Dusk Network is positioning itself as a pivotal player in the tokenization of real-world assets (RWAs) by directly tackling the core tension in blockchain for finance: the need for both transactional privacy and regulatory transparency. Through a series of strategic technical upgrades and high-profile partnerships, Dusk is constructing what it terms a Decentralized Market Infrastructure (DeMI), designed from the ground up for institutional use.

Core Innovation: The Modular, Compliant-by-Design Stack

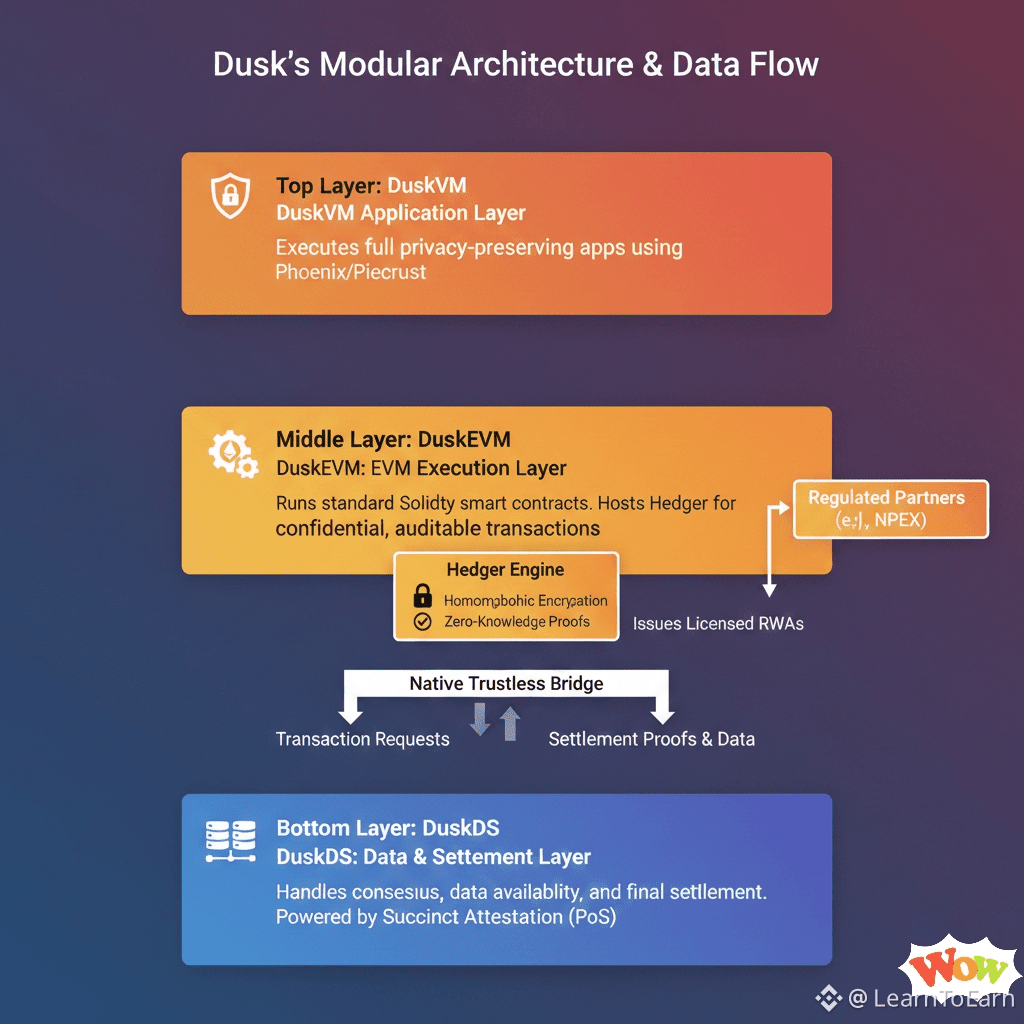

Dusk's architecture is a three-layer modular stack, with each layer serving a distinct purpose to balance performance, privacy, and compliance.

