Dusk is a blockchain project designed specifically for the future of regulated finance. Instead of competing with public chains that focus on open DeFi or NFTs, Dusk takes a different path: it builds privacy, compliance, and real-world asset tokenization into the core of its protocol. The project was originally known as Dusk Network and is now simply called Dusk, reflecting its broader ambition to become the settlement layer for compliant digital securities.

Dusk is a blockchain project designed specifically for the future of regulated finance. Instead of competing with public chains that focus on open DeFi or NFTs, Dusk takes a different path: it builds privacy, compliance, and real-world asset tokenization into the core of its protocol. The project was originally known as Dusk Network and is now simply called Dusk, reflecting its broader ambition to become the settlement layer for compliant digital securities.

At its heart, Dusk is focused on enabling financial institutions to issue, trade, and manage real-world assets on-chain while respecting regulatory requirements such as KYC, data protection, and investor privacy. Traditional financial markets operate on trust, paperwork, and slow intermediaries. Dusk attempts to modernize this system by using blockchain technology without exposing sensitive user or business data to the public.

One of the most distinctive features of Dusk is its privacy-preserving architecture. The network uses advanced cryptography, including zero-knowledge proofs, to allow transactions to be verified without revealing confidential information. This is particularly important for assets like bonds, shares, or tokenized funds, where investor identities, deal size, or settlement terms cannot be broadcast openly. With Dusk, participants can prove that a transaction follows the rules without showing the underlying data.

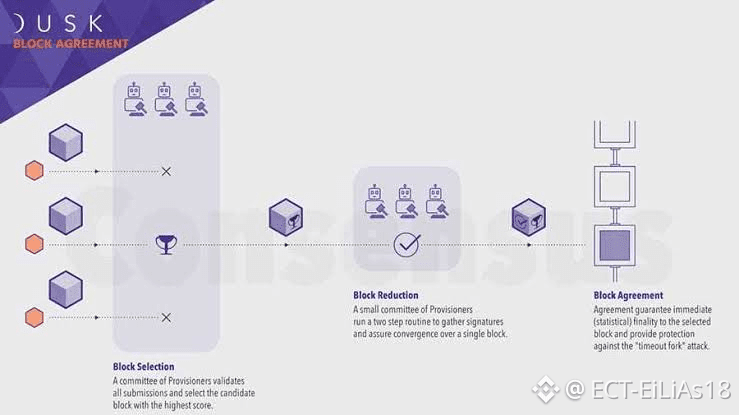

Another key innovation is Dusk’s consensus mechanism, known as Segregated Byzantine Agreement (SBA). This system is designed to deliver fast finality while keeping the network secure and decentralized. In practical terms, this means transactions can be settled quickly, which is essential for financial instruments that require predictable execution times. The network also supports staking, allowing token holders to participate in securing the chain while earning protocol-level rewards, depending on network conditions.

The main use case for Dusk is the tokenization of real-world financial instruments. Through its infrastructure, companies and institutions can issue digital versions of shares, bonds, or structured products in a compliant manner. Instead of relying on manual record-keeping or fragmented databases, asset ownership can be tracked transparently on the blockchain, while sensitive data remains protected. This combination of transparency and privacy is what makes Dusk attractive for enterprise adoption.

Dusk also introduces a framework for on-chain compliance. Smart contracts on the network can enforce rules such as who is allowed to trade a specific asset, under what conditions, and within which jurisdictions. This reduces the risk of regulatory breaches and lowers operational costs for issuers and exchanges. In a world where regulators are increasingly scrutinizing digital assets, having compliance embedded at the protocol level is a major advantage.

From an ecosystem perspective, Dusk is not only building a blockchain but also a suite of tools for developers and institutions. These include libraries for privacy-preserving applications, templates for asset issuance, and infrastructure for secondary markets. Over time, this could support a complete financial lifecycle on-chain, from issuance to trading and settlement.

In summary, Dusk is positioning itself as a bridge between traditional finance and blockchain technology. By focusing on privacy, compliance, and real-world asset tokenization, it addresses some of the biggest barriers preventing institutional adoption of crypto infrastructure. Rather than chasing hype, Dusk is quietly building the foundations for a regulated digital asset economy where efficiency, trust, and confidentiality can coexist.@Dusk #dusk $DUSK