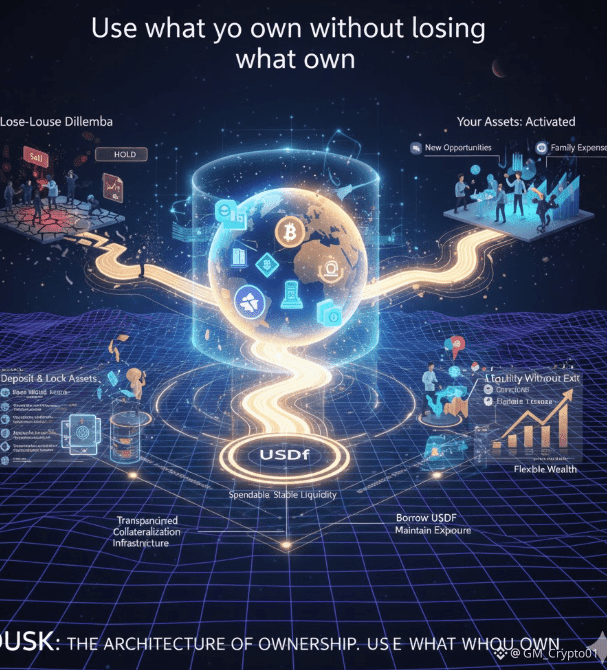

There is a quiet truth about crypto that people rarely admit out loud. Most of the time, ownership feels powerful only on paper. You open your wallet app, you see balances, charts, numbers that rise and fall, and it all looks impressive. But when you actually try to use what you own without selling it, the reality hits. Your assets are locked into place. You can look at them, you can believe in them, you can argue about them online, but you cannot do much with them unless you give them up.

That is the trap DUSK is trying to break.

The idea is not wrapped in complicated theory. It is simple once you see it clearly. You should be able to keep what you own while still being able to do something useful with it. That is how wealth is supposed to behave. Not as a framed picture you stare at, but as something that supports your decisions and plans.

Think about how the typical crypto journey goes. Someone researches a project, buys tokens, commits emotionally to the long term story and then time passes. Markets shift, life needs real world money, new opportunities appear suddenly. Every situation leads to the same uncomfortable decision. Do you sell and risk missing a big move, or do you hold and accept that you are stuck watching everything else from the sidelines

That constant tension is mentally exhausting. It feels like you are being punished for believing in the future of something. DUSK tackles this by letting you use your assets as collateral instead of as something that must be sold to become useful. You lock your tokens inside the protocol, you receive USDf, and your original holdings remain yours. They can rise, they can fall, and your exposure stays intact while your liquidity becomes real and usable.

For many people this is the first time ownership starts feeling flexible instead of fragile.

The practical effects are easy to imagine. A trader needing quick capital for a sudden opportunity does not have to break their entire position. A long term holder who has been patient for years does not need to abandon that patience just to deal with short term needs. A builder staking assets or committing to governance does not need to dismantle everything the moment they want to support a new idea. With DUSK, movement is finally possible without destruction.

Risk management is where people usually become skeptical, and that is fair. The system uses overcollateralization, meaning more value is locked than borrowed. This introduces a natural safety buffer in volatile environments. Positions are visible, rules are known, the process is automated rather than emotional. There is accountability rather than chaos. It is not magic. It is engineering.

What makes the timing of DUSK especially interesting is how fast tokenization is moving. Real world assets are not just theory anymore. Real estate, debt, revenue rights, commodities, and even cultural assets are starting to live on chain. These assets are valuable but very often frozen. You might own a token representing a building or a bond, but without infrastructure like DUSK that token is simply a digital certificate, not a financial instrument.

DUSK turns these static tokens into active components of a broader economy. They suddenly participate rather than sit still. Capital becomes fluid instead of trapped inside individual silos.

The progress around the ecosystem recently has been more quiet than flashy. Conversations are shifting from speculation to design. More emphasis is being placed on transparency, stress testing, collateral health, and long term sustainability. Integrations and tooling are steadily improving. People are no longer asking only what DUSK is, but how it fits inside a future financial system that blends traditional assets and digital ownership.

Those are signs of maturity, not hype.

What stands out most about DUSK is not loud marketing or dramatic promises. It is the sense that the protocol solves a very real and very common frustration. It gives people breathing room. It removes the feeling of being trapped by your own conviction. It makes assets behave like tools, not like glass displays you are afraid to touch.

In the end the promise is simple. Keep what you own. Use what you own. Stop choosing between belief and action. For many people, that is the difference between crypto as a hobby and crypto as an actual financial system.

When ownership finally starts working for you, everything else begins to make more sense.