· Foundation: DuskDS (Data & Settlement Layer)

This is the secure base layer. It handles consensus, data availability, and final settlement for the entire network. It uses a Proof-of-Stake mechanism called Succinct Attestation and a unique peer-to-peer protocol named Kadcast for efficient, low-latency communication. Crucially, it provides a native, trustless bridge for moving assets between layers.

· Application Engine: DuskEVM (EVM Execution Layer)

This is where most developer and user activity occurs. DuskEVM is a fully EVM-equivalent environment, meaning developers can deploy standard Solidity smart contracts using familiar tools like MetaMask and Hardhat. This layer settles its transactions on the secure DuskDS base, inheriting its compliance and security guarantees while offering massive developer accessibility.

· Specialized Privacy: DuskVM (Privacy Application Layer)

This forthcoming layer is dedicated to executing fully privacy-preserving applications using Dusk's original Phoenix transaction model and Piecrust virtual machine, which are being extracted from the base layer.

This separation allows each layer to be optimized for its specific role, making the system more efficient, scalable, and easier to maintain while keeping full-node hardware requirements low.

Hedger: The Privacy-Compliance Bridge for Regulated Finance

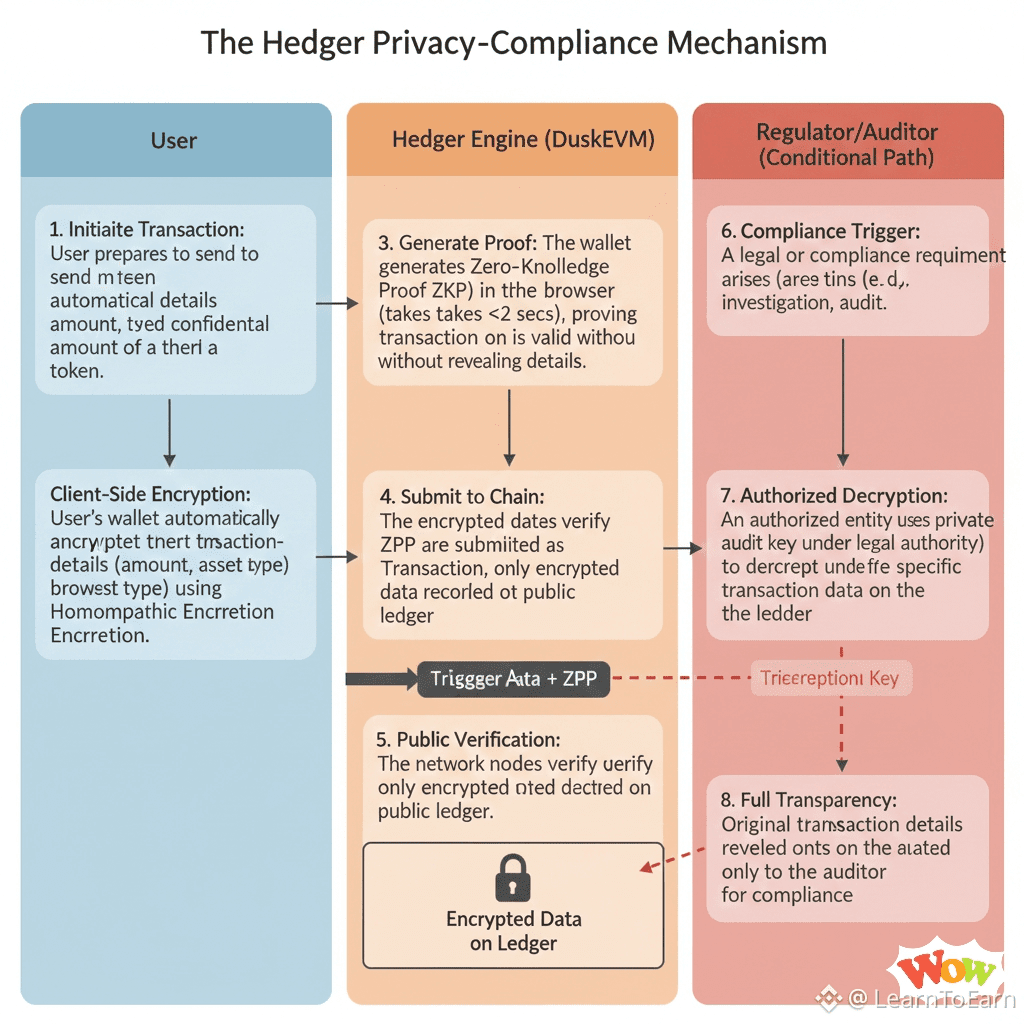

The standout technical innovation enabling Dusk's vision is Hedger, a new privacy engine built specifically for the DuskEVM layer.

