On the first Friday of 2026, 793 million XRP sat inside newly minted United States spot ETFs. It's more than the total Marketcap of rival Blockchain Polygon. it represents 1.14 percent of the circulating supply removed from day-to-day trading in less than eight weeks. The speed of that absorption is why traders who once thought of XRP as a sleepy large-cap are now laser-focused on its next move.

Below in this article, we are trying to unpack the five major reasons that will decide whether the token’s rally can extend through the first quarter.

I. Vanishing Exchange Reserves and an ETF-Driven Squeeze

Centralized exchange wallets held roughly 11.22 billion XRP on January 5, the lowest level since early-2024. CryptoQuant shows Binance balances down to 2.6 billion XRP during the same stretch, a 20 percent slide from the 2024 peak. With spot ETFs quietly warehousing almost an extra 1.37 billion USD worth of coins by January 6, the available float is shrinking faster than in any other top-ten asset.

The combination of falling exchange stockpiles and ETF siphoning has already delivered an environment where minor spot bids trigger outsize price responses. Should reserves continue to grind lower while ETF creations stay net-positive, the rally’s fuel line remains open.

II. Technical Map: A Reborn Uptrend Above Two Key Floors

Daily charts show a clean falling-wedge breakout that launched in early January once price cleared the 2.00 USD ceiling. The breakout flipped that level into first support. Two additional guardrails now matter:

2.11 USD – the November consolidation shelf and the locus of 38.35 million USD in long liquidations, meaning dip buyers are likely waiting there.

1.95 USD – December’s congestion zone and the secondary floor if a deeper washout hits.

Resistance layers cluster at 2.23 USD and 2.28 USD (November high), then 2.40 USD, where January-end options carry max-pain pressure. Daily RSI sits near 56, momentum remains positive on MACD, and ADX above 30 confirms a trend strong enough to punch through sellers if volume arrives.

The setup favours upside extension as long as 2.11 USD stays intact. A failure there would likely see algo traders gun for 1.95 USD before fresh bids appear.

III. On-Chain Pulse: Payments and DeFi on XRPL Catch Fire

Payment transactions on the XRP Ledger spiked to 1.65 million on December 17, part of an eight-million-payment week that represented more than 60 percent of all on-chain activity.

XRPL’s infant DeFi stack echoed the surge: AMM pools processed 350 million XRP of volume, and TVL reached 73.8 million USD, more than doubling since mid-2025. Stablecoin integrations (RLUSD, USDC) and the first smart-contract AlphaNet have broadened utility beyond cross-border transfers.

Active addresses touched 191 thousand in late December and now hover near 170 thousand, erasing the autumn soothe. Meanwhile, top exchange wallets continue to shrink, a sign that tokens are not simply rotating between venues but leaving them outright.

This on-chain cocktail, rising usage, falling reserves, and a widening DeFi sandbox, reinforces a narrative of fundamental demand rather than pure speculative churn.

IV. Derivatives Positioning Points to Upside Skew

Futures open interest stands at 4.11 billion USD, though leverage has eased 8 percent in the last 24 hours, flushing weak longs. The distribution of positioning matters: 96 percent of recent liquidations hit long traders, suggesting late bulls have already been forced out.

Funding rates flipped from sharply negative on December 19 to a modest +0.006 average, a level that historically accompanies sustainable trends rather than blow-off tops.

Options markets echo the picture. Total OI sits at 75 million USD, with max-pain anchored at 2.20 USD for the nearest weekly expiry. Traders are paying a premium for upside strikes in the 2.40 -2.60 USD band, a classic sign of bullish skew.

A glance at the liquidation heat-map reveals a minefield of long stops below 2.07 USD but far fewer shorts above 2.28 USD, meaning the path of least resistance remains higher for now.

Finally, the exchange-level open-interest heat-map confirms that Bybit and OKX traders have reduced exposure far more than Binance, lowering systemic liquidation risk if price wobbles toward support.

