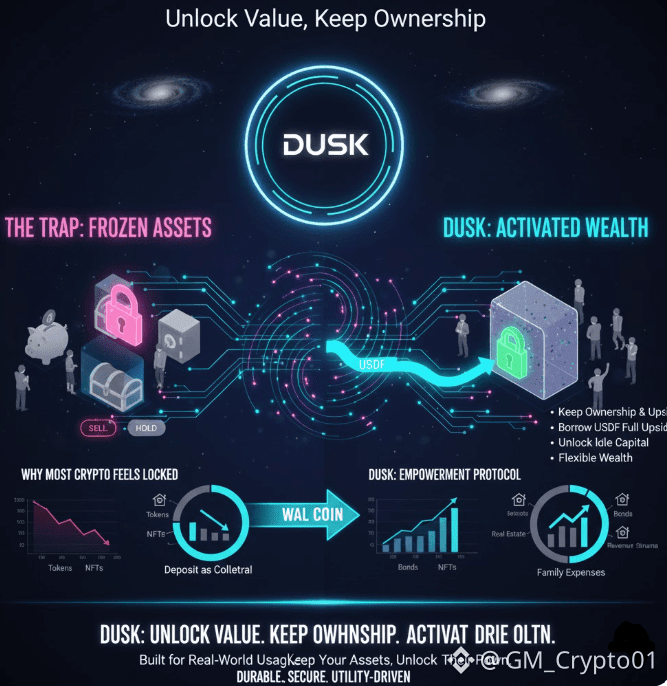

Owning crypto can feel impressive on paper. Wallets show balances, charts fluctuate, and your portfolio looks big. But most of the time, that wealth is frozen. You can see it, track it, or brag about it, but you can’t do much with it without selling. That’s the problem DUSK is solving.

Why Most Crypto Feels Locked

Anyone who has held crypto knows this feeling. You invest in a project because you believe in it. You hold for the long term. Then life happens. Opportunities come up, unexpected costs appear, or markets shift. Suddenly, you’re stuck deciding: do I sell and risk losing future gains, or do I hold and miss out on what I need now?

It’s a constant tension that makes ownership stressful rather than empowering.

How DUSK Changes the Game

DUSK offers a simple idea: your assets should work for you, not against you.

Instead of selling tokens to get cash, you can lock them in DUSK as collateral and receive USDf in return. Your original holdings stay yours. They can rise, fall, or move with the market, while you gain real liquidity you can actually use. For many people, this is the first time ownership feels practical instead of frozen

Real Benefits You Can Feel

Here’s what this actually means in everyday life:

Traders can seize opportunities without dismantling long-term positions.

Investors can access cash for real needs without breaking patience.

Builders and governance participants can support new projects without undoing previous commitments.

Assets start to behave like tools, not fragile objects you’re afraid to touch.

Risk Is Built In

Of course, people worry about risk. DUSK isn’t magic, and it doesn’t ignore volatility. The protocol uses overcollateralization, meaning you always lock more value than you borrow. Positions are visible, rules are clear, and liquidations are automated. It replaces panic-driven choices with structure, so users can act confidently.

Unlocking Tokenized Real-World Assets

Crypto isn’t just about digital coins anymore. Real world assets are moving on-chain: property shares, bonds, revenue streams, commodities, even intellectual property. These tokens are valuable, but without the right infrastructure, they are frozen. DUSK turns them into active capital.

Suddenly, what was static can now circulate, fund projects, and generate opportunities all without selling the underlying asset.

Quiet Growth, Not Hype

The DUSK ecosystem is developing quietly but steadily. Collateral management is improving. Stress testing and transparency tools are getting stronger. Integration with tokenized real-world assets is expanding.

The conversation is shifting from speculation to practical design. People are no longer asking “What is DUSK?” but “How can DUSK fit into a future financial system where traditional and digital finance work together?” That is maturity, not marketing noise.

Why DUSK Matters

DUSK solves a problem almost every crypto holder faces: the conflict between holding and acting. You no longer have to sacrifice belief for liquidity. Assets can become working tools. Ownership becomes functional instead of fragile.

The Promise Is Simple

Hold your assets. Use your assets. Stop choosing between belief and action.

Once ownership becomes functional instead of frozen, crypto stops feeling like a hobby. Portfolios are no longer just numbers on a screen. Assets start supporting decisions, funding projects, and enabling action. Capital becomes fluid, useful, and empowering.

Ownership You Can Finally Trust

When DUSK adoption grows, the experience of holding crypto changes. You regain control. Liquidity becomes tangible. Assets transform from static certificates into active participants in your financial life.

DUSK turns potential into action, bridging the gap between owning something and actually using it. Finally, your crypto begins working for you, not the other way around.