· Cryptographic Foundation

Hedger's power comes from combining two advanced cryptographic techniques:

· Homomorphic Encryption (HE): Allows computations to be performed directly on encrypted data. On Dusk, it's based on ElGamal over Elliptic Curve Cryptography, enabling operations like balance checks or trades without revealing the underlying numbers.

· Zero-Knowledge Proofs (ZKPs): Generate cryptographic proofs that verify a transaction is valid (e.g., a user has sufficient funds) without revealing any details about the sender, receiver, or amount.

· Purpose-Built for Institutions

This hybrid approach is designed to meet the non-negotiable demands of regulated markets:

· Confidential Asset Ownership: Holdings, balances, and transfer amounts remain encrypted end-to-end.

· Regulated Auditability: Despite the privacy, transactions are fully auditable by design. Authorized entities (like regulators) can be granted access to view transaction details when necessary for compliance.

· Obfuscated Order Books: Hedger lays the groundwork for hiding trading intent and exposure on-chain, a critical feature for institutional trading to prevent market manipulation.

· User Experience: Lightweight circuits allow clients to generate the necessary ZKPs in under 2 seconds directly in a web browser, ensuring a seamless experience.

Strategic Partnerships: Bringing Regulated Assets On-Chain

Technology alone isn't enough. Dusk is building a licensed ecosystem to host real financial activity, most notably through a landmark partnership with NPEX, a fully regulated Dutch stock exchange.

· The NPEX Collaboration

NPEX holds a Multilateral Trading Facility (MTF) license and a European Crowdfunding Service Providers (ECSP) license from Dutch authorities. Through this partnership, these licenses apply to applications built on the Dusk stack, creating a fully licensed environment for issuing, trading, and settling tokenized securities like equities and bonds. The first major application, DuskTrade, is slated for launch in 2026 and is designed to bring over €300 million in tokenized securities on-chain.

· Chainlink Integration

To connect this regulated pool of assets to the broader blockchain ecosystem, Dusk and NPEX are integrating Chainlink's Cross-Chain Interoperability Protocol (CCIP) and its Data Streams oracle solution. This will enable NPEX's tokenized securities to be securely transferred across different blockchains while preserving their regulatory status, and will feed verified, low-latency market data directly into Dusk smart contracts.

The DUSK Token: Fueling the Ecosystem

The DUSK token is the unified economic engine across all layers of the Dusk network.

· Utility: It is used for staking to secure the network (with a minimum of 1,000 DUSK), paying transaction gas fees, and rewarding network participants.

· Tokenomics: The total maximum supply is capped at 1 billion DUSK. Half (500 million) was created at genesis, and the other half will be emitted over 36 years to reward stakers, following a halving model similar to Bitcoin's every four years.

Roadmap and Market Position

Dusk is in an active phase of development and rollout:

· Near-Term (Q1 2026): The DuskEVM mainnet launch is a key milestone, transitioning the EVM-compatible layer from testnet to full production, which is expected to significantly boost developer activity.

· 2026 and Beyond: This will see the rollout of the NPEX trading dApp (DuskTrade) and the full implementation of the Hedger compliance module on the mainnet.

Analysts note that Dusk's unique positioning has generated a mix of bullish institutional interest due to its compliant pipelines and near-term volatility correlated with the broader RWA sector. Its technological differentiation is clear, but widespread adoption hinges on successfully onboarding traditional finance institutions.

Dusk Network is not merely creating another blockchain for DeFi speculation. It is engineering a new foundational infrastructure for global capital markets, aiming to make the issuance and trading of regulated assets as seamless and composable as trading cryptocurrencies, all within a framework that respects both individual privacy and societal regulatory requirements.