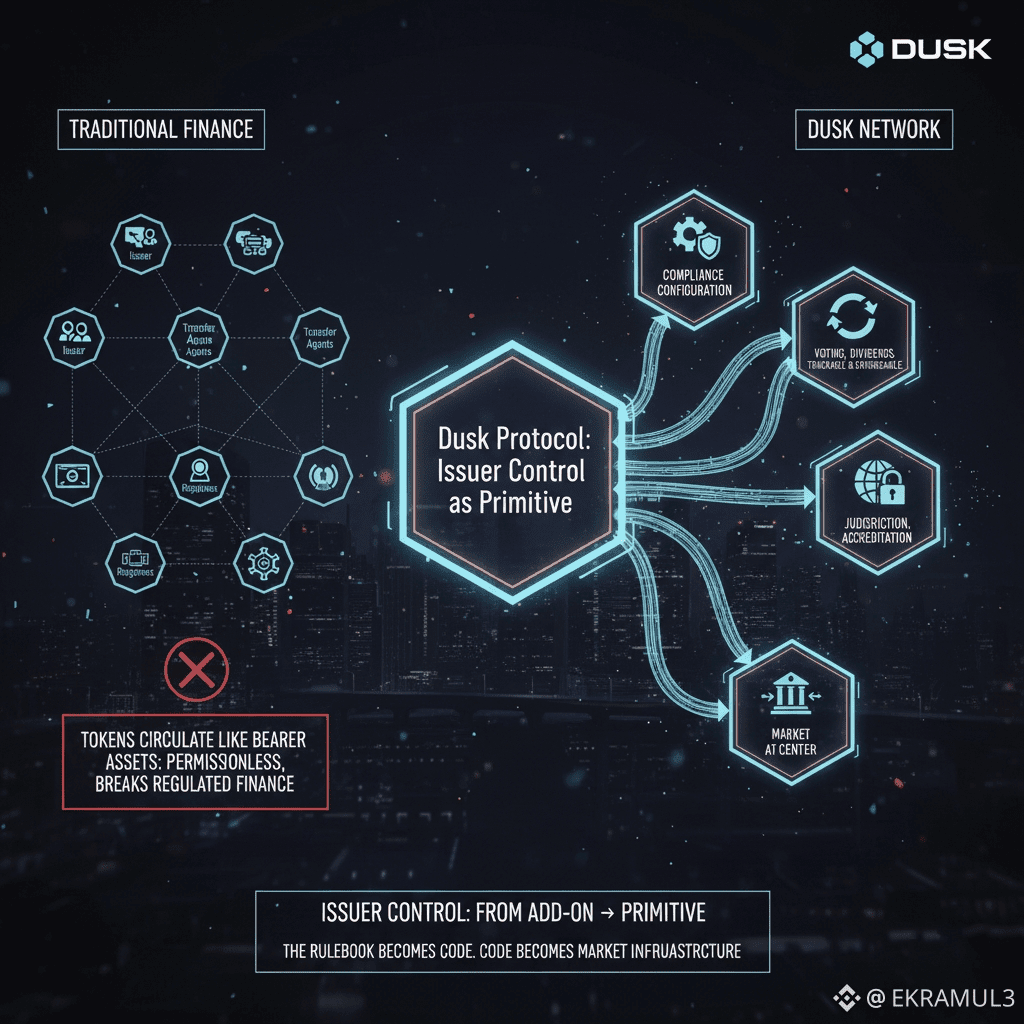

Blockchains inverted this logic. Once a token is minted, the issuer loses control. Tokens circulate like bearer assets freely transferable, permissionless, jurisdiction-agnostic, and governance-neutral. This is useful for commodities, currencies, and speculative assets, but it breaks regulated finance. Securities cannot behave like bearer instruments because legal identity, lifecycle continuity, and compliance are inseparable from issuer authority. If the issuer cannot enforce constraints, the security loses its regulatory definition.

Dusk restores issuer control not as an add-on, but as a primitive a foundational layer from which market behavior emerges. On Dusk, the issuer defines the compliance configuration, transfer constraints, eligibility requirements, reporting triggers, and lifecycle attributes. These definitions do not sit around the market as legal paperwork; they sit inside the market as executable protocol logic. The network does not ask intermediaries to interpret the issuer’s rulebook it enforces it as the settlement mechanism.

This architectural choice changes the market hierarchy. In crypto, market infrastructure is defined by trading venues. In securities, infrastructure is defined by issuers. Broker-dealers, custodians, and CSDs do not exercise authority because they are endpoints; they exercise authority because they enforce issuer-defined constraints. Dusk allows these constraints to exist without the intermediaries themselves, shifting enforcement from organizational bureaucracy to protocol execution.

Issuer control also determines lifecycle continuity. Securities are not finished at issuance; they evolve. Dividends, coupon payments, redemptions, tender offers, conversions, splits, votes, and disclosures all require that the issuer knows who the holders are and under what eligibility conditions they participate. A blockchain without issuer control can mint securities but cannot support their lifecycle. Tokenization pilots failed for exactly this reason: they achieved representation but not continuity. Dusk solves continuity by making ownership and eligibility trackable and enforceable across secondary trading.

Control over eligibility also determines market composition. Institutional markets are not open to everyone; they are segmented by jurisdiction, accreditation, and regulatory constraints. Without issuer control, segmentation becomes impossible. Markets collapse into undifferentiated pools, which are incompatible with securities regulation. Dusk’s architecture allows the issuer to define segmentation rules upfront and lets the network enforce them continuously. This is not a UI feature it is market infrastructure.

Finally, issuer control enables market determinism. In regulated markets, the outcome of a transfer must be knowable: either it settles or it doesn’t, and the conditions governing that outcome are not negotiable. When constraints are left to off-chain agents, determinism is replaced by interpretation. When constraints are executed at the protocol layer, interpretation is replaced by computation. Markets built on computation are significantly more scalable than markets built on case-by-case legal interpretation.

The deeper insight is that tokenization did not fail because blockchains lacked issuance; it failed because blockchains lacked issuer control. Without issuer control, securities become orphaned artifacts compliant at minting and non-compliant in circulation. Dusk treats issuer control as a primitive because securities cannot exist without it. When issuer authority becomes part of the infrastructure, tokenized markets cease to be experiments and begin to resemble capital markets.