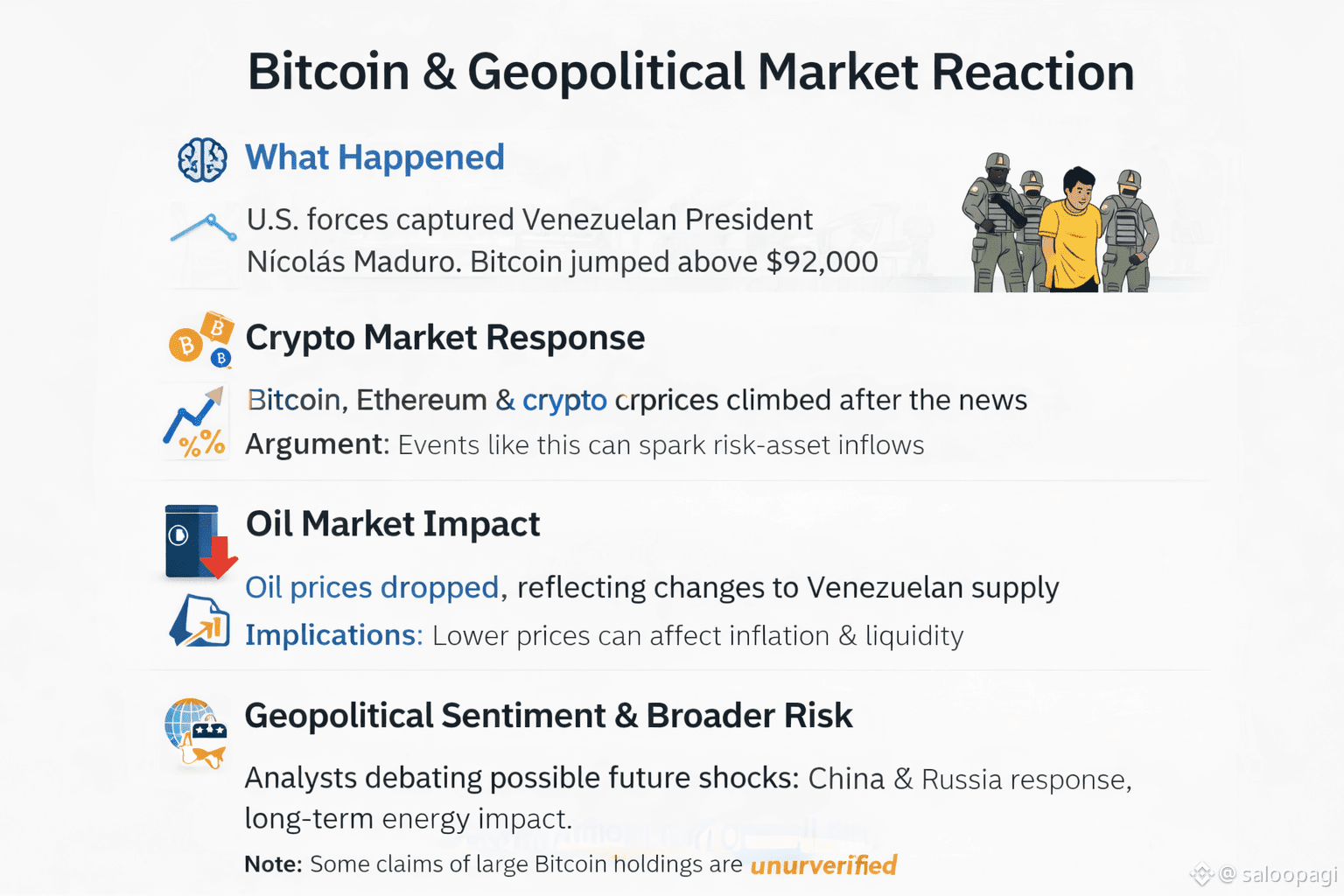

In early January 2026, U.S. forces captured Venezuelan President Nicolás Maduro in a high-profile operation. Markets reacted quickly: Bitcoin climbed back above $92,000 shortly afterward, and other cryptocurrencies like Ethereum also showed gains. Analysts and firms are now trying to interpret how this geopolitical event might influence crypto and broader markets. �

Investopedia +1

📈 Crypto Market Response

Bitcoin & Crypto Prices: Bitcoin and other major cryptocurrencies saw modest gains following the news, bouncing after a prior dip. Ethereum likewise traded higher. �

Investopedia

Some analysts argue that geopolitical events like this may spark risk-asset inflows as traders reposition after volatility. �

DL News

🛢️ Oil Market Impact

The capture pushed oil prices lower in early trading as traders priced in potential changes to Venezuelan oil output and U.S. control over supply. Lower oil prices can have complex effects on inflation expectations and market liquidity. �

HTX

📊 Speculative Narratives

Various narratives are circulating in markets and online communities — for example:

Rumors surfaced that Venezuela may hold a large amount of Bitcoin reserves, though such claims are unverified and speculative based on on-chain data (which shows only a tiny traceable official holding). �

ODaily +1

Intense trading activity (like bets on prediction markets) highlighted how geopolitical events are increasingly intertwined with financial speculation. �

AInvest

🌍 Geopolitical Sentiment & Broader Risk

Beyond crypto:

Markets such as U.S. stocks and gold also reacted, but not always in expected directions. Some analysts note that crypto’s strength in this moment reflects changing risk pricing rather than purely geopolitical interpretation. �

Forbes

Oil sector dynamics and long-term production expectations could reshape global energy and inflation profiles — with indirect consequences for risk assets like Bitcoin. �

FinancialContent

📌 Important Context

⚠️ Most links between Maduro’s capture and broad crypto performance are market observations and speculation, not guaranteed causal effects. While Bitcoin has shown resilience, narratives about massive hidden Bitcoin reserves or definitive future outperformance should be treated carefully and verified independently. �