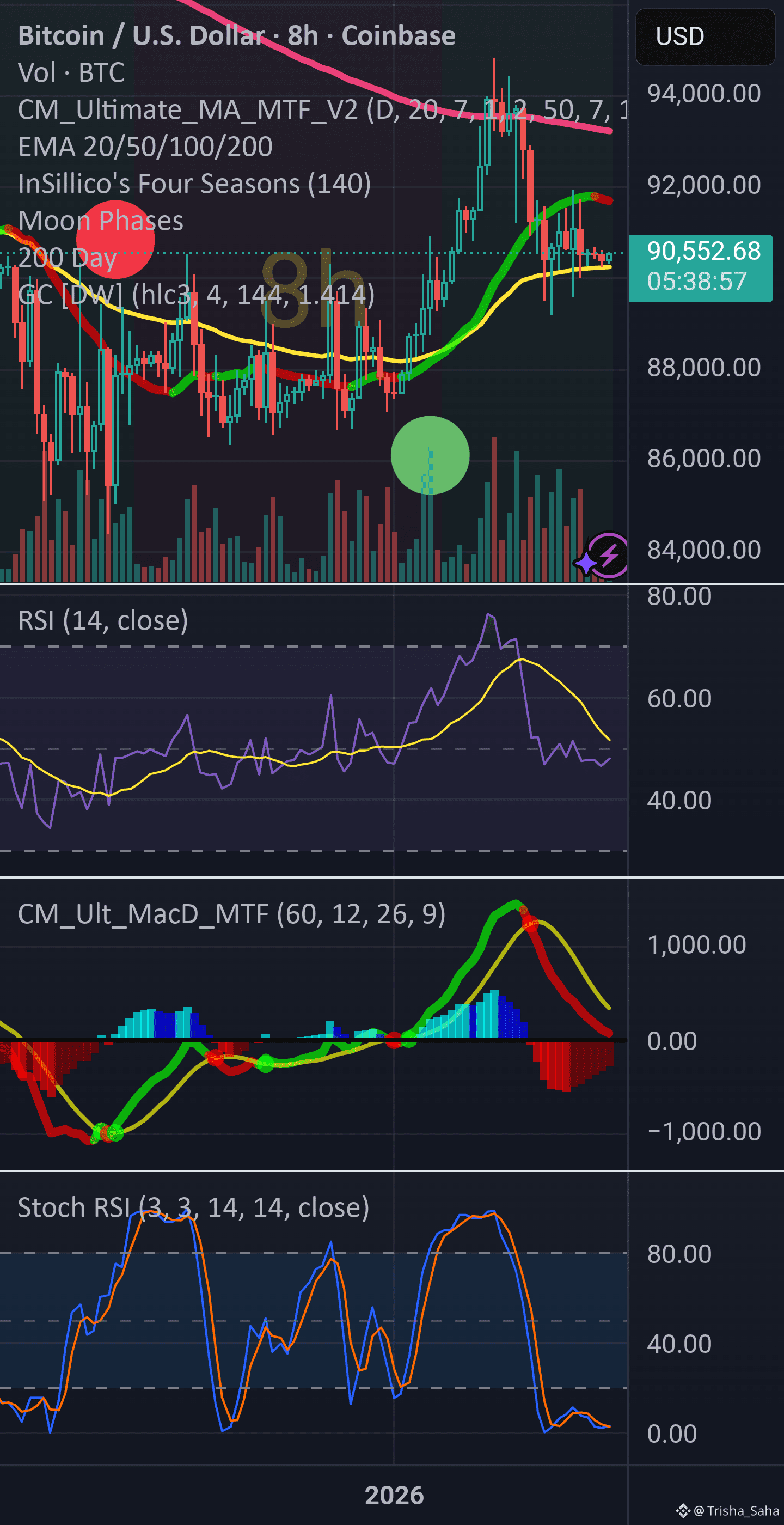

BTCUSD – 8-Hour Chart (Oracle System)

Current Price: ~90,566

Timeframe: 8H

Market State: Post-rally distribution

---

Indicators on This Chart

1) EMA Ribbon (20 / 50 / 100 / 200)

EMA 20 & 50 (short-term trend)

EMA 100 (mid-trend support) ≈ 90,100

EMA 200 (macro trend) ≈ 91,200

Price is below EMA 200 and hovering on EMA 100.

This creates a compression zone where trend flips are decided.

Structure = bearish until price reclaims EMA 200.

---

**2) CM Ultimate MA (Multi-Timeframe Trend)

** The Ultimate MA turned red at the top and is now curling downward.

This confirms trend exhaustion and distribution.

---

3) Moon Phase + Oracle Cycle

The green Oracle dot marked accumulation near 87k.

The red Oracle dot at the top marked distribution near 94k.

Price did exactly what the Oracle model predicts:

> Buy low → rally → sell into premium → start down-cycle

---

4) RSI (14)

RSI peaked in the 60–65 sell zone and rolled over.

Now:

Below its signal line

Falling

No bullish divergence

Momentum has flipped bearish.

---

5) MACD (MTF 60)

MACD lines crossed down

Histogram flipped red

This confirms:

> Trend momentum has turned negative — this is not a healthy uptrend.

---

6) Stochastic RSI

Stoch RSI ran to overbought and dumped back near 0–10.

That means:

> The bounce is already exhausted — sellers have control.

---

Price Structure

Price failed at:

93,200 – 94,300 (200-day MA + trendline + Oracle sell zone)

It dumped to:

~89,400

Now it’s stuck between:

EMA 200 (91,200)

EMA 100 (90,100)

That creates a bear-flag / distribution shelf.

---

Key Levels

Resistance

91,200

92,000

93,200 – 94,300

Support

90,100

89,400

88,200

86,800 (next Oracle buy zone)

---

Signal Status

Trend: Bearish

Momentum: Bearish

Cycle: Distribution → Down-leg starting

Oracle: Sell week completed → move toward discount zones

---

Quick Next-Move Summary

BTC is not in a breakout phase.

It is in a post-distribution compression.

This structure favors:

> Another push lower toward 88,000 – 86,800

That is where the next Oracle accumulation zone sits.

Only a reclaim of 92,000+ would invalidate this.

Right now the chart is signaling: Sell strength → wait for lower buy zone.