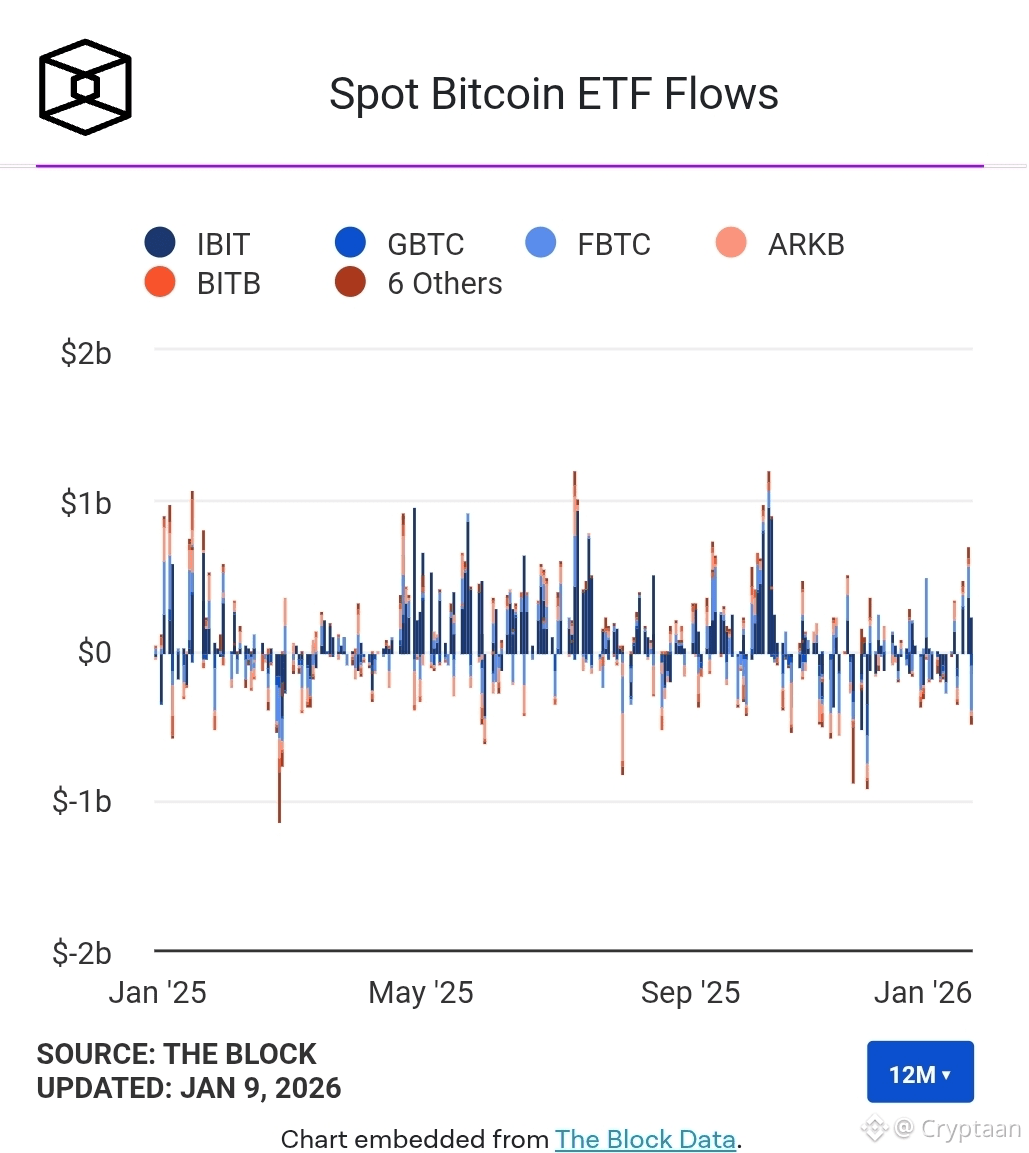

U.S. spot bitcoin exchange-traded funds saw another day of net outflows on Thursday, extending their negative streak to three days.

According to data from SoSoValue, U.S. bitcoin funds recorded $398.95 million in net outflows on Thursday. BlackRock's IBIT saw $193.34 million leave the fund, and Fidelity logged outflows of $120.5 million. Funds from Ark & 21Shares and Grayscale also posted net outflows.

Over the past three days, roughly $1.12 billion has exited the bitcoin ETFs, nearly wiping out the net inflows generated during the first two trading days of 2026.

Spot Ethereum ETFs mirrored their bitcoin counterparts, reporting $159.17 million in net outflows on Thursday. BlackRock's ETHA reported $107.6 million in outflows, while Grayscale's ETHE also saw $31.7 million in negative flows.

"The recent ETF outflows continue to reflect portfolio rebalancing, profit-taking after an initial rally, and short-term caution amid market consolidation rather than a fundamental shift in institutional demand," said Nick Ruck, director of LVRG Research. "The crypto market remains in a resilient consolidation phase with hovering just above $90K while being supported by underlying institutional accumulation."

According to The Block's bitcoin price page, the world's largest cryptocurrency gained 0.26% in the past 24 hours, trading at $90,660 at the time of writing. It briefly fell below $90,000 earlier on Thursday. Ethereum slipped 0.54% to $3,104.

Meanwhile, spot XRP ETFs returned to positive flows on Thursday, posting $8.72 million in net inflows after recording $40 million in outflows on Wednesday — their first daily net outflow since launch. Spot Solana ETFs also reported $13.64 million in inflows, extending their positive streak to eight days.

"Traders should closely monitor ETF flow trends, key resistance levels near $95K for Bitcoin, and macroeconomic signals like Federal Reserve policy shifts for potential breakout or further volatility," Ruck noted.