Solana (SOL) is entering what many analysts consider a pivotal phase in 2026, as the actions of whales and large institutional capital flows increasingly shape its price trajectory.

On-chain data continues to highlight Solana’s dominance in network usage, with daily transaction volumes reaching nearly eight times those of several competing blockchains. At the same time, ETF-related inflows remain positive, as U.S.-listed spot Solana ETFs have recorded consecutive net inflows since December 2025.

These developments raise a critical question: Can Solana sustain its growth momentum, or are early signs of structural weakness beginning to surface?

New and Dormant Whales Converge

New Solana “whales,” particularly institutional players via ETF products, have maintained steady capital injections into the ecosystem since December 4, reinforcing bullish pressure.

Adding to this narrative, a previously dormant whale has re-entered the market, accumulating 80,000 SOL worth approximately $10.87 million from Binance. Such activity is widely interpreted as a signal of long-term conviction, especially when combined with sustained institutional demand.

The convergence of ETF inflows and large-scale accumulation continues to strengthen Solana’s market positioning. However, maintaining upward momentum will largely depend on SOL’s ability to defend key technical support zones.

Network Activity Continues to Outperform

Solana remains one of the most actively used blockchains in the market. Its transaction throughput significantly exceeds that of its closest competitors, processing volumes that are multiple times higher on a daily basis.

This level of performance goes beyond raw technical metrics. It reflects strong real-world adoption, consistent user engagement, and increasing activity across decentralized applications, DeFi platforms, and broader ecosystem use cases.

High network utilization has long been viewed as a fundamental strength for Solana, reinforcing its role as a core infrastructure layer within the blockchain sector.

SOL Chart Signals Growing Downside Risk

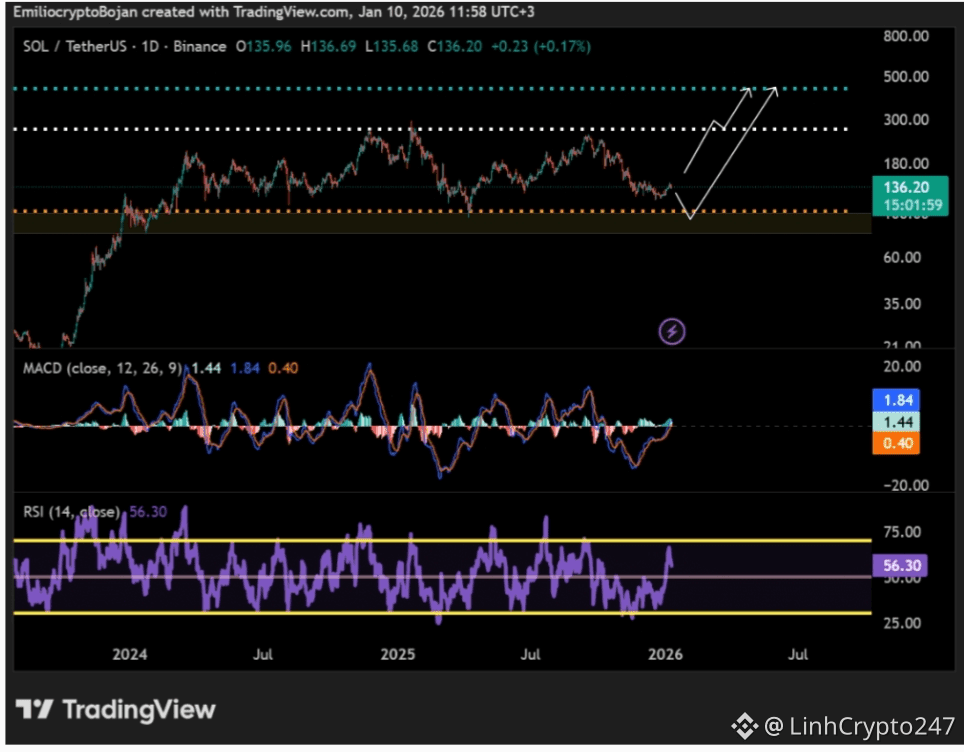

From a technical perspective, SOL was trading around $136 on January 10, but recent recovery attempts appear fragile amid a broader risk-off market environment.

On the daily timeframe, downside risk could intensify if SOL begins forming a similar low near the $102 level, which would suggest weakening demand and increasing bearish control.

On the weekly chart, selling pressure is likely to persist unless SOL can firmly hold the critical support range between $122 and $145 on lower timeframes. A confirmed breakdown below $122 could open the door to a deeper correction toward $102, a zone that aligns with:

Previous price peaks

Previous price peaks

The breakdown point of an ascending support trendline

The 61.8% Fibonacci retracement level

In a more adverse scenario, failure to defend the $102 support could expose SOL to a much sharper decline toward the $50 region. At the same time, weakening momentum indicators such as RSI and MACD point to growing downside pressure, increasing the risk of further losses if key supports fail.

Liquidity Concentration Below Current Price

Liquidity heatmap data over the past two weeks shows a dense concentration of positions below the $120 level. This zone could act as a liquidity magnet if bearish sentiment spreads across the broader market.

A sharp move into this region could trigger cascading liquidations, especially given the current lack of strong bullish catalysts and the generally fragile market backdrop.

A sharp move into this region could trigger cascading liquidations, especially given the current lack of strong bullish catalysts and the generally fragile market backdrop.

Final Thoughts

While Solana continues to benefit from strong network fundamentals and institutional interest, technical and liquidity-based signals suggest that downside risks cannot be ignored. Price action around key support levels will likely determine whether SOL can stabilize or enter a deeper corrective phase.

This article is for informational purposes only and does not constitute investment advice. Readers should conduct their own research before making any financial decisions. The author is not responsible for any investment outcomes.

👉 Follow for more Solana insights, on-chain data, and crypto market analysis.