$BTC Current Price Action

Bitcoin recently rebounded toward ~$92K–$94K, showing renewed buying interest after late-2025 weakness.

However, prices have also dipped toward ~$90K amid macro data uncertainty, showing volatility near key levels.

🔍 Bullish Factors

✔ Post-halving scarcity persists — reduced supply supports medium-term upside.

✔ Institutional interest & ETFs could lift prices if inflows resume. Analysts forecast targets like $150K or higher in 2026 if macro and sentiment improve.

✔ Network health (hash rate) and adoption metrics remain strong.

📉 Bearish / Risk Signals

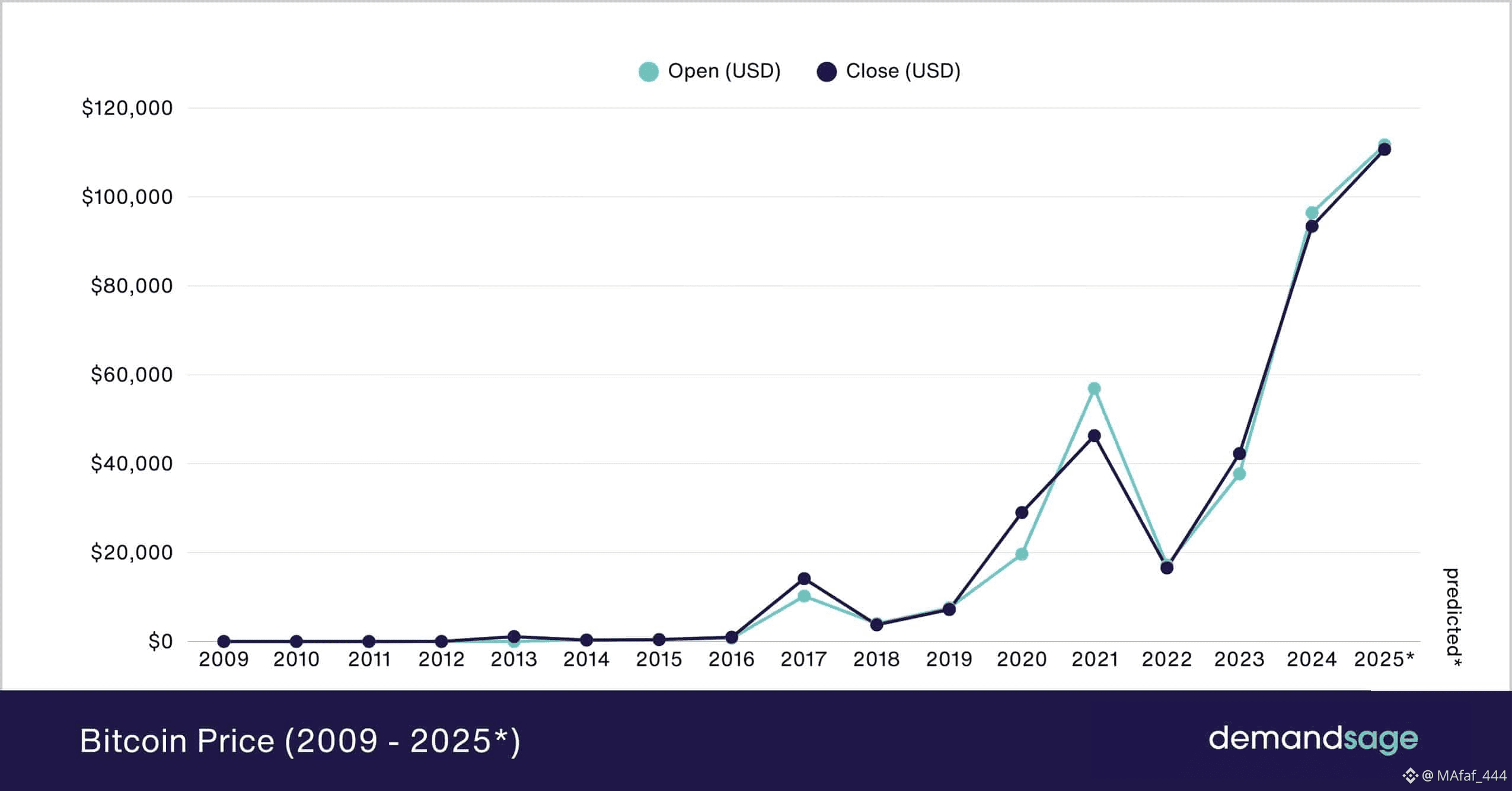

❗ Bitcoin may enter a corrective phase after strong 2025 rally, consistent with historical post-peak behavior.

❗ Macro pressures (rates, risk-off sentiment) can pull risk assets lower quickly.

❗ Regulatory or structural sell pressure (ETF outflows, whale selling) could amplify declines.

📌 Near-Term Outlook

Bullish scenario: Hold above ~$90K → attempt breakout above ~$100K → extended rally.

Neutral consolidation: Range trade ~$80K–$120K if macro data stays mixed.

Bearish trigger: Loss of key support → deeper pullback toward ~$75K or lower.

🧠 Sentiment & Macro

Traders are pricing in macro catalysts (inflation, Fed decisions) — Bitcoin is reacting to broader market liquidity and risk sentiment.

Summary:

Bitcoin remains in a high-volatility phase, balancing between renewed upside momentum and risk of correction. The medium-term outlook is cautiously bullish but event-dependent — price action and macro data will likely determine whether BTC moves toward its higher forecasts or stays in a consolidation/correction phase.