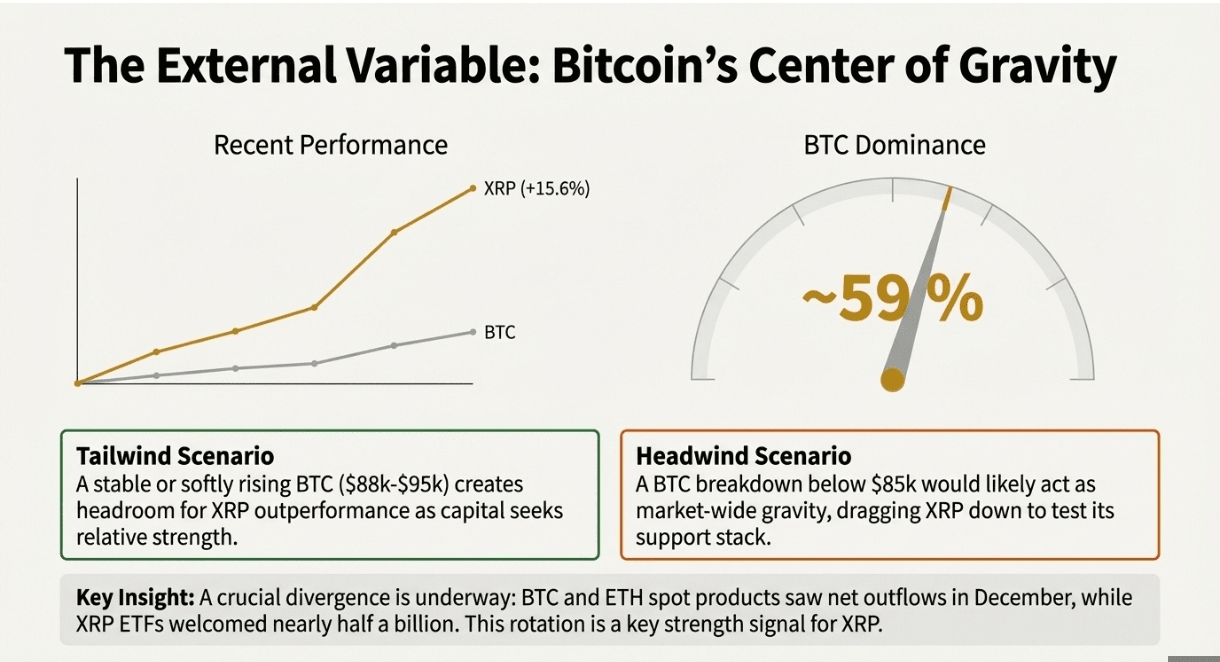

V. Bitcoin’s Center of Gravity and Broader Risk Appetite

Bitcoin ended 2025 near 88 kUSD, its first post-halving down-year in over a decade, then rebounded to 92.7 kUSD by January 8. In that span XRP advanced 15.6 percent, more than tripling BTC’s move. Macro investors still measure altcoin risk in BTC terms, so a stable or softly rising Bitcoin creates headroom for further XRP rotation.

BTC dominance is flirting with 59 percent, yet ETF flow divergence says capital is already tiptoeing out along the risk curve: BTC and ETH spot products saw December net outflows near 1.6 billion USD, while XRP ETFs welcomed nearly half a billion. If Bitcoin stalls below 95 kUSD, traders may keep hunting relative strength plays such as XRP. A Bitcoin breakdown below 85 kUSD, however, would likely drag every risk asset with it and test XRP’s support stack.

❍ Scenario Analysis for Q1 2026

The balance of probabilities favors a patient continuation. Exchange withdrawals show conviction, derivatives leverage has reset, and on-chain demand is visible. Still, any sustained Bitcoin downdraft or ETF redemption wave could flip the script quickly.

❍ What Could Go Wrong

ETF Outflows Accelerate

The first net redemption on January 7 totaled 40.8 million USD. A second or third wave would shrink the structural bid that has underpinned demand.Funding Turns Aggressively Positive

If overnight funding jumps past +0.02, history says momentum longs crowd in and leave the market brittle.On-Chain Activity Falters

A drop below 120 thousand active addresses for several weeks would hint that recent payment-volume spikes were seasonal outliers, not a secular trend.Macroeconomic Risk-Off

A sharp move in Treasury yields or an equity correction could pull liquidity from crypto broadly.Regulatory Surprise

While Ripple’s legal battles are quieter, any adverse ruling on secondary-market transactions could spook ETF issuers and investors alike.

The early-2026 XRP narrative blends visible supply shrinkage, a technically clean breakout, growing payment-layer usage, and still-cautious social sentiment. Those ingredients argue the rally’s fire still has oxygen, provided Bitcoin does not yank the market into a fresh risk-off spiral.

With leverage reset and ETFs still luring capital, the path higher looks smoother than it has in years, yet the market remains one macro shock or policy twist away from a harsh reminder that possibilities never equal guarantees.

But we are optimistic, XRP has always been that Gold jewelry in your wardrobe which easily Outperformed every asset in your portfolio silently.